The Perfect Storm: Why I Think It's Time to Get Out of Stocks

Disclaimer! I am not a market conspiracy-theorist or self-proclaimed clairvoyant, what I am about to share is data-driven talking points that support the need of an exit strategy for equity investors. I will be sharing some macro indicators, graphs, & commentary that I hope will prove to be of use.

What I have to say is this: Our stock market is currently, massively overvalued (total market value cap is 150% above total GDP since Q2 of last year). Economic cycles would tell us that this bull market is likely to come to an end quite soon, yet the S&P continues to rise. The issue here is that retail investors and business-friendly policies are artificially extending this run in our equity market. Don't get me wrong, tax cuts are fantastic contributors to economic growth, but the stock market is simply too high given historical context. There is also not enough intrinsic value to justify the market's current standing.

Here is the combination ("storm") that I believe will trigger a severe market correction & the end of this bull market: Volatility is at an all- time low, margin account debt is at an all-time high, & geo-political uncertainty is vastly underestimated. There are obviously a thousand other factors that went into my analysis (shitty IPO's, higher borrowing costs, small # of leading stocks, etc.) but I didn't want to bore any would-be readers with a research paper. Unfortunately, my rush to be concise may result in me appearing to be a lot more stupid than I really am, but I can live with that LOL.

One thing I want to stress is that I have no idea when this bull will correct and start its transition into a bear. Leading indicators, such as margin debt, can help investors to forecast but no one can predict the future. Personally, I'm glad. Heavily involved investing is not for the faint of heart. I enjoy the dangers of the capital market, they are what drive me to perform and learn. They are also what make a successful strategy so rewarding.

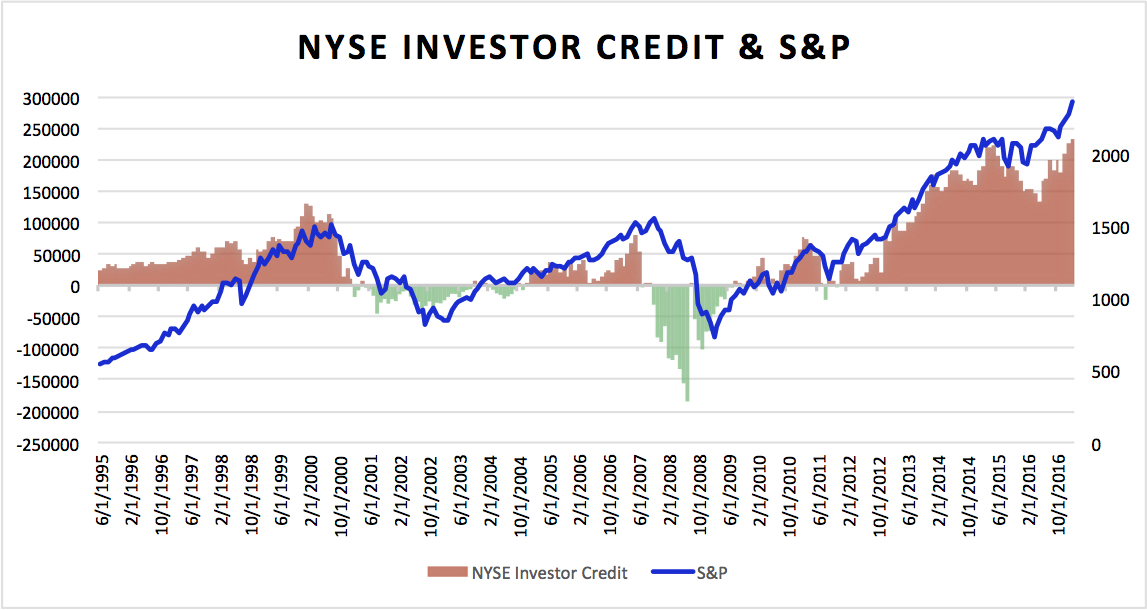

Here is a graph of historical margin debt (how much $ investors are borrowing from brokers to invest). As you can see, the red bar (margin debt) forecasted a serious drop in the stock market (measured by S&P) in both 2001 (.com bubble) & 2008 (housing bubble). Here is the part that should scare you...margin debit is significantly higher than in both instances prior to a market crash. This in itself isn't necessarily significant, margin debt has not been recorded since the inception of the stock market, but in the last 15 years it has been a very vital indicator of what is to come.

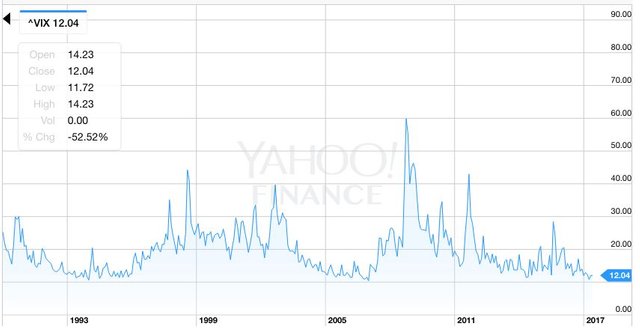

This is the VIX (tracks market uncertainty aka volatility) & it it's last close is down 50% + since it was created. This level, as it stands, is not sustainable. This is where geo-political and speculative issues come into play. There are way too many big-hitters hanging around in Syria (U.S., Russia, etc.), the EU is most likely to become fractured further (closing of Brexit, Italy & Greece debt bubble and populist responses to refugee crisis), politics in the U.S. are more polarized than ever, etc. etc. etc. HERE'S THE POINT: There are a million things that could trigger a spike in volatility. When things become less predictable, the market responds. When the market responds, brokers get nervous and issue margin calls (requests for investors to return borrowed money). When these things occur our useless media finally catches on and starts to seriously report market conditions; finally sell-offs by antsy investors happen and very soon the market down-shifts in higher multiples.

I'm rambling now so here are my final thoughts. I would HIGHLY recommend that my fellow investors close their bullish stock positions (many of you have already made a killing, sometime you need to take your $ and run). Secondly, for those who want to profit from a would-be bear market, I suggest you look into counter-cyclical investments that increase in value when the market bleeds.

PLEASE up-vote & comment (feedback is greatly appreciated).

I agree. "Investing" is def out of the equation here. The RR, and ROI are great and minimized, respectively. I invest in PMs and also an options trader giving me the ability to trade up and down. I do not sell or "write" contracts so sideways (chop) is where I am out, unless the channel is 2 std deviation.

Good article, even if dumbed down a little for those that don't understand the fundis. Upvoted.

Trade well!

Chris

Thanks brother! I read recently in the WSJ that the options market is losing some profitability (I didn't read in much depth) would love to hear your thoughts and your experience in derivatives in general.

All the best,

Steve

Well, that's a lot to go over. Generalizing, if you can understand the Greeks, implied volatility, read Fibonacci extension and retracement, you should do ok. Futures are very risky. Really gotta know your shit to trade futs