TIB: Today I Bought (and Sold) - An Investors Journal #481 - Solar Power, US Technology, Semiconductors, Bitcoin, Oil Producers, Soybeans, Europe Interest Rates

Markets flip flop either side of the weekend not really knowing which way to go but jumping on every news item. With a month away coming up I am toning down my trade activity - a few covered calls and some crypto-related action through a pretty volatile Bitcoin weekend.

Portfolio News

Market Flip Flop

Flip flop happens either side of the weekend.

A report that White House was thinking of limiting access for Chinese firms listing in US shook markets on Friday.

The report was denied as rumour by official spokespersons on Monday and all is good again. It seems clear to me that market is less concerned about impeachment inquiry compared to China trade discussions. The way agricultural commodity prices moved on Monday suggests to me discussions are going ahead as planned.

Yields are leaning to a better market rather than the fear seen earlier.

China Superpower

China prepares for its 70th National Day with a massive military parade.

Premier Ji Xinping is expected to make a chilling superpower speech - China versus the World are in the words in a draft released to official newspaper journalists. All good for world markets with spending moving along as long as nobody presses the anti-superpower buttons.

Sold

Soybean Futures (SOYB): Soybeans. One contract closed on hitting profit target for $8.30 (0.92%) per contract profit. Trailed stop losses on trades on soybeans and wheat that are above breakeven.

Shorts

Euribor 3 Month Interest Rate Futures (IZ): Europe Interest Rates. With margin call driven by Bitcoin price fall on Friday, closed the remaining short contract in IG Markets account for 99 basis points loss. This equates to 4 rate cuts when I was expecting rises = OUCH!!

Expiring Options

Apache Corporation (APA): US Oil Producer. With Friday closing price of $25.70, strike 23.5 sold put options expired in my favour. This trade was set up to grab back some premium on stock assigned last month. I will report the income in the calcs for the covered calls written for October expiry. (see TIB477)

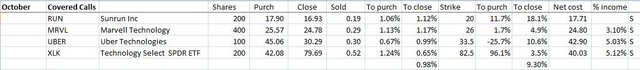

Income Trades

4 new covered calls written for an average 0.98% premium with coverage of 9.3%

- Technology Select Sector SPDR Fund (XLK): US Technology.

- Marvell Technology Group Ltd (MRVL): US Semiconductors.

- Uber Technologies, Inc (UBER): Ride Sharing.

- Sunrun Inc (RUN): US Solar Power

Cryptocurency

Bitcoin (BTCUSD): Price range for the five days was $753 (9% of the open on Sept 26). Price basically ended up where it started but it did trade all the way down to test support at $7761 twice and back to resistance at $8400. Yesterday's bar (Sept 30) is important as it a bullish engulfing bar off a strong support level. With price testing that level twice now this is a strong reversal possibility.

This early weekend drop did drive two margin calls in my IG Markets account = driving me nuts as I can see where price will bounce and it does each time. One new contract opened on a 4 hour reversal - held off and waited for this one.

Ethereum (ETHUSD): Price range for the five days was $30 (18% of the open). Price action was quite different with the low for the 4 days reached on day one (Sept 26) with price then pushing higher to test resistance at $177 and closing above yesterday (Sept 30). The short term level I drew in last time (blue ray now extended was respected with all 3 tests below closing above)

Ripple (XRPUSD): Price range for the five days was $0.03769 (15% of the open). First day (Sept 26) also saw the lowest low with a long tailed engulfing bar. Price then traded inside that bar for 3 days before breaking up to test and push through $0.26

CryptoBots

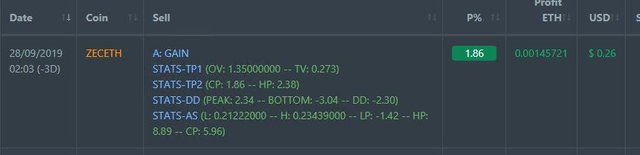

Profit Trailer Bot One closed trade (1.86% profit) bringing the position on the account to 9.84% profit (was 9.81%) (not accounting for open trades).

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 19 trades on AUDNZD, EURGBP, XAUUSD, GBPUSD, NZDUSD for 1.71% profits for the four days. Trades open on GBPUSD, USDCHF, USDJPY (0.79% negative)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work.

China flag image is Creative Commons free to use for commercial purposes. I added the 70 Years words.

https://www.maxpixel.net/photo-1752046 https://creativecommons.org/publicdomain/zero/1.0/deed.en

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex and crypto prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

September 26-30, 2019

How does Cryptobot work? I think you are right that Bitcoin could be an interesting buy at this level