Future Financial Needs

.jpg)

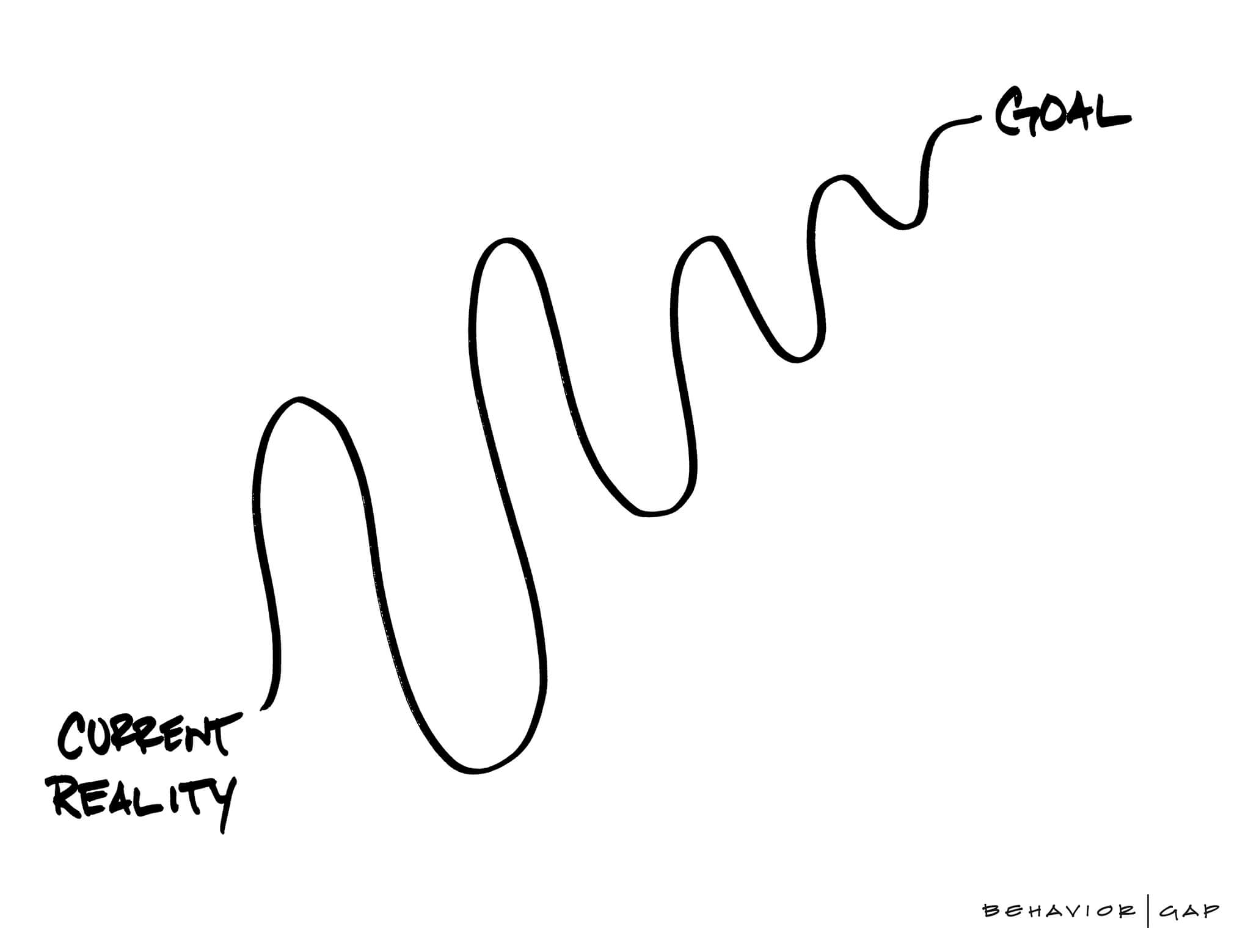

Believe it or not, there are people on track to reach their financial goals, but the only way they know they’re on track is that they took the time for figure it out. Knowing where to start remains the first major obstacle for most people when it comes to financial planning. If you never start the process you have two problems:

- You have no idea where you are: what I call your current reality

- You have no defined goals

It’s rather hard to arrive at a destination with a trip plan that lacks a beginning and an end. Of course, the other issue with having no plan is the low-grade headache it creates because you do have a sense of where you are and where you want to go, but no idea if you’re on track. We all know the feeling of lying in bed wondering if we’re going to make it.

Getting started is really just as simple as taking the time and getting the help to:

- Clearly define your current reality, where are you today

- Put some framework around where you want to go

The task of assessing future financial needs can be daunting. Often we have perceptions that, under scrutiny, don’t match reality and have to be adjusted. One prime example is the cost of educating our kids.

There are a million ways to approach education planning. Some people want their kids to work and earn their way through college, and others want to pay for the best schools their kids can get into, BUT the point is that until you sit down, TALK about it, and put some numbers around it, you have NO PLAN!

In the college example, and almost every other financial goal that is years away, it’s important to understand that things will change. No matter how much time we spend creating a plan it can’t capture everything about our future reality. All we’re trying to do is make the best guess we can and move on.

If you understand that these are guesses (very important guesses), then you can give yourself permission to not obsess over them. Make the best guess you can with the information you have, and then commit to revisiting it often enough to make course corrections long before you veer too far off course.

The other wonderful thing that will happen is that often we find out that even though our perception of our future financial needs was not even close to reality, we gain a sense of control that helps us focus on living our lives NOW.

In many cases, we learn that we do have enough money and time to meet our goals. It might not even be a situation of needing to grit our teeth and save more, but we never know until we take the time to plan!

I dont have much plans for finance.. the only plan I have is to become a Steemit whale :P

Congratulations @behaviorgap! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Congratulations @behaviorgap! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!