Major warning: Crisis in China is turning into a panic.Is a worldwide financial crisis at the doorstep? STATMAN comments.

Good evening my friends. Another interesting day at the market. All the news is OIL down to 55.00 per barrel. I do recall that not so long ago it was 39.00 per barrel and so out of favor that we bought! That is of course before starting to post here. And the Dow up earlier tanked.

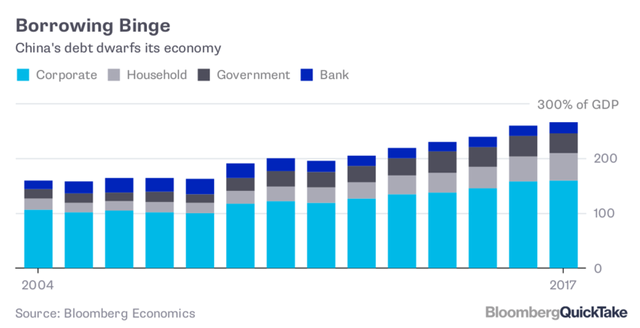

China is in a mess of massive proportions and will have worldwide impact. Their debt is 3 times their GDP. This is unsustainable and they claim they will not devalue the yuan to help exports. The market will do it for them. But wait! Who holds more US debt than any nation in the world? China. Russia incidentally unloaded all US debt and bought gold.

Therefore the US and our rising interest rates are an enormous problem. We can talk about Italy, Germany and the rest of the world later.

We are in a trade war with China. The US can't tolerate rising rates and a strong dollar. Things will get very, very interesting soon. Don't let this last bought of Gold and silver slip buy. My bet is you'll not again see prices like this maybe bot ever. They are going dramatically higher and we believe it is very late November and possibly from the lower 1100's.

The London Bullion Market Assoc. (LBMA) consensus just out is for gold 1532 one year out. My take is that's conservative.

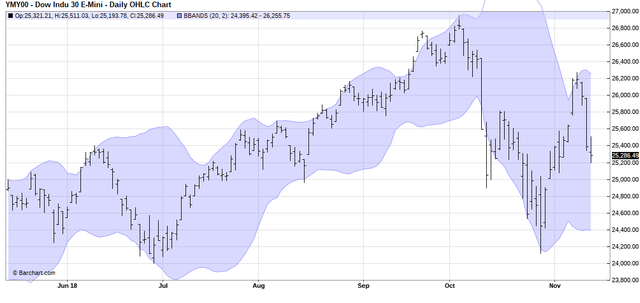

The Dow-Jones hit 25,200 today (down about 200) before a slight recovery. AS far as we are concerned we are in a bear market that will have traps along the way as you saw recently. We said sell about two days before the major selloff in October at the top, so far only about 9 per cent. I personally sold out and wrote it mid September at 26,500. While this market will hold up a bit longer towards the end of 2018, I believe 20,000 Dow will be seen in 2019 and possibly considerably lower beyond '19. That's when gold reaches beyond the old highs as soon as 2020. Let's see if we're right. Since posting in early January, we've called every market "on the nose". Gold (and silver) has been the most frustrating, but not for long. We'll have to just see.

Thank you for the support and have a great Wednesday.

I'm not very well-versed on this topic, but it is making the news in Malaysia where I am now. This is a land of cheap gas, but they want the price to go up.

The other thing I see about China is the soybean glut in the us due to them no longer taking the imports. I watch some farm news, and the mid-us soybean farmers are in a very bad way without any more storage to hold the overflow crops!

I'm here to ask for your Q vote for my son at photo friday on qurator. His wonderful flower shot got nominated and I hope he will win this one. Most of the time I ask for this help we nominated ourselves for toss up thursday, so I am very proud :)

https://steemit.com/qurator/@qurator/qurator-s-photo-friday-photography-competition-49#@bxlphabet/re-qurator-qurator-s-photo-friday-photography-competition-49-20181109t214424960z

As always, a 1% vote is enough to count. Thank you so much for all of your support.

I am glad to see you still posting @yankee-statman. A number of the people I have on my list for this Q vote thing have disappeared. It's one thing to say btc is less voitile than the dow, but this gradual sinking is not helping one bit!

you bet I will support....and thanks..the best to you..

Nice analysis and just Gold is starting to wake up.

thank you..

It's coming!

Posted using Partiko Android