⚠️ The US Consumer Price Index for October 2021 shows growing inflation ⚠️

Hello dear people of steemit!

Magnus here, I'm sure that if you are not currently dwelling under a toadstool that you: my smooth brained banana fueled brothers have heard the news recently about the US CPI for October 2021.

And so we are gathered here today to contemplate and discuss the recent news about the increase in inflation in the US and how this will impact us as investors in the near future.

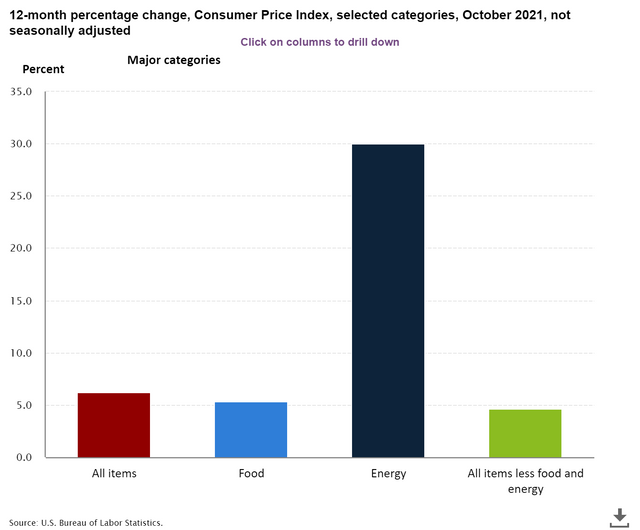

“US inflation has reached a height that has not been seen in over three decades. The US Bureau of Labor Statistics has released data on the Consumer Price Index for October. The data shows that the CPI has increased 6.2% more than the same period a year ago.”

“But Magnus, what does the increase in inflation mean!?”

I hear you cry.

Fear not my smooth brained simian friend. Magnus is here to share with you his illustrious opinion! Let us start from the bottom shall we?

Source

What is the CPI?

The Consumer Price Index (CPI) is a measure of the average change in the prices of goods and services consumed by households over a given time period. The data is released on a monthly basis by the United States Bureau of Labor Statistics (BLS).

The CPI is the most widely used metric for the identification of inflationary or deflationary periods.

A higher CPI shows that the price of common goods and services are increasing at a faster rate making the purchasing power of the common household decline (inflation).

A lower CPI shows that the price of common goods and services are increasing at a slower rate allowing for the purchasing power of the common household to increase (deflation) or atleast decline in a slower manner.

And now time to throw a chart into the post to break up the wall of text this turned into…

Source

“But Magnus, how does this impact me!?”

I hear you shout.

Well my vigorously vociferous yet vexatiously vulnerable vagabond. I will vivify what is vague and voice my various opinions and views.

Inflation - The enemy

As mentioned above, inflation eats away at our purchasing power meaning that we can buy less products for the same monetary value. For example:

Let's say this year a bunch of bananas consisting of 5 bananas costs $1. But over the course of the year the economy suffers an inflationary increase of 20%. Now those five bananas will still be worth five bananas but that $1 is now worth 20% less than it was at the same time last year.

This means that the same $1 will now only buy you 4 bananas. Or the producer will have to increase the price of 5 bananas to $1.20. Now in this example bananas have “become more expensive” and this simply will not do!

source

This means that if an individual saves money from one year to another and gains no interest upon their savings they have in fact lost money and not saved any. Even if an individual does save money and gain interest upon their savings, if the interest is not higher than the rate of inflation that individual has still lost purchasing power!

And so as a savvy investing simian, you now know that you must at minimum increase your savings by the value of inflation or you are in fact getting poorer.

Do you think that the feds will raise intrest rates in the near future?

I hope to speak to you soon!

- Magnus Chimpski

Find me elsewhere:

Buy me a banana:

Bitcoin(BTC) - 14jUKeGFgN6USdxfuT6uX8Qx3RM3gppmmt

Ethereum(ERC20) - 0x4c2d122c66412598486e373f885835ccbf0e1a35

Doge(DOGE) - D5nCBwbKCUwm33F6hJ8tNr5rNeNb4B9XhQ

Shiba(ERC20) - 0x4c2d122c66412598486e373f885835ccbf0e1a35

@cleverbot test

I don't think bots don't exist anymore!

Great read! Easy explanations for us chimps🐒

Thanks babomadam! :D

I'm glad you liked it!

Apes together strong!

Excited chimp noises

Here is a good read over on Reddit.

It's about profiting from an inflationary environment.

Inflation sucks...

It does, but unfortunatley it seems it is inevitable!

I think the feds raise rates.

Most probably!