8 Great Investing Themes for 2018

Now that we’re midway through December, I’m starting to think about good investing opportunities for 2018. The business and credit cycle are in mid-cycle. Interest rates are still historically low, but they should be steadily rising over the next few years. The Federal Reserve is forecasting three small interest rate increases next year. We are seeing increased chance for inflation in 2018.

There’s a lot going on around the world this year. We are farther along in the credit and economic cycles. After reviewing previous investing themes, I see eight great investing themes emerging.

In general, we are looking to get in early on trends. If we can find markets or sectors that have had a correction, then we can get in cheap. Moreover, if we can find markets or sectors that are now back on an uptrend, we can get in early. In other words, our goal is to get in early by identifying cheap and up-trending investment themes.

So, what does that mean for investing opportunity next year? Here are eight great investing themes to consider for 2018.

China

China is a developing country with other countries like India, Brazil and Russia. China is growing at a pace of about 6%, which is 2–3 times greater than that of the United States. The Chinese economy is shifting from an export-driven economy to a Chinese consumer economy, and the economy will continue to shift. In 2018, I think we’ll see Chinese companies that are focused on selling to Chinese customers do well. China has also rebounded from the lows experienced in the index of stocks that fell greatly over the past year or so. As the global economic cycle continues, we expect inflation to start to rise and emerging markets’ equities to do well.

One of the big reasons it is a good time to invest in China, is because shares are being added to the MSCI Emerging Markets Index as they buy more and more Chinese shares to keep portfolio percentages accurate within the MSCI EM index. This expansion will bring $1 trillion of investment into Chinese companies because of the increased percentages for China. You can find a general index Exchange Traded Fund (ETF) for China, or you can look for an index that focuses on Chinese “A-shares,” which is the direction that the bulk of the increased percentages are headed. Google “China Index ETF” or “China Consumer ETF.”

Robots & Automation

Almost anything business-related in the media last year talked about either robots and artificial intelligence. Companies are pushing for more and more automation. From a company financial statement perspective, employees’ salaries are a recurring expense, while robots and software are assets. Both produce income, but robots cost less than employees. So, what is there to do? Invest in companies that are investing in robots and automation. Google “robots and automation ETF.”

Cashless Society

There is a global push led by many countries to move to a “cashless” society. Countries tout convenience and how they could end money laundering and cash used for illicit activities. More importantly, it will make tax collection easier.

There are many countries leading the way. Singapore and the Netherlands are two countries leading the way. For more, check out this article for top cashless countries. With this push, there are going to be companies that are winners. Increasing processing and payment systems is going to become more profitable in 2018. If you want to check out an investment vehicle, search “payments ETF.”

Commodities

With the improvement in the economic cycle, it can be expected that inflation will follow in 2018. The Federal Reserve has been waiting for inflation to come for many years. So why now?

To forecast inflation, I like to use three criteria : the rate of increase of the Money Supply (M2), the price of copper and the 10-Yr US Treasury. As of now, M2 Money Supply has been steadily rising, even with the normalization efforts from the Fed. This creates the potential for inflation because more money in circulation means each unit is worth less. Checking in on the price of copper, it’s over $3, which means a base commodity has an increasing price and that leads to inflation. Finally, check the 10-Yr U.S. Treasury rates; it’s producing a yield of 2.39% and it’s rising. These signs all point to rising inflation in 2018. With inflation on the rise, you want to be investing in commodities. I would add commodities exposure to my portfolio. Google “commodities ETF” to find some investment options.

Precious Metals — Silver

Since many global central banks are still in a manipulative easing mode, this creates a good opportunity for precious metals. As currencies weaken, their purchasing power also weakens. Last year, gold was up 10% and silver was up 2.6%. I think we will see somewhat similar returns for gold in 2018, but because of the commodities cycle, I think silver will do better than gold in 2018. Silver is cheap when compared historically to the gold:silver ratio. In the past, silver would average 40 times less than gold. Right now, silver is closer to 80 times less than the price of gold. I would buy the silver ETF and not the miners, but if you want to employ leverage to your trade, do some research on “silver streaming and royalty companies.”

Artificial Intelligence (Still)

How much have we heard about AI in 2017? It was a topic of probably every other story that came out on the technology section. Will AI overpower humans and lead to a new world order? Some derivation of that story was printed every week this year.

One truth is that we’ve made an amazing leap in the application of AI for two reasons. One, is that now we have processing power that is far more capable than in times past, which allows us to train larger and more complex models. Two, is that we have a lot more data to train these AI models. More data and more computing power means we can find a lot more practical application for artificial intelligence. While AI was a big story in 2017, I think investment in it and profits from it will continue in 2018. If you want some investment ideas, google, “AI ETF” or “artificial intelligence ETF.

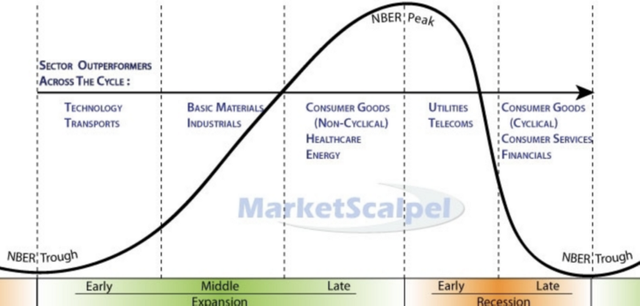

Business Cycle Mid-Cycle — Industrials, Materials & Healthcare

Based on where we are in the business cycle, we are in the mid-stage of expansion. What did well last year was technology and transports. What I expect to do well this year is basic materials, industrials and healthcare. I would look at investing in three core S&P sector ETFs. This idea comes from the notion of sector rotation as we improve through the economic cycle. Other sectors may do well, but I expect these three to outperform the S&P 500 index in 2018.

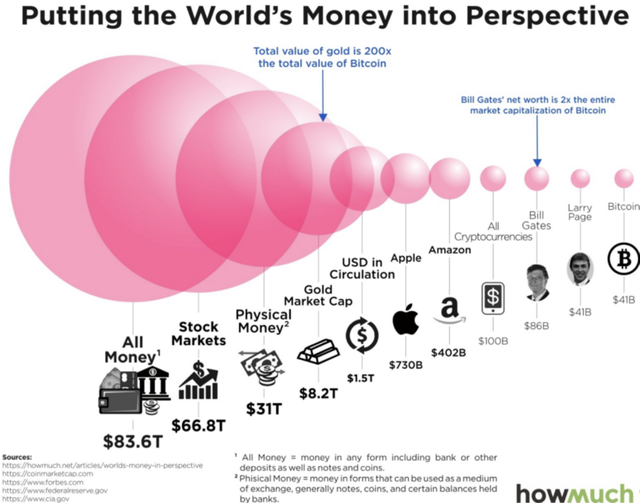

Cryptocurrency — Bitcoin & Ether

Bitcoin and all cryptocurrencies saw a large rise in market value in 2017. It was the year the early adopters got paid. But, in 2018, we’re going to see the year of wider mass adoption, so I expect cryptocurrencies to do well next year. A beginner in crypto investments could start with the two most popular cryptocurrencies: bitcoin and ether. They have the highest market cap, which you can track. I like to follow the total market cap of the cryptocurrency market, which is floating around $605B at my last reading of it. I expect to see the cryptocurrency market in total rise to at least $2T, and I expect it to rise to greater than $10T over the next 10 years. Just look at the size of several markets of money. Even if cryptocurrency disrupts a portion of each market, we’re talking about trillions of dollars in value.

So, those are my eight investing ideas for 2018: Investing in China because of the relatively high growth rate, a bottoming in price a year ago and the steady march of more capital into their stock markets as the MCSI adds more Chinese shares to their index; investing in technology through robots, automation and artificial intelligence; investing in inflation through commodities, silver and basic materials; investing in the mid-cycle sector rotation with industrials and healthcare; investing in the world becoming a cashless society through payments systems and cryptocurrency.

We’ll check in at the end of the year and see how I did.

Happy Hunting!

Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice. Please do your own homework.

If you enjoyed this article, like it to help others find it! For more, join us on Facebook and Twitter and if you want to receive the latest weekly updates on Investing, Entrepreneurship & Personal Finance, feel free to subscribe to our NEWSLETTER.

Resteemed by @resteembot! Good Luck!

The resteem was paid by @greetbot

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.