RE: Think the Stock Market isnt a bubble? (Only the Federal reserve doesn't)

This post is spot on. I have been following the markets for 20+ years and the bubble like nature of stocks especially in the US is way more extreme than even the dot com bubble with all those crappy tech stocks with billion dollar valuations.

The interesting thing is that there are so many warning signs going off and yet mainstream establishments are oblivious to it all like in 2007 or if you prefer 1987.

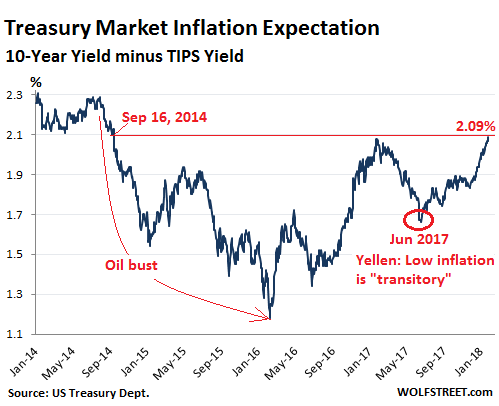

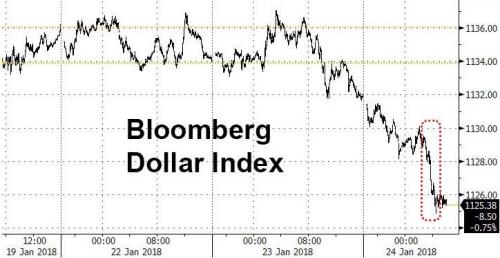

We have a rising Oil price which is going to hurt most consumers. The USD is collapsing without much fan fare at this stage. Lastly we have US bond yields spiking higher and with massive debt levels this is huge.

Take a look at the charts to see what I mean.

On your point of money flowing into Altcoins with the collaspe, here is my theory based on what happened in 2008 & 2009.

I believe when the crash comes in stocks and most bubble assets it will unfortunately bring down the price of Altcoins and Bitcoin in the short to medium term as investors and traders will be reeling and need to sell liquid assets to make margin calls on all debt obligations.

This same event occurred with Gold even though it normally does well in crisis and forced selling drove the price lower.

Cheers.