Stock Markets: Outlook 2018 for the S & P500

Through this platform, I will communicate investment-, trading-, -ideas / suggestions to interested private Investors.

Excessively stocks from Switzerland, from Europe including UK and stocks from the USA. Always presented as a trading idea for the long-term investor.

I will avoid long Texts in the Future.

My Posts are more about delivering visual stimuli into Stocks that I think have big Up-Potential. These Suggestions are intended for People who independently run a long-term equity portfolio and not for the lucky knight looking for quick profit. It is about building up the substance of a long-term equity portfolio.***

The idea is to provide interested readers with a Trading-Account on their own initiative with Trading-Suggestions. And to encourage them to think independently.

Whenever I see opportunities in the Financial Markets, in individual Stocks (Stocks from CH, EU, UK, US), then I write a Post on steemit.com.

Also, from time to time, I will chart the evolution of the major stock indices (My "Big Picture" of Financial Markets) and show graphically some possibilities for future development.***

You can put the shares I have listed on an observation list (Watchlist) and watch the future course. Or continue to research and eventually reach the conclusion that the shares I have mentioned are worth buying.

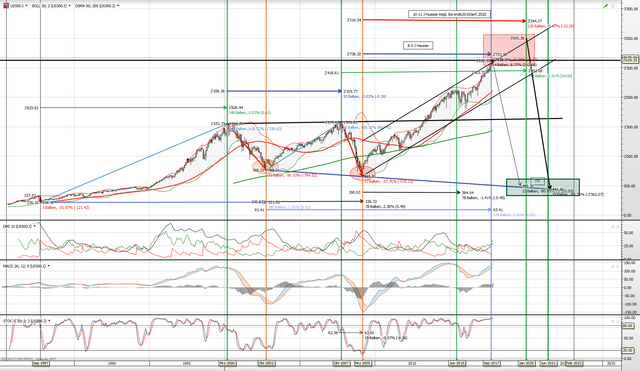

This post is about the S & P500, which has been in an uptrend since March 2009 - "thanks" to the Interventionism of the World's Major Central Banks (FED / SNB / BOJ / BOE / PBoC).

Nine years uptrend! Ludwig von Mises called this a "Crack-up-Boom"

***For 14 years I observe, trade and live Financial Markets. I am 36 years old, Italian Swiss dual citizens, live and speculate in Zurich. Stock markets are my Daily Bread. I advise Nobody to enter the Stock Market anymore. I expect a final "Grand Finale", a final euphoria boost that will lead the World's Major Indices (S & P500, DowJ, DAX, SMI, FTSE100, ect.) To a (temporary) Zenith (ATH).

In this Phase it says: The last bite the Dogs. Therefore:

Now it's Time to prepare in the coming months (10-20) the Exit.

If you do not own stocks, you are preparing for a Crash (2018/20192020?) with the following Recession and Depression. Then the time has come ... and here I just quote Nathan Mayer Rothschild:

"The secret of speculation: Buy when the blood flows on the streets."

From Blood to see far and wide. Wherever you look: Only bubbles: Bond-, Stock , Real Estate, Art Market/s....

... and as always in the history of mankind a "novelty" which is not one:

Bitcoins and all other cryptocurrencies are strongly reminiscent of the tulip mania in the Netherlands (1637). If Fiatmoney is zero then Bitcoins & Co. are less than zero. (Faith is one thing, knowledge is another). You can or could use it to make short term "cash" / speculate, that is not to negate but behind this hype is what was behind every hype in the story: Man. The human in the herd (And the herd can be steered very well (in one direction) .In addition, the story teaches us:

From the history of the peoples, we can learn that the peoples of history have learned nothing. Georg Wilhelm Friedrich Hegel (1770-1831)

My thesis about Bitcoins:

On October 31, 2008, Satoshi Nakamoto (pseudonym) sends the nine-page concept / discussion paper entitled "A Peer to Peer Electronic Cash System to Cryptography Group E-Mail Distributor" [email protected].

On 15 September 2008, two weeks before, Lehman Brothers became insolvent. And what happened after that should be clear to all.

Chronological coincidence?

Quantitative Easing 1 (QE1, December 2008 to March 2010)

On November 25, 2008, the US Federal Reserve announced that it would buy up to $ 600 billion in Mortgage Backed Securities (MBS). On December

BoE/BoJ/ECB/SNB act too. (Q1/Q2 2009: CreditEasing/QuantitativEasing)

January 2009 the Bitcoins Protocol will be released as Open-Source (Version 0.1)

February 2010 first Bitcoins trade.

For decades, the National Banks (At First the BoJ, than FED/BoE/SNB/ECB) have operated what they call "accommodative monetary policy" and coordinated Interventionism in the Capital Markets. In 2008 they realized that the Market Interventions that were in preparation (as of 2008/2009/2010/2011/2012/2013/2014/2015) would put the Currencies (USD / YEN / CHF / GBP) in the Final Death Penalty. So the the moneyed nobility created this first "Cryptocurrency Test - Trojan Horse Test Vehicle" .... And then, when the Time comes and the Financialsystem is once again close to Meltdown (and the causes of I call you already today: A.Greenspann / B.Bernanke / J.Yellen / JCTrichet / M.Draghi / H.Kuroda ...as a stooge others or as "Friends" of a "Circle" .. however .. you may call it ... Monetary Policy is coordinated and certain "Circles" have a common Agenda ... other "Circles" have a different Agenda. .. what connects them is only one thing: the preservation, the claim and the securing of Power.), then you let the cryptocurrency bubble burst and the upheavals on the international Financial Markets are attributed to this Vehicle or it then serves as a distraction strategy. The money needle / "The Power/the Elite" plans far in advance.....

My claim: Bitcoins was created by them (possibly for quite different reasons as I assumed). While "the 99%" are focused on Facebook, Instragram, the constant look on the Display, the Finger once in the Nose once on the Screen and the Headphones in the Ears. The over-stimulation of the Senses. In the interest of Puppet-Guides/Puppets-Leader. As lazy as people are, they don't see the Bic Picture....:

"Almost all people ever come across the truth in their lives. Most of them quickly jump up, knocking the dust off and rushing to their shops as if nothing had happened. "-Winston Churchill

Last but not least:

I expect new ATH for 2018.

There are still a Handful of Opportunities on the Stock Markets.

I will soon be presenting one or two Stocks. But potential Stock Investors need to be aware of the Maturity of the Uptrend.

Also on the cause of bullish Markets: negative interest rates, zero interest rates, quantitative easing, share repurchases, an economy based on even more Exessive lending than in the past was seen.!!

Happy New Year!

Congratulations @investment-ideas, you have decided to take the next big step with your first post! The Steem Network Team wishes you a great time among this awesome community.

The proven road to boost your personal success in this amazing Steem Network

Do you already know that @originalworks will get great profits by following these simple steps, that have been worked out by experts?