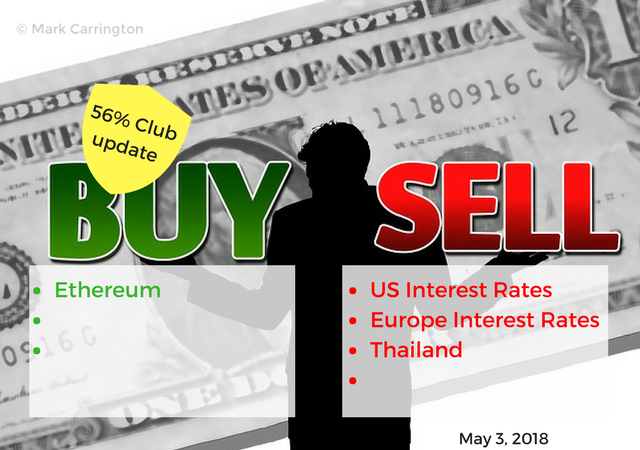

TIB: Today I Bought (and Sold) - An Investors Journal #220 - Thailand, Interest Rates, Ethereum, 56 Percent Club

Interest rate action is weird. I am onto it again. 56 percent club has some new winners and Europe is rising to the fore.

Portfolio News

Crypto Craze Maybe we have to stop talking about the crypto craze now that Goldman Sachs, doyen of Wall Street investment banking wants to start trading in Bitcoin-related instruments.

There is some way to go before they do get going and it looks like they will not actually trade Bitcoin directly (custody is a big problem for them). Legitimacy will be the big beneficiary.

In a step that is likely to lend legitimacy to virtual currencies — and create new concerns for Goldman — the bank is about to begin using its own money to trade with clients in a variety of contracts linked to the price of Bitcoin. While Goldman will not initially be buying and selling actual Bitcoins, a team at the bank is looking at going in that direction if it can get regulatory approval and figure out how to deal with the additional risks associated with holding the virtual currency.

https://www.bloomberg.com/view/articles/2018-05-03/goldman-wants-to-trade-your-bitcoins

Europe Inflation Europe inflation came in at 0.70% vs an expectation of 0.90%. This creates a conundrum for the European Central Bank who have signalled that they want to start reducing monetary stimulus from September and to stop bond buying by the end of 2018. There is also a softening in GDP growth numbers.

This has an important impact on my European portfolios which are leaning heavily to benefit from rising interest rates. It looks like having lots of time for this to play out will be key to success.

Shorts

Euribor 3 Month Interest Rate Futures (IZ0): The Federal Reserve remains on track for 2 interest rate hikes in 2018. 2020 Euribor futures rose this week from 99.50 to 99.61 = nearly the size of half a rate change (11 basis points vs 25) implying that in 2020 European interest rates will be less than 0.5%. I find that hard to believe.

The impatient trader in me added another short contract at the level of the previous highs. The patient trader would wait for the reversal from yesterday's bar. The chart shows the 12 open contracts - all somewhat under water. I am totally comfortable that price will move back to 99.30 which is where some of the profit targets sit at the bottom of the chart before December 2020.

Eurodollar 3 Month Interest Rate Futures (GEZ9): What gives me confidence in the Euribor trade is the Eurodollar chart - mapped for the same time frame as the Euribor chart.

In the time since February, the Euribor price went up 31 basis points whereas Eurodollar went down 17 basis points. The levels are what has my attention. Eurodollar December 2019 futures are currently priced at 97.03 implying a 3% interest rate in 20 months from now. My sense is Europe rates are more likely to close half the gap - i.e., be closer to 1.5% than 0.5%.

I did add another short position on this trade too. This is a little more tidy as price did hezitate at the top of the last cycle up. I am exposed to 5 contracts on this trade and 1 on the December 2018 future. These are in-the-money in aggregate.

Income Trades

One of the ways I use income trades is to let the market find exit points for winning trades. I keep writing covered calls one month ahead at a 5% premium to closing price - if the market moves more I exit the trade. This next trade is a good example. Market analysts are getting nervous about Emerging Markets exposure. I do not necessarily agree with them. I already have a 42% gain in under two years on Thailand. There may be more to go but I do not know how much more. Squeeze out another 5% in a month and another month and another month and get taken out - feels good to me.

iShares MSCI Thailand Capped ETF (THD): Sold May 2018 strike 101 calls for 0.51% premium (0.93% to purchase price). Closing price $97.47 (new trade). Price needs to move another 3.6% to reach the sold strike (new trade). Should price pass the sold strike I book a 46% capital gain.

I was prepared to take a 0.5% premium on this trade as there are only two weeks to expiry. I prefer to be between 0.75% and 1% for a full month.

56 Percent Club

Another month passes and it is time to report on the stocks and options that have done better than 56 percent up. Each month, I review all my portfolios and tabulate the 56 percent movers from all time and highlighting the ones from the last 12 months. I review stocks and options separately.

First is the table of stocks. I have highlighted ones that are new to the club in Yellow. I have also marked up whether they have gone up or down since last time.

What stands out?

- The list is shorter than last time (23 vs 24). I left Global X Argentina ETF (ARGT) on as it was 55.45% up

- There were 4 sales that would have remained on the list (Bulk Shippers - SB and SBLK. First Solar (FSLR) and Lithium Producer (SQM)

- No change in leadership with Cobalt Blue (COB.AX) dropping 16% points

- Japan was a climber on the list with the Nikkei 225 ETF (CBNKY) doing better than Japan Small Caps (DFJ).

- Returning to the list are Dutch insurer, Aegon (AGN.AS), European steel maker Arcelor Mittal (MT.AS) and Dutch oil giant, Royal Dutch Shell (RDSA.AS).

- Cybersecurity software and services supplier, FireEye (FEYE) tells us that cybersecurity is a mainstream problem.

- Russian sanctions and Europe gas problems knocks Gazprom (OGZD.IL) off the list

- Profit taking and some disappointing assay results takes cobalt prospector, Alloy Resources (AYR.AX) down a few points

- Of note is that only one of the 23 positions was bought within the last 12 months (Broken Hill Prospecting (BPL.AX).

On the options side

What stands out here:

- A longer list with 18 entrants vs 17 last time with 2 sold for profits

- No change in leadership with Cisco (US Technology) adding another 112%. This continues to surprise me as the technology selloff has continued.

- I did sell holdings in US Financials (SPDR Financials ETF - XLF) and Amsterdam Index (AEX)

- Fallen off the list are US regional bank, Zion Bancorporation (ZION), UK Bank, Barclays (BCS) and US Airline, Delta (DAL)

- New entrants somewhat match the stocks list with Royal Dutch Shell, and Aegon and FireEye.

- Other new entrants are all new trades on Dutch Bank, ING (INGA.AS), French Insurer, Axa (CS.PA) showing some resilience after the market hated their takeover bid for XL Group (XL) and Oil Driller, Transocean (RIG)

- Europe now accounts for nearly half the positions and Russia is holding on.

The standout in both lists are the big investing themes are intact: Batteries, Interest Rates, Japan, CyberSecurity, Oil, Europe, Emerging Markets

Note: I have not included cryptocurrency in this list - all my core holdings are well over 56%

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $634 (6.4% of the high) which is below average volatility. It is hard to describe the day as volatile as price just moved up solidly all day and is testing the top of the range it has been in for a week now. The encouraging part of the chart is that volumes (bars below the chart) was about average. Price wants to break higher. The actions by Goldman Sachs will propel this forward.

While the mainstram analysts talk about Bitcoin, the real price action has been in Ethereum which has been powering ahead after breaking its downtrend on April 12 (less than a month ago) and is now 64% ahead in 21 days of trading.

There were no new trades on my Bitcoin accounts. I do have a take profit on one IG markets position just above current price levels at $9982.

CryptoBots

Outsourced Bot Bot closed 6 trades on NEO (2.51%), IOTA (1.97%), BTS (1.68%), DASH (1.25%), LTC (1.8%), OMG (1.64%) for 194 closed trades in total. Problem children (>10% down) list had some changes - STRAT traded below the 10% level. PPT, DGD, QTUM joined the list - PPT was a new trade for the day.

The current list is now ETH, ZEC, DASH, ENG, GAS, NEO, ETC, BTG, PPT, DGD, QTUM (11 coins). The bot is fully invested and needs to close some trades before it can open new ones.

Profit Trailer Bot The bot did go into sell only mode during the day as the Ethereum price had moved more than the threshold amount (2%) in a specific time period (45 minutes). Overall the bot closed 5 trades for an average profit of 2.38% bringing overall loss on 207 closed trades to -0.67% (was 0.71%) of total balance. Only one trade had been into DCA with LTC doing one level.

With the strong move up in Ethereum price, many pairs were left behind. The DCA list shows the % moves down over the 24 hour period (all over 10% down). Dollar Cost Average (DCA) list was increased by three with XLM, ICX and EOS joining the list. It is going to take some time for these to trade out - I am OK as most of these coins have solid credentials apart from the two pump and dump coins still on the list (KNC and OAX)

I have opened up trading to 10 pairs for a few hours.

New Trading Bot Overall trade positions are down 18% (was 19%) driven by strong move in Ethereum.

All positions improved on the day with one Ethereum position moving into positive territory (5.19%). I will not close this position as I am happy to continue holding ETH and to use it for the other trading robot. I will remove it from the scorekeeping as a profitable USDT trade and hold the ETH.

Currency Trades

Forex Robot closed 8 trades (0.41% profit) and is trading at a negative equity level of 17% (lower than prior day's 18.4%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and Bloomberg.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

May 3, 2018

So good to read that we no longer need to refer to the Crypto Craze. I do like to see the traditional financiers getting on board - even if they do move at the pace of a snail to get there. Ultimately they have to manage the associated risk and ensure they aren't putting the farm at risk. As always a good read.

Upvoted ($0.13) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

for 3 minutes I read it your post, there make me very interesting with what you give by post. In order to achieve a very important investment to get maximum results. this post is amazing. salam know from me @syakiran.balya who came from the tip of the country Indonesia dubbed as Nanggroe Aceh Darussalam

@carrinm