SoftBank’s Outsized Bets will pay off in a Hyperconnected & Digital Economy

I think many in the mainstream media and Wall Street Analysts do not understand SoftBank’s Vision Fund from a Thematic, Macro or Technological Standpoint at all.

I’m not going to go into numbers, quarterly reports or profits, because I have not even been paying attention to that stuff. Although there could be something I am missing there.

But what I have been paying attention to is their macro thematic strategy which fascinates me. SoftBank is making bets on digital transformation, hyper connectivity, and the technological singularity. And I believe as we are beginning to see in 2020 and as it becomes very clear, you do not want to bet against digital transformation, exponential technologies, hyper connectivity and convergence.

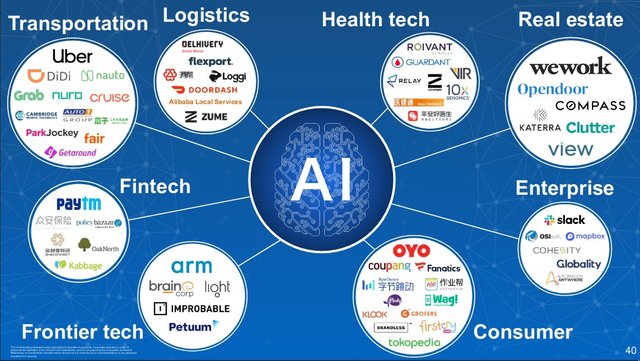

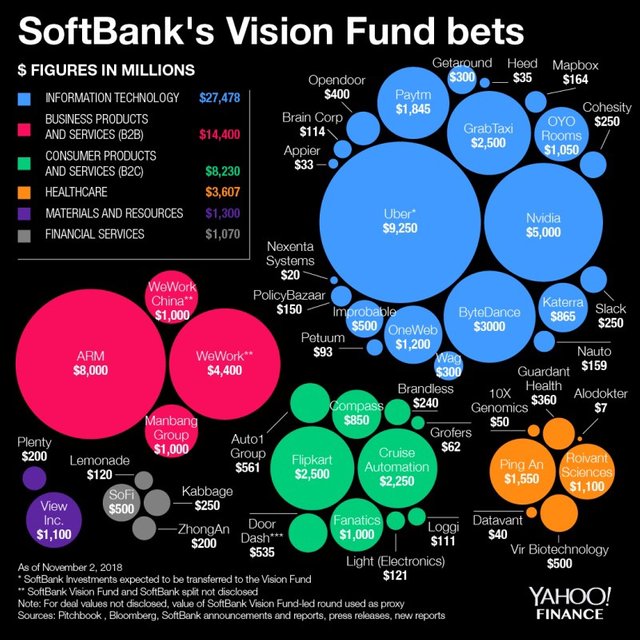

Take a look at many of SoftBank’s investments below and the industries they are apart of.

All of them are ultimately connected to computing and AI in some shape or form. While everyone is paying attention to wework, they are missing out on all of SoftBank’s outsized investments in other companies such as ARM, Uber and Nvidia. Those 3 companies themselves are involved in everything from gaming, semiconductors, autonomous vehicles, IoT, Cloud to AI and 5G.

But when you look at SoftBank’s Vision Fund in it’s entirety you see that they have already won. Stop looking at short-term debt and start looking at the bigger picture of what they own. Because SoftBank now own’s much of the digital infrastructure that runs the modern world and digital economy and I believe Masayoshi Son is the most legendary Private Equity Investor the world has ever seen. The world just hasn’t caught up to the digital world.