TIB: Today I Bought (and Sold) - An Investors Journal #368 - Swiss Banks, Swiss Insurance, Gold Mining, Network Management, US Healthcare, Marijuana, Corn

Markets like a patient Federal Reserve. More big moves in cannabis. Back into CVS Health. Busy day setting up covered calls and shuffling deckchairs in Swiss financials. Corn pops up

Portfolio News

Market Rally

The market was nervous ahead of the Federal Reserve minutes but settled the nerves with the patient tone calming things.

Cannabis Carnival

Carnival continues with Tilray (TLRY) making its biggest acquisition of Manitoba Harvest, a company that claims to be the world’s biggest hemp food maker.

Tilray said it expects to use the deal to launch CBD-derived products in the U.S. as early as this summer. There are some legal details that need sorting around CBD approvals from FDA.

Bought

Yamana Gold (RNY.DE): Gold Miner. Added a small parcel of European listing for Yamana Gold as a hedging trade. This hedges Euro risk as income is generated in US Dollars. A quick look at the chart for the European listing.

Price broke the downtrend on a weekly chart in late 2017 and then tested back to those lows during late 2018. The Federal Reserve action seems to have put a floor under price since then and we could well see a break of the more recent downtrend. That new trend line can be drawn a few ways but I like to use the tops of bars for a weekly chart. What convinces me is price has just made a higher high. See TIB307 for the initial rationale on Yamana.

CVS Health Corporation (CVS): US Healthcare. CVS announced results with forward guidance for 2019 which disappointed markets.

Price was pushed down 8% which worked just fine for me as it answered the question I raised on Monday about buying the stock back that were assigned on covered calls. I bought it back in all my portfolios and immediately wrote covered calls against it. Jim Cramer did write a note about the results - he was disappointed about the guidance but was advising buyers to wait a few days and look to enter around $62 - I paid $64.08. I was assigned at $68 on Friday.

UBS Group AG (UBSG.VX): Swiss Bank. I deployed some of the proceeds of the Zurich Insurance sale into the December 2021 14/18 bull call spread that I had tried to buy on Monday. Net premium was SFr 0.63 offering maximum profit potential of 534% if price passes SFr 18 in the next 34 months.

See TIB366 for the discussion on the charts. Of course, the news of a French court imposing a $5.1 billion fine did not help the story. News broke after the trade was made.

The lawyer in me has to share the press release - the whole case sounds spurious to me, in a very typical French way. The problems are in jurisdiction of applying French law in Switzerland, in weight of evidence, and in proving the fraud and in scaling the penalty.

The conviction is not supported by any concrete evidence, but instead is based on the unfounded allegations of former employees who were not even heard at the trial. No evidence was provided that any French client was solicited on French soil by a UBS AG client advisor to open an account in Switzerland. As no offence in France was established, the decision effectively applies French law in Switzerland. This undermines the sovereignty of Swiss law and poses significant questions of territoriality. The judgement does not depart from preconceived notions, incriminating the bank based on the fact that it offered certain legitimate and standard services under Swiss law that are also common in other jurisdictions.

https://www.businesswire.com/news/home/20190220005530/en/UBS-Group-AG-UK-Regulatory-Announcement-UBS

eBay Inc (EBAY): Online Commerce. Topped up in one portfolio to get to 100 shares so I could write covered calls.

Aurora Cannabis Inc (ACB.TO): Canadian Marijuana. Added another small parcel into one portfolio with the Tilray news pushing stocks up in the sector.

Corn Futures (CORN): I added one more long contract on a price reversal on a 4 hour chart.

Corn is one of the China trade topics. The uncertainty of the progress is driving the price all over the place. I did see a news clip that China said they would buy more - my whole corn investment thesis is based on China demand. This trade is a trade move that fits in with that thesis.

Sold

Zurich Insurance Group AG (ZURN.VX): Swiss Insurance. Price continues to hold above 320 at SFr 324.10. Closed out December 2020 strike 320 call options for 9% blended profit since November 2016. This is an impatient exit and leaves this portfolio holding the stock and December 2021 strike 320 call options. See TIB366 for some charts on Zurich

Income Trades

Cisco Systems, Inc (CSCO): US Technology. Cisco remains on my radar screen as a stock holding though I am reticent to buy back stock, that was assigned, at these levels. Instead I sold March 2019 strike 48 put options. With closing price of $49.63 premium was 0.56% and price is 3.4% above strike. What the trade does if price does drop to $48, is I get a 3.4% discount to current price plus the 0.56% premium.

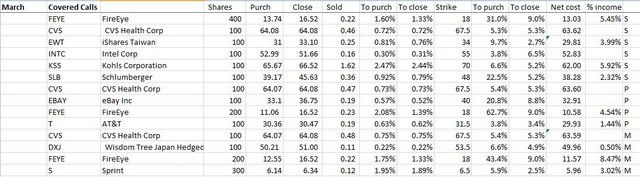

Covered call trades were executed overnight. A quick reminder on my process for writing covered calls.

- Select stocks I am happy to sell if I get exercised.

- Calculate 5% move up in price from previous day close (7.5% for tech stocks)

- Choose a one month out call option closest to 5% or 7.5% move up in price.

- Place a bid between bid and ask. Ideally one should aim for a premium of about 1% to make this worthwhile - I do not check but I did average 1.08% last month (1.0% this month thus far)

The table shows purchase price and closing price, the premium received and the % relative to close and to purchase price. The strike is shown and the important columns after that are the amount price has to move to reach the strike price - you will see they are all around 5 to 8% with a few more than that. The net cost column is updated each month to show purchase price less accumulated premium received - the percentage column at the end shows what contribution income has made compared to purchase price. New trades do not have that calculation

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $106 (2.7% of the high). Price took a rest short of the $4000 resistance level and made an inside bar

Ethereum (ETHUSD): Price range for the day was $9 (6% of the high). Price did not feel happy in "no mans land" and tried to push lower though the session did end near the high of the day's trading - less nervous than earlier in the day

CryptoBots

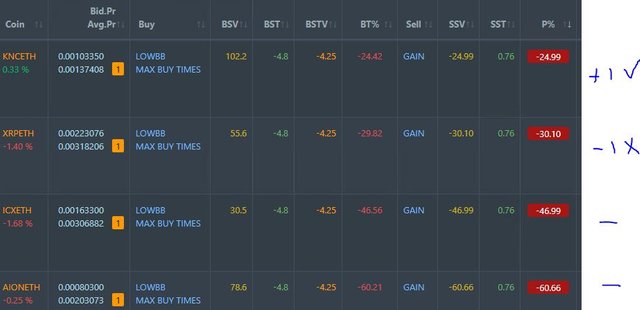

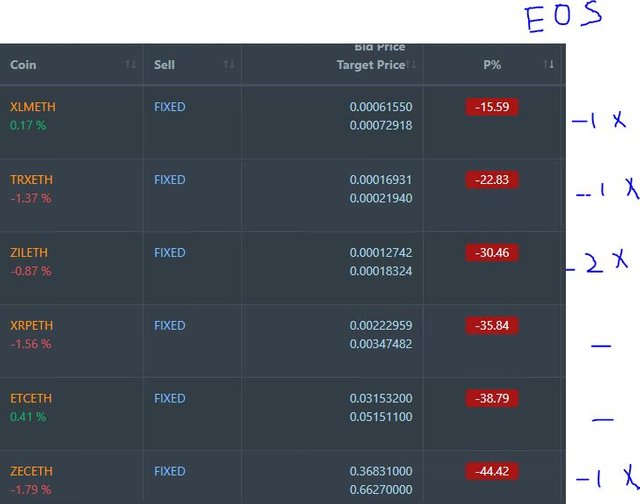

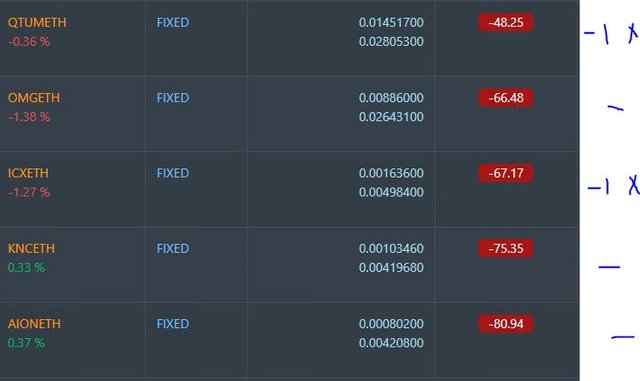

Profit Trailer Bot One closed PT Defender trade on EOS (1.00% profit) bringing the position on the account to 5.85% profit (was 5.84%) (not accounting for open trades).

Dollar Cost Average (DCA) list remains at 4 coins on a flat day for altcoins

Pending list drops to 11 coins with EOS exiting and with 0 coins improving, 4 coins trading flat and 7 worse.

PT Defender is now defending 11 coins with the defence of EOS completed. I will leave EOS on the whitelist.

New Trading Bot Trading out using Crypto Prophecy. No closed trades.

Currency Trades

Outsourced MAM account Actions to Wealth closed out 3 trades for 0.8% profits for the day. Trades open on USDCAD, AUDNZD, USDCHF are running at 1.2% negative equity.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

February 20, 2019

The floodgates could soon open up as bad news in the economic front is good news to put the Fed on hold. We may have a freeride through Q1 earnings although retail earnings comes before it and can spoil the party.

Posted using Partiko iOS