TIB: Today I Bought (and Sold) - An Investors Journal #456 - Europe Interest Rates, Bitcoin, Ethereum

US markets like the strong retail data - data wins. Drop in Bitcoin and agriculture prices drives margin pressure. Rather than fund the shortfall, time to bite the bullet on European interest rates - this baby is sick.

Portfolio News

Market Selloff/Rally

The headlines say it all.

Markets opened all green with the talk around the data = strong retail numbers from Target (TGT) the day before and Nordstrom (JWN) and Home Depot (HD) today. By the time I got to watch the end of the day show this morning, the talk was back to what Jay Powell might say at Jackson Hole and the German 30 year zero coupon bond auction. Negative yields in Europe are now baked in 30 years ahead

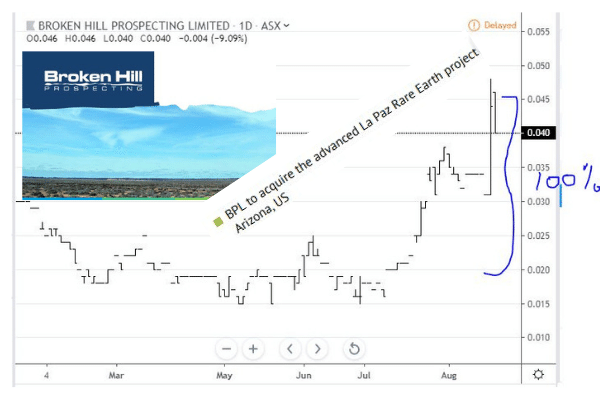

Rare Earths

Broken Hill Prospecting (BPL.AX) share price jumps 100% in my portfolios after a long spell in the doldrums.

Not long ago lithium was the magic dust, then it was cobalt and now it is rare earths. BPL acquires tenements in Arizona to mine rare earths - good news as US is mining friendly, infrastructure is close by and rare earths are in the trade war cross-hairs. Bad news - this is a patch of dirt in Arizona - not an operating mine = could be a long wait. BPL has not yet resolved its dispute with Cobalt Blue (COB.AX) on the other magic dust thing it is pursuing = cobalt

Bought

De Grey Mining (DEG.AX): Australian Gold Exploration. Received allocation notice on share purchase plan including additional allocation from the shortfall allocation increasing holding by 18%. Issue price was at a substantial discount to price at announcement time and is still 8% lower than current price. De Grey own substantial tenements in the Pilbara region of Western Australia. Nugget finds and field size estimates rival those of Witwatersrand gold field on which Johannesburg, South Africa was founded. This is however a long journey from tenement to mining - still a patch of earth.

Shorts

Euribor 3 Month Interest rate Futures (IZ): Closed down 2 contracts to cover margin calls in IG Markets account driven by falling crypto, corn and soybean prices. The German 30 zero coupon bond auction came out with a negative yield implied. Chances of a December 2020 yield improving much from the trade negative 68 basis points are now quite low. Time to bite the bullet on what has become a bad trade. I had been hoping for a slide uptick in yield to reduce the scale of losses - not to be. I will progressively release margin in this account this way. Losses were 95 basis points and 61.5 basis points. The disturbing part is the 61.5 basis points move was in one month only.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $954 (8.8% of the high). A day with twice the price range of the day before - a drop from the middle of "no mans land" - maybe those 2 short term turning points I wrote about the other are being respected

I added one new contract with pending order on a reversal on the 4 hour chart. Hoping the support holds around the $10,000 level.

It is hard to pin down news events that might drive a drop in Bitcoin prices - maybe it was this one

https://cointelegraph.com/news/us-treasury-sanctions-bitcoin-litecoin-addresses-under-kingpin-act

Ethereum (ETHUSD): Price range for the day was $18 (9% of the high). This price move was easier to see coming as it followed on the rejection the day before at that $201 resistance level.

I added one new contract this morning on a 4 hour inside bar reversal.

Ripple (XRPUSD): Price range for the day was $0.01577 (6% of the high). Price stayed below the resistance level it has broken the day before (0.27735) and headed lower.

Note: the chart shows a price spike - this is an anomaly on the Kraken exchange (the little pink ray is the high achieved on Binance which I used to calculate the range)

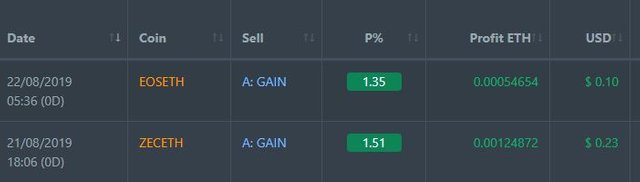

CryptoBots

Profit Trailer Bot Two closed trades (1.43% profit) bringing the position on the account to 9.59% profit (was 9.56%) (not accounting for open trades).

I trimmed the tradeable pairs to 6 from 7.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account No closed trades

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and CoinTelegraph.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

August 21, 2019

Makes sense we saw this as the consumer is still 70% of the economy. However, some of these are trailing indicators and I am sure that the talks of recession alone by the friendly media will impact retail soon enough.

Posted using Partiko iOS

Just found this - nice write up! I like your format on financial metrics

Posted using Partiko Android

Thanks

Hi, @carrinm!

You just got a 0.38% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Nice, article going to use it on my trading session on Primexbt today!