BITCOIN HITS $10,000 FOR FIRST TIME IN 15 MONTHS - TA FOR 23 JUNE 2019

23 June 2019 | Darcy K. Butcher, MA, Journalist | Pacific Rim International

BITCOIN HITS $10,000

Bitcoin continues to range above $10,000 where for the first time in over a year it slowed and is finding price equilibrium. Early Saturday morning Bulls had driven BTC to the $11,000 mark on many exchanges. Bitcoin is the most popular and well known cryptocurrency and continues riding a new wave of digital currency optimism for investors.

In this last bear cycle crypto investment firms have seen a robust inflow of capital from institutional investors. While many retail investors are finding more interest in this asset clearly the majority of the surgein the first quarter of 2019 has come from institutional investors. Grayscale’s Bitcoin Investment Trust (GBTC) has now surpassed $2 billion in assets under management while reaching a record high in daily volume and accounts for more than 70 percent of investments

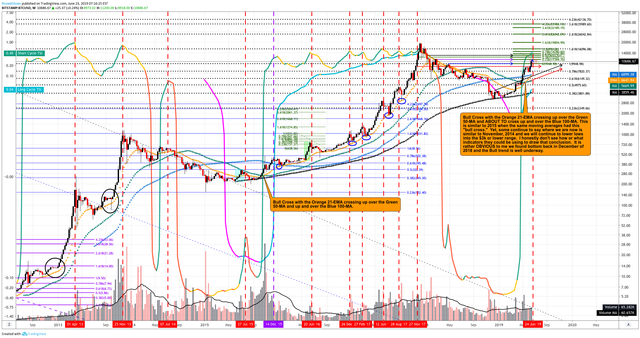

Chart TA Credit: TradingView: David Ward. Please consider giving him a follow: @ProwdClown

Bitcoin price has spent the last eight weeks with the Bulls in control and has surged past 160% this year. Bloomberg Crypto Index, which tracks the largest cryptocurrencies has doubled. This recent price surge is currently testing the $10,000 range after a short squeeze. Additionally, the USA Stock Market (SPY) and gold have seen prices surge upward in the same timeframe.

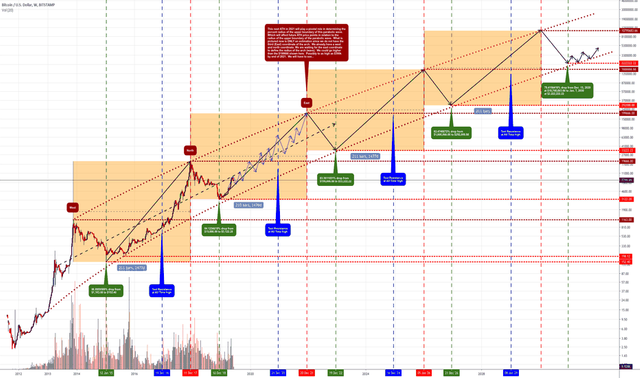

This range is significant because historically, in comparison when bitcoin first crossed over $10,000 in November 2017, it topped its all-time high in just 18 days. The all time high was just shy of $20,000 before taking a bearish correction lasting over 400 days. This latest run has had less media attention, hype, as the market shows significant signs of maturing.

PRICE MILESTONES

FIBONACCI POINTS - KEY RANGES FOR BITCOIN

4.234 $42136.70

3.618 $35989.60

2.618 $26042.84

1.618 $16096.08

1.000 $9948.98

0.786 $7820.37

0.61816 $6149.32

0.500 $4975.60

0.382 $3801.88

BITCOIN TECHNICALS - TRADING WITH THE TREND

A confirmed local top for Bitcoin has NOT been establish with this run. The Historical Volatility Percentile & SMA is ticking up on higher time frames. Lower time frames show signs of consolidating. The 2-hour RSI is constructive for continued upside. Full bullish posturing on all moving averages on all higher time frames with this strong trend and oscillators currently are resetting. Trend is in strength to the upside. Closing above $10,200, the top bollinger band (CME closed at $10, 015 and top before was $9600) today is bullish.

Bitcoin 3-day gains momentum and is indicated to the upside (because a higher high has not posted), the stoch is up and the RSI shows some bearish divergence. CME top range is coming in at 11,400 - $11500 a hisotrical Bitcoin top range. Caution is warranted for Bulls until a break above $11,150 - $11,500 on most exchanges is confirmed. The golden cross of the 50 EMA and the 200 set the tone for a long term bullish bias. Extreme fumes accelerating to higher highs would be volatile in this pivot area. Notable lower time signals that the trend is showing some exhaustion.

MOVING AVERAGES

Bullish cross and follow through occurred on the MACD on the monthly. The 200 SMA, which Bitcoin has broken above, is an indication phase, guidance and governance for strong longer term trends. The 200 SMA establishes major trend lines and will also govern potential future lows. Established market makers note that Bitcoin is unprecedented in the current paradigm because established retest to the downside has not occurred. The current Weekly Bitcoin range is $10,200 - $11,500, with volume tick would strike close to $11,800 and with volume to $13,000 (monthly indicator is closer to $14,250 -$15,000). A higher high has not occurred. A higher low would occur on the testing of the monthly 21 EMA. Typically, violent moves to the downside could encompass ranges of up to 40%. For investors who use DCA, Dollar Cost Averaging is most effective in upper trends.

LONGS AND SHORTS

Datamish reports shorts at 27,500 (25,200 open naked) verses 24,000 longs which puts more pressure on to the upside. Shorts have shot up since 11th of June, then again on the 19th and many are now trapped. They are trapped below a major market pivot zone (by as much as 2,000 points) which is more rocket fuel for the upside as more are squeezed (having to cover if the market moves up).

FEAR AND GREED INDEX

Fear and Greed may test all time highs, up to 95 for a critical and extreme range is possible. The Bitcoin Network Momentum, which lags in nature, charts upside after oscillator signals above critical marker (which has not yet occurred and is quite compelling).

When the index pushes this extreme it means that investors are anxious which could be a buying opportunity. Likewise it indicates that the market could be due for a correction. For now indications and market sentiment signal that bulls are in control while Bitcoin is testing the top range of this index.

NOTABLE

- The 12 and 26 EMA crossed bullish at $5500 which began this bull trend

- Low weekly support would be $7670 - 7840 (12/26 EMA) depending on exchange and timeframe

- Weekly Stoch found support at 80 range and has room to run up. It is looking for cross to confirm

- RSI Weekly hitting 80 range and double top. Top off possible up on the 89-90 range

- Monthly TD is green 4

- BTC is not in a bullish sequence with Moving Averages: Still have 100 over the 50 and the 200

- Bullish would be the 50 to cross and be above both the 100 and the 200

- Cross of the 50 MA would accelerate bold climb with BTC

- Running room on the OBV goes up to $15676

- Lower time frames showing some exhaustion

CURRENT MARKET CAP

Market Cap: $325,373,358,125

24h Vol: $72,055,122,011

BTC Dominance: 58.6%

- There is some analysis indicating that Bitcoin could reach 70% dominance

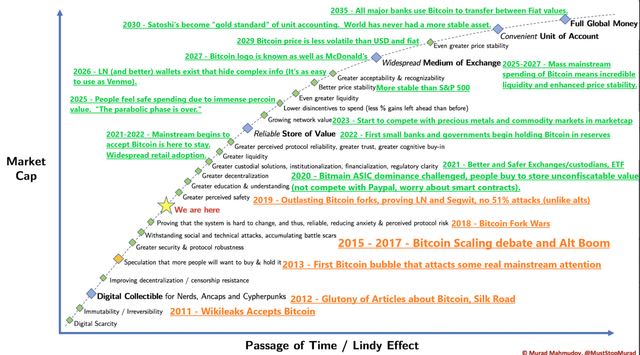

THE LINDY EFFECT CHARTED

The Lindy effect is an idea that the future life expectancy of things like a technology or an idea is proportional to its current age. The Lindy effect theory is states that every additional period of thriving, even survival, implies a longer remaining life expectancy in coordination with natural cycles of aging. It helps give a timeline to cycles, maturity and aids in managing expectations while providing guidelines and insights.

I appreciate you and thank you for your support, contribution and connection!

BTC Wallet:

346W2wMDXVULDkuA3UUMe9S3EQT1KiMNon

LTC Wallet:

MUFGoHiwEQQJnfXFSUjN5eJTaBUCd7cu8k

For educational purposes only. This is not financial advice. DYOR

If this content is useful to you please consider an upvote, share. Trade and Invest wisely.

We got this! Thank you Everyone!

#LTC #Litecoin #XRP #Ripple #ETH #Etheruem #ADA #Cardano #RVN #XLM #bitcoin #cryptocurrency #trading #PriceAction #PricePrediction #BitcoinAnalysis #BitcoinTrading #ETH #Ethereum #CryptocurrencyTrading #Bitcoin2019 #Fibonacci #BitcoinCrash #BitcoinMoon #BitcoinNews #BitcoinPrice #Finance #Business #CryptocurrencyAnalysis #WYCKOF #Accumulation #TradingView #ProudClown #RiskManagment #Krown #ChartVampire #CrackingCrypto #Cryptonews #Steem #Steemit #settemengine #blog #darcykbutcher #Writer #Journalist #Photographer #Educator

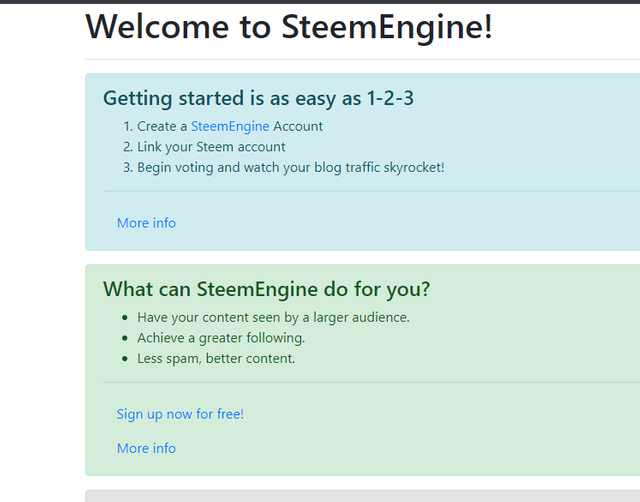

Improve your experience and result by signing up for Steam Engine:

https://steemengine.net/join?r=2743

START INVESTING OR TRADING -JOIN COINBASE EXCHANGE

https://www.coinbase.com/join/5a034297625b200116c8e782?src=ios-link

I think it was past 11,500 btiefly on xcoins today.

I bought another $200 today to catch the little bump when it was 10,900 earlier in the day.

Congratulations @fieldsofgold! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @fieldsofgold! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!