Smooth brain sleuthing of stale SPACs 🕵️

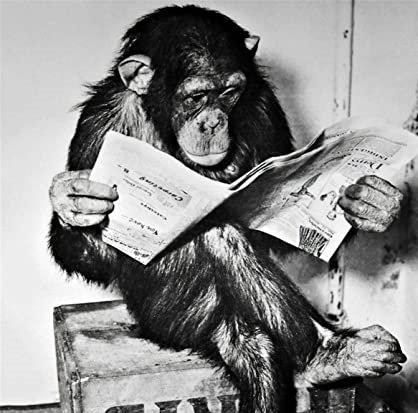

BEHOLD! ... Magnificence! ✨

Magnus here, how are you all doing this evening? Exciting day, ei? Did you rake the tendies in from $GGPI? No?

And how about $AMC? It would seem the battle for $40 is over i dare say! Let us not forget our smooth brained prediction what what!

Anyway, enough with the pleasantries! Let us move on to business!

Today I found my self endlessly screening company after company moping around on the interwebs glossing over some SPACS.

Given that we are currently in The Year of the SPAC a trend where the good old SPACs are prone to hype buying and wild tendie grabbing moonshots I thought it I might find something interesting.

Well my dear brethren, I stumbled upon a company... And I'm not too sure wether I'm excited that I found it, or saddened by my blinding $GGPI-SPAC-fueled bias!

I hear you say. Yes, of course! I am talking about Dragoneer Growth Opportunities ($DGNS). Now hang on a minute my dear brethren! Let us take a closer look.

First the chart

At first glance, nothing special. They began trading as a publicly available company on the 17th of November 2020. They YOLO'd it into the new year and crashed until April 2021. Slowly bled until August anf flatlined until now.

But this is of no consequence... Let us see what has happened in the last month! 🔎

Volume... Lots and lots of volume...

You query. Well I shall put it like this:

| Data provider | Avg. Vol. | Current Vol. | % change in Vol. |

|---|---|---|---|

| Finviz | 439,860 | 6.10M | ~ +1286% |

| Yahoo Finance | 446,040 | 6.1M | ~ +1254% |

| TradingView | 1.65M | 6.13M | ~ +271% |

| MarketWatch | 439,570 | 6.13M | ~ +1294% |

Quite a sizeable increase wouldn't you say? So naturally one looks even deeper! 🔬

This brought me to the next quirk... There iwasn't much news to go on, no hype, nothing!

Except a few articles back during the summer.

Source link: Finviz

Quite the rollercoaster we seem to have here! A warning, a merger announcement, legal problems and a presentation. Interesting stuff I say ei fellows? Let's plot them out on the chart to see if they seem to have affected prices:

Well the merger certainly drew some attention and the legal problems seem to have bled it back down again. After that follows that eeriely quiet period. Not much movement, no news... Speaking of news, lets have a look at these articles!

Merger announcement

On the 4th of June 2021 they announced a merger with Cvent. Cvent will go public via a merger with Dragoneer (SPAC) in a 5.3B deal.

Source link: MarketWatch

Source link: Businesswire

Source link: YahooFinance

Cvent is a meetings, events, and hospitality technology provider. They sell software solutions for planning events and a little more. You can read what they do in their own words here and here Is an investor presentation about themselves.

When the merge goes through the ticker will be changed to "CVT" and Cvent will become a public company... Again!

Yes, Cvent has been a public company in the past. It was taken private in 2016 in a $1.65B deal, a 69% premium on their share price at the time! Im sure that made investors very happy!

Now the inverse is happening, Cvent is becoming a publicly traded company once more. Now from this data we can see that it was taken private at $1.6B and now has an "initial enterprise value of $5.3 billion". So since 2016 the value of the company has grown ~231% in 7 years, not too shabby!

According to Finviz, ~86% of the company is owned by institutions. There are 102 institutional holders and you can find a list of them here.

Form 425 - Merger Prospectus/Communication 2021-11-12 00:00:00

- " today announced that Dragoneer’s registration statement on Form S-4 (as amended, the “Registration Statement”), in connection with the previously announced proposed business combination (the “Business Combination”), has been declared effective by the U.S. Securities and Exchange Commission (“SEC”)."

- "The Special Meeting of stockholders and the vote to approve the business combination will be held on December 7, 2021, at 9:00 a.m., Eastern Time. If the proposals at the Special Meeting are approved, the business combination is expected to close on December 8, 2021, subject to the satisfaction of customary closing conditions."

If all goes well, the deal closes on December the 8th.

This is getting out of hand! For more information on the merger, scan the SEC filings dear simians!

This was originally much longer, but i have cut it back seriously to allow me to post this while we are still in 2021...

Cut short:

- Cvent does virtual meetings.

- SPAC merger going to complete in December.

- Looking for a merge hype play.

- No news pushing or pumping so far.

- 1200%+ Increase in volume, yet only a 2.5% price increase.

Anyway dear ape brethren, I will leave it up to you to dig further if you so see fit!

- Magnus Chimpski

Disclaimer: This is not financial advice. It is an opinion. Magnus is not a financial advisor.

Magnus is infact a ficticious smooth brained simian of the interwebs, to take advice from an internet monkey would be insane.

- End of transmission

Find me elsewhere:

Buy me a banana:

| Crypto | Address |

|---|---|

| Bitcoin(BTC) | 14jUKeGFgN6USdxfuT6uX8Qx3RM3gppmmt |

| Ethereum(ERC20) | 0x4c2d122c66412598486e373f885835ccbf0e1a35 |

| Doge(DOGE) | D5nCBwbKCUwm33F6hJ8tNr5rNeNb4B9XhQ |

| Shiba(ERC20) | 0x4c2d122c66412598486e373f885835ccbf0e1a35 |

You can read this on Reddit!