Is Starbucks Stock A Buy?

Its been a tough week for a holder of Starbucks stock as the price has fallen 12% in total over the past two days. Today it closed at $50.62, a price that it hasn't traded regularly at since 2015.

On June 19th the company updated guidance to show only a 1% growth in same-store sales. In addition, they announced they will be closing 150 underperforming US locations.

Well, it certainly shocked the market as prices fell over 9% on June 20th and another 3% today.

Starbucks Company Overview

The largest chain whose direct focus is on the sale of coffee beverages.

They operate in 75 countries and have nearly 28,000 locations.

They sell their wares in company-owned stores, licensed stores, and packaged products.

Starbucks controls approximately 40% of the market, with Dunkin Donuts and McDonalds each having about 22%.

Before this week McDonald's stock was up 7% in the past year while Dunkin was up 22% and Starbucks was down 4%.

Currently, 5 analysts are bullish on the stock and 11 are neutral with an average price target of $61.67.

My Thoughts & Numbers

To me, it appears that Starbucks is going through the transition from a fast/medium growth company to a slow growth dividend company. This changeover of investor types is most likely at the center of this precipitous drop.

This is shown in the announcement that Starbucks also announced that they will increase investor returns through share buybacks and dividends. They upped the amount they will pay in dividends and buybacks from $15B to $25B from now to FY2020 and announced a 20% dividend raise.

This increases the forward dividend yield to 2.84% with an updated payout ratio of 60%. They have increased the dividend for 7 years straight, from just 5 cents per quarter in 2010 to a current quarterly payout of 36 cents. The next ex-dividend date is August 8th.

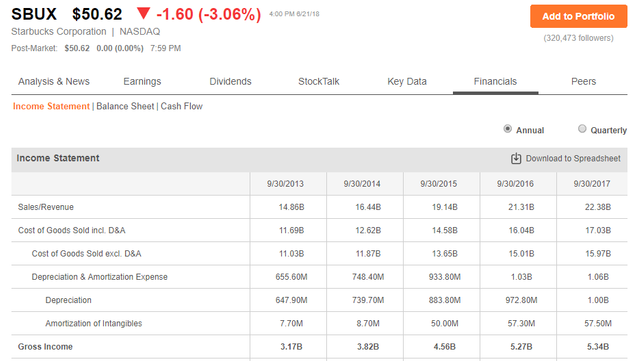

As you can see in this picture, revenue went from $14.86B in FY2013 to $22.38B in FY2017, but only increased by $70 million from FY16 to FY17 – basically no growth.

Gross income paints the same picture, going from $3.17B in FY13 to $5.34B in FY17, but only increasing by $70 million against FY16.

They have $3.71B in cash and investments and $3.93B in debt, which is a debt ratio of 0.944.

The Future of Starbucks

The company has laid out a plan for growth that mainly focuses on growth in the US and China as well as expanding the global reach of its branded products.

How can Starbucks focus on growth in the US when their locations are seemingly on top of each other. It reminds me of the joke about a Starbucks being inside a Starbucks. Well, as funny as that is I see Starbucks as too focused on cities.

You see, while they might have a location on every corner in large cities, smaller towns often have only one or two locations. Reviews that I have read about the smaller town locations state that the locations are usually too busy, and that customers are turning away because of the longer wait times.

Starbucks seems to have that culture mindset that the only thing that matters are cities, and that smaller America is backward and not worth their time. I say that this mindset is total bullshit. If they can get it out of their system, I see a lot of potential.

As for China, they say that the Chinese are not as large of a coffee drinking populace but Starbucks believes that they will be as the country becomes more wealthy as a whole. They want to be at the forefront of that predicted wave.

Is Starbucks a Buy?

That depends.

I believe that this is a temporary drop and a great entry point for dividend growth or value investors looking to start or increase their position. Starbucks will certainly not go bankrupt and they have the leverage of a strong brand.

But I also think that returns will be in the single digits for the foreseeable future and that will turn off anyone looking for quick and large returns.

So it really comes down to you. Do you want a potentially solid 6-9% return (including dividends) for the next 5 years or are you wanting more returns with more risk?

Another thing to consider is if another recession happens. While the stock price will most likely drop, I think that a cup of Starbucks coffee will be the one cheap luxury that many people allow themselves.

Am I buying? No, not right now. But maybe I will if it drops to the mid to high $40's as I do understand that great brands often bounce back.

Great, great analysis. There is nothing to add, you covered it, so I will just give you my opinion on where the price may head.

From a macro view, price has been range bound since 2015. If price close below $50.50 on the monthly chart below, I think price will go down to $37.50...which would the opportunity to buy.

If price closes on the monthly chart above $50.50, that would be a good sign that price may go back to the origin of the recent drop at $56.

Hope that helped.

Upvoted ($0.12) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

I like big price dips on major companies. Once the selling starts it's fueled by automated stop losses and panic selling / weak hands. Often these will recover half the dip before going flat. It's on my radar, but I'm waiting on it too.

Yeah, it doesn't excite me at this price yet. I figure it will take more of a drop to get on the radar of the value and dividend growth investors.

They are starting to get better at food, so that's a definite growth area for Starbucks. If I was investing it seems like a good company but did they name a new chief yet? I'd want to see his track record.

They changed CEO's last year so maybe people are holding off to see how he operates going forward.

I do know that starbucks will die a horrible death from the bad karma they have accrued, but i do not know when and how this will happen.

Right now, the current working paradigm seems to be fuelled by coffee. And such, it is probably one of the leading indicators of actual economic performance.

So, short term looks hazy.

Medium term it will bounce back and grow while the FED pumps the stock market.

Long term, it and many of the big box stores are just going to die.

Oh, I am no fan of Starbucks myself either. But I would invest if I thought I could get a good return.

Heck no!

There China stores are doing way under what was expected! And USA stores closing by the year. This stock is a dog and will be under $35.00 soon enough

At $35 it would have a dividend yield of 4.1%. THAT would certainly get some dividend growth investors attention.

Dividend will be cut in half f this trend goes on. There doing horribly

I have had starbucks as one of my largest holding in my IRA for over a decade now. I enjoy the dividend, but cannot remember the last time the stock was in the 40's its been so long....rather not re-visit LOL.

It has been range bound for a VERY long time between 52 to 64, sadly it just broke the bottom of that range with today's move. UGH, alot of downside real estate on the price chart is available.

Over a decade! Well, you have had some great capital appreciation then.

Thanks @getonthetrain for your Post. I think you make a good point about smaller towns. I think that is something to consider because I have lived in small rural towns and they love their Coffee. No doubt about it.

I remember krispy Kreme back in early 2000s built way too many stores and they paid for it dearly in stock price depreciation.

Btw, I'll being going on vacation tomorrow for over 3 weeks so if you see me in a limited role here at Steemit with visiting other peoples' blogs that's the reason :)

I’ll take AT&T now with a 6.33% dividend

@getonthetrain To many good Crypto's to look at buying instead..............