Wealthsimple Review - Simple Automated Investing

So you're looking to invest in Canada or in the US (and the UK)? Traditionally, investing required some basic finance skills. Either one had to go through an investment advisor, with fees often being quite prohibitive, or one had to find and choose some funds to pickup in order to have a good overall asset allocation. Furthermore, usually advisors are available only to high net worth individuals.

For the average investor, investing in stocks can also be seen complicated and a lot of people lack suck knowledge or just do not want to know more about that. At the same time, as we live in an environment with an all-time low-interest rate, a lot of people choose to park their money in traditional bank accounts, with really low interests, which is one the best way to lose some money due to inflation!

Updated Wealthsimple Review 2017

Wealthsimple is an investment app, which is one possible solution to make investing easy and accessible. Now that we live in a world where everything can be done with the swipe of a finger, many companies have seized upon this new era which is the world of Robo-Advisors.

- Wealthsimple now has more than $1.5 Billion in Assets Under Management (as of early November 2017) and 50,000+ users!

- With a raise of $50M in funding from Power Financial (early May 2017), Wealthsimple has now raised more than $100M in funding to date.

- Wealthsimple has officially launched in the UK.

- What is Wealthsimple?

- How does Wealthsimple work?

- Wealthsimple Features

- Wealthsimple Account Types

- Wealthsimple Socially Responsible Investing

- Wealthsimple for Work

- Wealthsimple Dashboard

- Is Wealthsimple safe?

- Wealthsimple (super easy) Sign-up Process

- Are there any fees associated with Wealthsimple?

- Wealthsimple Review Summary

- Final thoughts

What is Wealthsimple?

Wealthsimple is a robo advisor, founded in Canada in 2014 that invests your money in low cost index funds and it is one of the best investments app out there!

UPDATE January 2017: Wealthsimple is now also available in the US!

UPDATE September 2017: Wealthsimple is now also available in the UK!

UPDATE October 2017: Introducing Wealthsimple Gift Cards!

In a nutshell, Wealthsimple, like many other Robo-Advisors services, allows you to build an efficient and customized portfolio which is comprised of widely diversified, low-fee funds. The "Robo" part is mainly due to the fact that everything gets automated (and not the fact that it's managed by robots, because we're not in a sci-fi movie!).

It's really easy to use, even for new investors. If you do not want to manage your own portfolio, Wealthsimple is tough to beat for a very low price particularly for small accounts, and is based on the "Set it and Forget it" principle.

How does Wealthsimple work?

The whole concept of Robo-Advisor and low-fee funds is to mirror the stock market. This is a passive approach to investing. You invest your money in the market as a whole, in a balanced way, for a low cost. You’re not into picking stocks and trying to beat the market.

Investing is all about the *endgame*. When I'm saving, I don’t really care about investment theories; what I care about are the results! I'm investing for a specific purpose, like saving for a home down payment, or for retirement.All of that is handled for you by computers. Wealthsimple offer free re-balancing, tax optimization as well as a much cheaper MER (Management Expense Ratio) than the banks (about 0.2%).

Who doesn’t enjoy cheaper fees! There’s no need to research which investments you have to purchase or at what percentage for each. Wealthsimple automatically does this for you. This makes investing really easy for beginners. Wealthsimple’s goal is to maximize returns while also minimizing the risks. By investing in a wide pool of assets, this aims at collectively lowering the risks and yet stabilizing returns over the long term!

With Wealthsimple, you do not own individual stocks; instead, investments are held as ETFs (exchange-traded funds). The ETFs own a portion of the equities market via indexing. The asset allocation between these various ETFs ensures that your account is not weighted too heavily into one specific area, company or sector. While this doesn’t lead to outrageous returns, it has the benefit of preventing to put all your eggs in a single basket.

As of February 2017, I have made 11.8% on the money I have invested in Wealthsimple and paid not more than a couple cents for them to manage it for me (the first $5,000 are managed for free).

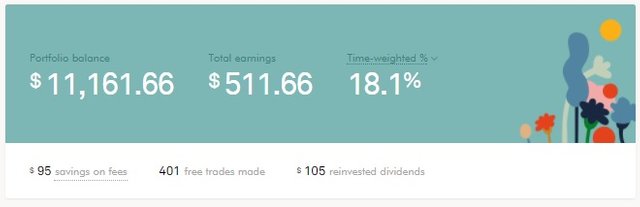

UPDATE October 2017: it's now up to 18.1%.

Wealthsimple Features

Wealthsimple has really low management fees. They also have the perks of modern technology as this a quite recent company (it was launched in 2014). It makes an attractive means to “set it and forget it” as you are able to set up recurring payments weekly, monthly or annually, as well as one-time contributions.

Minimum Account: No minimum

Management Fees: 0.4%-0.5%

Assets Under Management: $1.5 Billion

Founded: 2014

Users: 50,000

Services offered: Portfolio Rebalancing, Dividend Reinvesting, Automatic Deposits, Human Advisors, Tax Loss Harvesting

Portfolio typesConservative: (30% equity), Balanced (50% equity), Growth (75-90% equity), SRI

Setting up an account is also very easy. No more having to sign a lot of paperwork and waiting for it a long time before all is setup properly as everything can be done online. Once opened, just transfer your funds into one of their diversified portfolios and watch your money grow as everything else is taken care of.

Wealthsimple isn't a real “robo-advisor” by definition, because customers still can get financial and investment advice from a real human being. Named the "Wealth Concierge Service", clients can get advice from a team of professionals portfolio manager to discuss their customized portfolio, including asset classes and asset allocation, and also answer anything related to investments, goals or finances.

Wealthsimple Account Types

Supported accounts types (Canada)

- RRSP (Individual and Spousal)

- TFSA

- RESP

- RRIF

- LIRA

- Corporate

- Non-registered accounts (Single and Joint)

Supported accounts types (US)

- Personal

- Roth IRA

- Traditional IRA

- SEP IRA

- Joint

- Trust

Supported accounts types (UK)

- ISA

- JISA

- Personal Investment account

Wealthsimple Socially Responsible Investing

If you’re someone who cares about the impact your investments make on the world, up until now, you’ve still had to do all the worrying yourself. But Wealthsimple has options for you! They created an SRI (socially responsible investing) offering that has the same great features all Wealthsimple portfolios do.

These SRI ETFs include low carbon, cleantech, affordable housing bonds, and more. The idea is to invest in companies that promote your social values.

But you should be aware that many SRI funds can come with a higher price tag. In addition to the management fee from Wealthsimple there are underlying fees attached to the ETFs themselves. Wealthsimple SRI portfolio's management-expense ratio (MER) is slightly higher, ranging from 0.25 per cent to 0.40 per cent, compared with 0.15 per cent to 0.30 per cent for its non-SRI portfolios.Now you can feel better about the way you make money with the help of SRI through Wealthsimple!

Wealthsimple for Work

Wealthsimple for Work is another service offered by Wealthsimple which includes personalized investment advice for all plan participants and offers low-cost, passive ETFs instead of high fee mutual funds.

If you own a business, you can get help managing your Group RRSP or your company's investment benefit . That's great, because it takes some of the hassle and difficulty off your plate. If you want to offer a benefit to your employees, this can be a good way to do it, and Wealthsimple do not charge any administration fee for this (except matching contributions of course).

Wealthsimple Dashboard

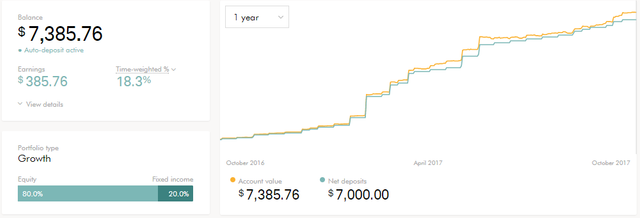

Wealthsimple recently did a major overhaul of their website and they made it more visually appealing and investor friendly. Here's what the user interface looks like now (I personally love it!):

As can be seen above, Portfolio total value, Earnings as well as Performance are really easy to find. But equally important is just below, where you can find Wealthsimple fees (and how much you saved on Fees), how many trades you have made and your reinvested dividends.

Is Wealthsimple safe?

Wealthsimple is considered one of the best financial services websites in the world. They even have won the Webby for the best financial services website (two consecutive years!). They are also the largest robo advisor in Canada and they have the highest count of Assets Under Management (AUM).

If this was not enough, Wealthsimple accounts have SIPC coverage up to $500,000 for the US. They also have CIPF coverage up to $1,000,000 for Canada and FSCS coverage up to £85,000 for the UK.This doesn’t mean that you can't lose money, but that it is protected if anything should happen to Wealthsimple.

Wealthsimple (super easy) Sign-up Process

The ease of signing up through Wealthsimple and their overall website design and app’s experience was what hooked me up in the first place.

Wealthsimple offers a blazing fast on-boarding process (whether it be online or directly in Wealthsimple App), unlike traditional banks, which allows to set up an account in less than 10 minutes from your smart phone or your computer. There’s no endless paperwork to sign. Everything can be done online!

You start by answering a few simple questions to be placed into a risk category (depending on your risk tolerance) from one 1 of 10, 10 being the highest risk focused mainly on equities (as opposed to fixed income). After this step, with an e-signature you get to sign documents electronically, thus eliminating the need to visit a traditional physical location to fill out paperwork. In just a couple minutes, you’re ready to start investing.

“I automated my contributions to my retirement account as if it was a simple monthly bill! Just set it and forget it.”

I was personally placed in Risk Category 8, which is a balanced portfolio of 80% equities and 20% fixed income.

Then, if you want, you can setup a call with their “Wealth Concierge”. This is a real financial advisor who has a quick conversation with you about your goals and validates if your risk category is right for you. Overall, here are the kinds of questions that you might be able to discuss:

- What are these accounts for?

- When do you think you’ll need the money?

- Do you anticipate taking any of the money out to buy a house, achieve other goals?

In a couple minutes, I was all set up with my Wealthsimple account.

If you do not want to create a new account, you can choose to transfer an existing one from another bank account.Once all the paperwork was submitted, it was a quick waiting game for Wealthsimple to use the funds to buy into the market. I think it took less than a day for my money to be invested.

Are there any fees associated with Wealthsimple?

The main reason why I chose Wealthsimple was because accounts under $5,000 are managed for free. Because of this I am allowed to grow my portfolio free of any management fee and gain a little investing experience at the same time. As a *young* and new investor this was a key point for me (also remember that with my Wealthsimple promo link, you get a $50 bonus (US) or $10,000 managed for free (CA and UK)).

You still have to pay the funds MER (Management Expense Ratio) fees that are used depending on the portfolio you chose, which are usually around 0.2%.

Another factor the led me to choose Wealthsimple over their competitors was the fact that Wealthsimple has no hidden fees. They have in their FAQ all the information you will need about Wealthsimple fee, from the percent you are charged for your account.

Wealthsimple just announced in January 2017 (see their blog here) that they greatly simplified and reduced their management fee. Now there are only two different packages regarding Wealthsimple fee:

- Accounts under $100,000: 0.50% management fee

- Accounts over $100,000: 0.40% management fee and you also get a Priority Pass (valued at $399) to access 1000+ airline lounges! This is their newly launched Wealthsimple Black.

As for transfer fees, if you choose to transfer from an existing account and if the transfer is over $5,000 Wealthsimple will reimburse the transfer fee your bank might charge for an account transfer (sometimes this adds up quickly to $100-$150!).

Wealthsimple Review Summary

Pros

- Low Management Fees – Wealthsimple charge no fees at all if you have less than $5,000 to invest. Otherwise it ranges from 0.4% to 0.5%. Wealthsimple will also reimburse transfer fees from your current bank account.

- Perfect for Young & New Investors – Wealthsimple makes investing accessible for new investors by automating all of the investing process.

- Great Referral Program – Get an additional $10,000 managed for free when you invite a friend to Wealthsimple (this can be cumulated!).

- Really Clean Interface – The web interface is really clean with just enough dashboards to get a quick "at a glance" view. You also get to have the awesome Wealthsimple App (iOS and Android).

Cons

- Not the Best for High Net Worth Individuals – For advanced investors, Wealthsimple might not be the perfect fit. If you can roll your own asset allocation and know investment theory, there's little need to use a service like Wealthsimple.

- No Goal Setting – This is a feature offered by other Robo Advisor like Wealthfront or Personal Capital, and one that would enhance Wealthsimple’s platform.

Rating

- Rated 5

Summary

- Wealthsimple is one of the best robo-advisors out there. It's the perfect way to get started investing for anyone and it features everything needed to get started quickly and easily with long-term investing. If you aren't interested in stock picking, but you know that investing needs to be part of your plan, Wealthsimple is definitely for you!

Final Thoughts

What started as a way for me to improve and automate my finances ended in a recurring contribution to my Wealthsimple account. So far so good as they say, and I'm still really impressed with their services! Starting investing with Wealthsimple was definitely one really interesting investing strategy which I now recommend to many people. If you are looking to start investing I would highly recommend using Wealthsimple.

Its a great way to get exposure to investing and low-cost funds, and with the first year of zero management fees from them on your first $5,000 it's a great option to get started. Also don’t forget to sign-up with my referral link to gain the $50 bonus when signing up to Wealthsimple (that's only for people living in the US. If you live in Canada or the UK, you get $10,000 managed for free!). Its a great way to save yourself some money in Wealthsimple fees or get a nice bonus to get started!

I hope you liked this review and learned more about Wealthsimple App and how to get started investing easily in Canada or the US/UK, and that you learned a bit about Wealthsimple and the whole "Robo-Advisor" concept in general!

Other financial tools reviews you might be interested in

- Automatically roundup and invest your spare change: Mylo Review

- Automatically earn rewards while shopping: Drop App Review

– Vincent