Limited Partnership/Distressed debt create Investment Opportunity

I learned something today in a call to Fidelity. I own OAK in my Rollover IRA. I recently received a K1-statement and didn’t realize this was a partnership. Within our company sponsored Fidelity 401K/Brokerage Link, last year they forbid having partnerships or MLP ownership, primarily because there are tax consequences.

Within any other account they are now ok to own. With a partnership, the company gets special tax treatment in that they pay no taxes by having earnings flow through to the partners. Thus, we get K1-statements. However, if your portion of earnings (dividends are actually a return of the capital you invested to buy your shares) are less than $1,000 annually, you don’t have to file any taxes on the partnership interest. And if it is over $1,000, you also don’t have to worry about it. Why? Because Fidelity now pays your taxes on your behalf directly out of your account to help simplify these positions. So we are now free to buy them.

Why is this so great? Because partnerships pay out 90% of their earnings as distributions to their partners. So normally, MLPs/Partnerships are great sources for high dividends (technically they are called distributions).

Now back to OAK. It is run by one of the worlds best investors of distressed debt (non investment grade corporate debt). Here is the short story…

Funds who invest in corporate debt need a liquid market for bonds. However, during a contraction of credit near the end of a credit cycle, defaults rates spike and corporate bonds get downgrades by the credit agencies. When the bonds get downgraded they often end up no longer being investment grade. Pensions forbid ownership of non investment grade bonds. So they must sell the bonds in the case of a downgrade. This is an issue then, since the bonds that get dumped on the market are trying to find buyers. The bonds get substantially discounted in order to sell them on the open market and this creates a liquidity issue. This can spread to even less risky bonds.

During a distressed debt crisis, you can often buy discounted bonds of companies that are still able to make all of their full bond payments and won’t default. You may be able to get these bonds for 30-50% discount to their par value (bonds sell as $1,000 face value). So if you buy a $1,000 bond for $700 and it has a 10% coupon rate, in essence you now are getting a 30% discount and will get an annual bond payment that is ($100/$700)x 100 = 14.28%. Plus, when the bond reaches its expiration, you get the full $1,000 par value back and make $300 in capital gains on the bond. These can be incredible investment vehicles.

So why is this situation good for OAK? Since OAK is one of the worlds best distressed bond investors, during these credit crises they make a boatload of money and you in turn get your partial ownership of this boatload of dividends. Last year OAK raised something like $20B in preparation for the next credit crisis.

Bottom line:

We have entered the beginning of the last phase of a credit cycle. Credit is tightening. NOW is a great time to own OAK.

Through one of my high priced newsletters, I’ll also be buying directly the distressed bonds and acting just like OAK. I purchased the first recommendation last year and sold the bond in 12 months for around a 60% return.

Wishing you a chance to join me by picking up OAK.

Kevin

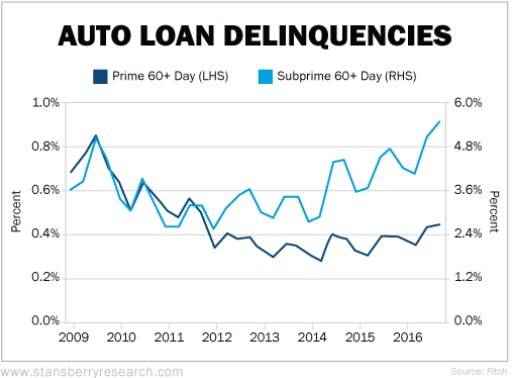

First sign of credit market stress

( )

)

Congratulations @morseke1! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Congratulations @morseke1! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPnice post, thanks for sharing

Thank you. I plan on writing more. I'm just trying to help people. I spend a lot of time on investing and I want to practice writing, so its a good combination.

Congratulations @morseke1! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @morseke1! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @morseke1! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @morseke1! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @morseke1! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPgreat analysis and very informative information.thanks for sharing friend @morseke.

upvoted

Hey friend @morseke1.... loving to your first steemit post.... there, i just registered on steem and bitcoin. i gave you an upvote. I've been reading your posts for a daily now. Keep up the good work.