A guide to Australia's Superfund's

THIS IS NOT LEGAL OR FINANCIAL ADVICE AND YOU SHOULD SEEK A REAL LICENSED FINANCIAL ADVISER FOR ASSISTANCE.

OVERVIEW-

I will be deriving information from various sources across the internet. Including Reddit, each specific super PDS, web reviews (such as canstar) and much more. This array of information will create a comprehensive guide for any smart and ambitious investor. I will start with a consensus of the best overall super funds and then dive into more detail for each fund.

Remember that a Superfund investment is a long-term game, and the short-term results of one fund should not discourage you from investing, in which a long-term result is considered usually over 5 years. The importance is to make sure that the super fund you have chosen is an actual competitive performer in the Superfund market, Warren Chant, the then principal of ratings agency Chant West stated: “From the member’s point of view, I think the message – now more than ever – is to keep an eye on your fund’s performance regularly, and at least every year. Don’t be too concerned if it under-performs in the short term, but if it consistently under-performs over a few years, try to find out why and maybe look at some alternatives.”

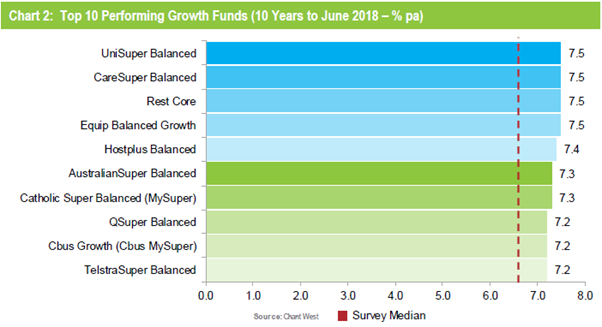

ratings agency Chant West explained that “The typical return objective for a growth fund is to beat inflation by 3% to 4%... Over that period, if the annualised return is 8.3%, and the annual CPI increase is 2.5%, giving a real return of 5.8% per annum – well above the 3% to 4% target”.

DISCLAIMER- The main fund focus will be on funds for 18-29 year old’s, as there are too many investment strategies to choose from if the age demographic becomes too large. Please let me know if you would like to see super for 30+ demographic

WHAT TYPES OF INVESTMENT OPTIONS

A super fund is not just one simple investment (unless you don’t specify the investment option you will want in which the default balanced option will automatically be chosen), there are a wide range of investment options to choose from to suit your situation or risk tolerance but for this guide of superannuation I will focus on the pre-mixed options, specifically the balanced, indexed balanced and growth options.

-To learn more click here https://www.moneysmart.gov.au/superannuation-and-retirement/how-super-works/super-investment-options

You will also want to select a fund/investment option that has the lowest fees and greatest returns. And, you will most likely want to opt out of any sort of insurance as the fees will be higher.

Analysing top Performers

- Above Graph courtesy of Chant west https://www.chantwest.com.au/resources/super-funds-have-that-positive-feeling-%E2%80%93-yet-again

FUN FACT- The main difference between retail and industry superannuation funds is what they do with their profits. Retail super funds return their profits to shareholders and investors whereas industry super funds generally return profits to their members. Large organisations such as banks and insurance companies tend to run Retail super funds. Industry funds are now open to the public and no longer restricted to their industry. Industry funds are not- for-profit organisations. -credit to Canstar- Industry vs Retail https://www.canstar.com.au/superannuation/industry-vs-retail/

REDDIT-

Secondly, lets quickly review and Analysing Reddit discussions on superannuation, as Reddit is a good method of gaining a perspective of real people’s choices and opinions. The Reddit discussions I used can be found here:

Ausfinance https://www.reddit.com/r/AusFinance/comments/9igm5g/what_is_the_best_super_fund/

fiaustralia https://www.reddit.com/r/fiaustralia/comments/8rvkvj/which_super_fund_are_you_with/

Ausfinance https://www.reddit.com/r/AusFinance/comments/7n5jxa/choosing_a_super_fund/

After reading over the suggestions, I found that the majority of votes went to (not in any specific order) :

1- SUNSUPER

2- HOSTPLUS

3- QSUPER

4- AUSTRALIAN SUPER

CANSTAR

Selecting the options of 18-29 year old with 0-55k in savings ( to invest in super), the top 5 star ratings were;

Australian super

Energy super

Hostplus

NGS super personal plan

Statewidesuper personal plan

Sun super for life

Qsuper at a close 4 stars

Credit to Canstar once again for a great comparison, Click Here https://www.reddit.com/r/AusFinance/comments/7n5jxa/choosing_a_super_fund/ to look further into the charts.

Fund of the year

https://www.superratings.com.au/award/fund-of-the-year/

Winners of SuperRatings Fund of the Year for previous years are:

2018: Sunsuper

2017: QSuper

2016: QSuper

2015: Telstra Super

2014: REST

2013: Sunsuper

2012: Sunsuper

2011: AustralianSuper

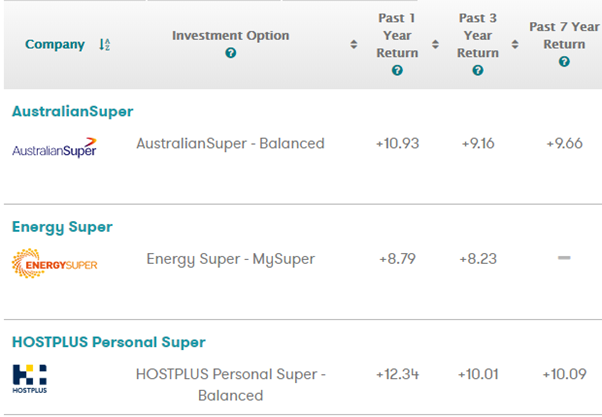

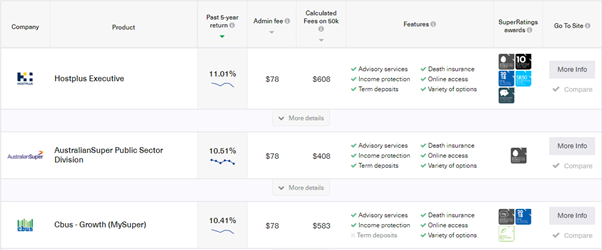

Lastly, we can compare the super funds shown by Ratecity , which is a similar website to canstar. In which we can see yet again Hostplus and Australian super are top performers.

https://www.ratecity.com.au/superannuation

Now by judging this information, I will cut the results down to just two choices. Australian super, and Hostplus.

Hostplus

Let’s start with Hostplus.

If you don’t make an investment choice you are automatically placed into the Hostplus Balanced option.

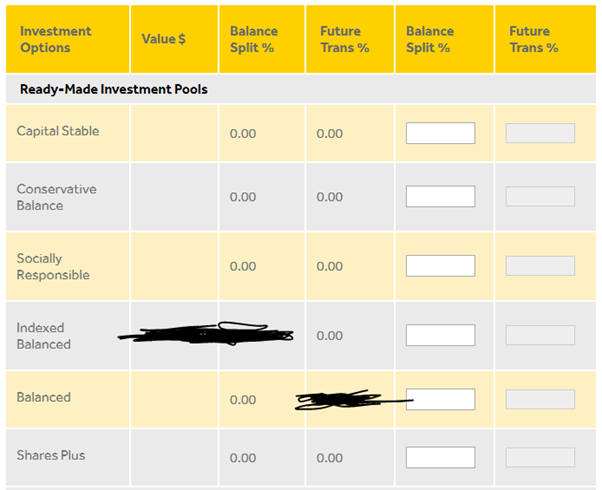

However, if you are to choose your Pre-mixed investment options, you could choose: Capital stable, Conservative Balance, Socially Responsible, Indexed Balanced, and Shares Plus.

There is also the:

-Sector investment option

-Individual manager investment option

-Choiceplus investment option ($10,000 or more so we can skip that)

But I will not go over the non-pre-mixed investment options.

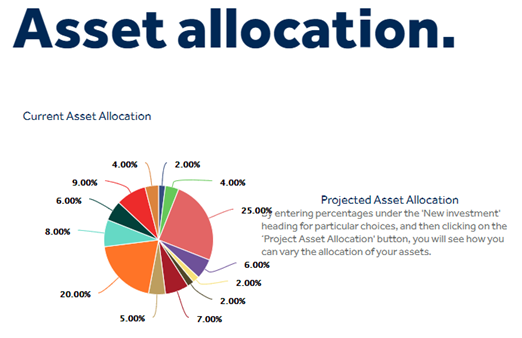

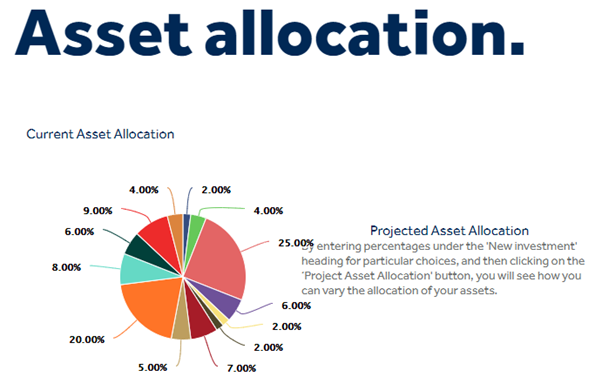

You can also allocate your investments/assets within the balanced fund, which may impact the outcome of your returns.

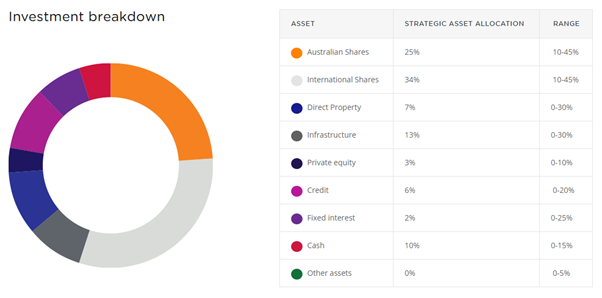

A Hostplus balanced fund will have an asset allocation that looks like this by default. But can be changed to suit your asset desires, this can aslo be changed in all the other pre-mixed options.

Returns/Performance

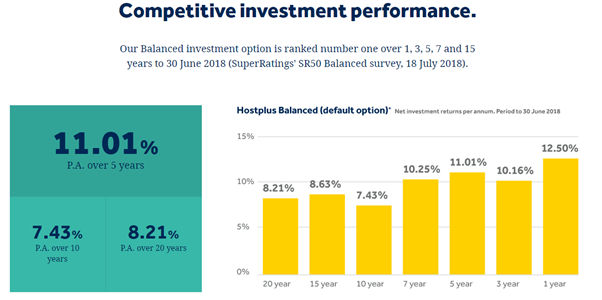

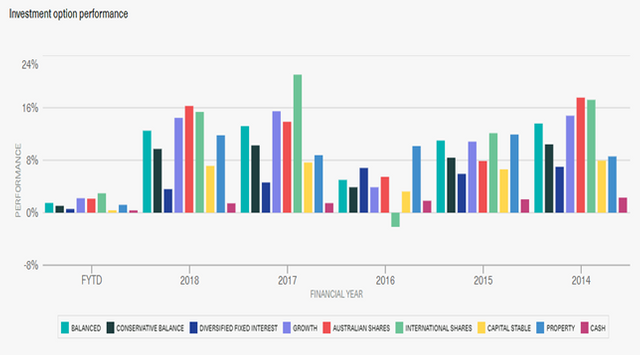

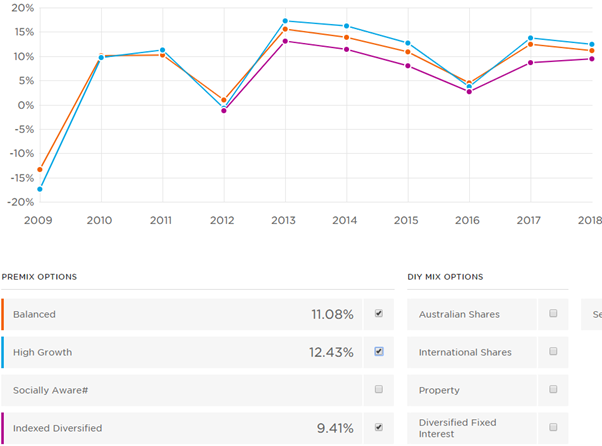

We can see a detailed chart of all host plus investment options returns. Here or shown below.

https://www.ratecity.com.au/superannuation/hostplus-superannuation-fund/hostplus-superannuation-fund

https://pds.hostplus.com.au/5-how-we-invest-your-money#a38cce86-7cbc-44f4-b220-b8f6bfd29656

Reading through the Host plus PDS (click on PDS for full charts) we can see:

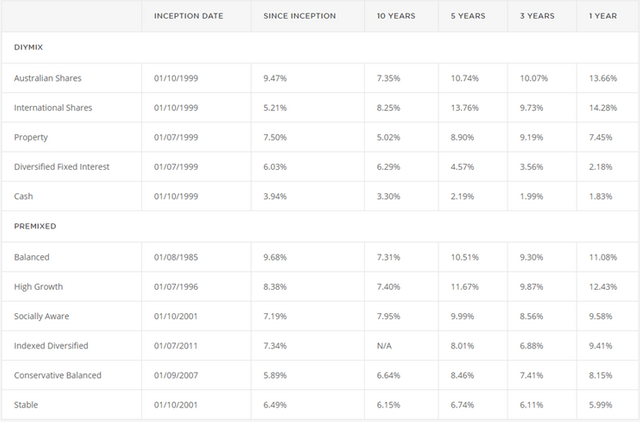

Overall host plus Has obtained an average 11.01% return in the past 5 years and an 7.4% in the past 10 years for the Balanced option.

Indexed Balance Returned 9.4% on a 5-year average 7.3% on a 3 year average, However there is no information yet for the 10 year average.

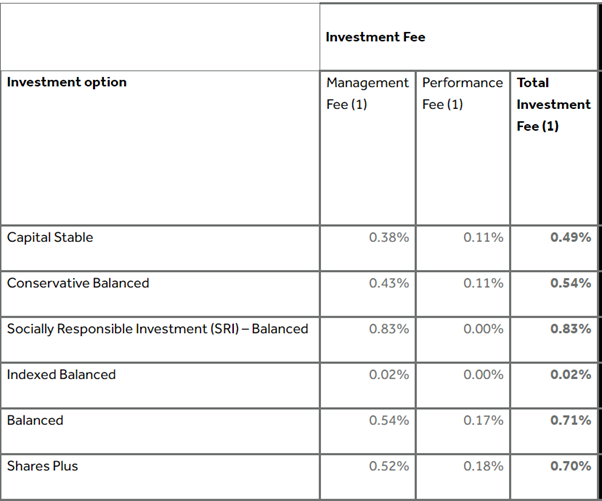

Fees

https://pds.hostplus.com.au/6-fees-and-costs

The most important thing to note is the Fee Rate, which is the only fixed variable no matter what assets you allocate (administration fee).

The Administration fee for Hostplus super $78.00 p.a (1.50 per week), which is the same cost for any asset allocation choice. In Hostplus’ PDS we can see a great table of investment option fees.

Overall the default Balanced option charges 0.71% investment fee plus a $78 p.a administration fee.

Whereas the indexed balanced is only at 0.02% investment fee plus the $78 p.a administration fee.

These investment fees should seriously be considered, especially for people with only a few hundred or thousand dollars in the super fund, as the fees may outweigh the returns.

Australian Super

Secondly, we have Australian super

Australian super also has an array of Pre-mixed Investment options, these being:

Balanced, High growth, socially aware, Indexed Diversified, Conservative Balanced, and Stable.

The asset allocation options are very similar to Host plus (e.g property and international shares) but have a largely different asset allocation for their default balanced option.

https://www.australiansuper.com/investments/your-investment-options/pre-mixed-investment-choice

(Australian super balanced asset allocation)

(Hostplus Balanced asset allocation)

Returns/Performance

Comparing the Returns of Australians supers Returns on three different pre-mixed investment options (Balanced, High growth, and Indexed diversified) to Hostplus’s very own Balanced and Indexed balanced options.

https://www.australiansuper.com/compare-us/our-performance

As we can see Australian super Balanced fund averaged a 5-year return of 10.51%, and 10 year return of 7.35%

The high growth fund averages a 5-year return of 11.67%, and a 10-year return of 7.40%

The indexed diversified fund averages a 5-year return of 8.01% and just like Host plus, has no 10 year average return yet.

Fees

Australian super also has the same administration fee as Hostplus of $78.00 p.a

Full table Here https://www.australiansuper.com/compare-us/fees-and-costs

Other contenders are: Uni super, Cbus, Sun super and Qsuper and should be researched respectively.

Overall Hostplus does have higher returns and Lower fees comparatively to Australian Super. Although I highly recommend that you do your own research or talk to a certified financial adviser. I Hope this article was a helpful Guide none the less. This article is not financial advice and should not be taken as such.

If you enjoyed this article, please subscribe for more.

Congratulations @bradleyconn! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!