Cryptocurrency Valuation an evolving measuring tool

Recently I found a “Quarterly Report” written by a company called Electric Capitol, which is a Silicon Valley firm which invests in cryptocurrency projects with three characteristics: one is high utility, as in many potential or actually use cases, second is high levels of developer activity and documented technological superiority over other projects and third is low Coin Market Cap ranking. As I read this report I realized that I had seen this before, in many of the writings attributable to Warren Buffet, the “value investor” worth over 2 billion U.S. dollars. His mantra is always paraphrased as “buy good companies when their market price is depressed in bear markets because their value increases disproportionately when the bull market returns.”

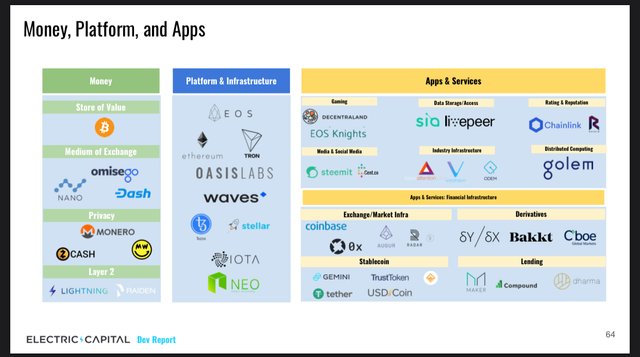

When it comes to determining value in cryptocurrency projects, I think the value mantra has always been look for utility, users and evidence of active developers. Utility has always meant use cases. Active development is macroscopically measured by shear Github volume, but microscopically by analyzing the software to see if the developers were actually making something unique to cryptocurrency or something new to their blockchain that increased value through things like improved scalability, lower server costs, improved server storage while reducing storage costs, or reduced need for memory to save costs. These items bring value to the particular blockchain in particular and cryptocurrency in general.

I read and understood that Electric Capitol starts with their version of these value measurements and added to them the Coin MarketCap rankings. Then by finding cryptocurrency projects that ranked high on the value scale and low on the Coin Market Cap rankings, they derive a list of “undervalued cryptocurrency projects’ for the firms investors to consider. Electric Capitol feels these coin projects will experience explosive growth during the coming bull market. These are the charts I found Steem on as a project with very significant developer activity, but it’s market cap is far less then the other coins on these charts, suggesting that if value follows development, Steem is undervalued.

Conclusion:

First, I believe that what we are seeing here is the use of accepted measurements of value for cryptocurrency project, along with a low ranking on CoinMarketCap to indicate “undervaluation”. I found that Electric Capitol’s data indicates that Steem is on the same map as many famous coins who fulfilled these criterion, and by these parameters Steem is undervalued. I am very happy that a third party has measured Steem by objective parameters and listed it amongst other projects with large amounts of intrinsic value whose prices are very low during this bear market.

Second, despite being present on the charts and graphs along with some well known coins, Steem is a relatively unknown coin. I think that one possible conclusion to draw is that as this type of data collection and analysis becomes more common, and Steem pops up on more and more graphs and charts, Steem’s day’s in obscurity will be gone, along with the low prices we have now. I think both will be just a memory.

✍️ by Shortsegments

Good News

Posted using Partiko iOS

Seem an interrsting way to value projects.

Posted using Partiko Android

Yes I agree. I hope this tool brings some attention to our blockchain!

They should open their eyes and begin pouring their fundings into steem

I am hoping this company will direct some of their customers investments our way.

I have little idea why Steem is so ignored in the space and wonder if it is because as a community, it doesn't target technical people much at all.

I think the answer to that question is very valuable to us. I plan to contact the writer and see what their perception is....

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.