Stay away from the UK

Recently I was in England visiting family. The place seems to be ticking along okay. Especially given the Brexit uncertainties, a very weak government, and a hard-left alternative waiting in the wings. Unemployment is low and there are plenty of people out dining and shopping. But there’s a dirty great problem underpinning it all. Debt is spiralling out of control. In fact, British borrowers make Americans look positively restrained.

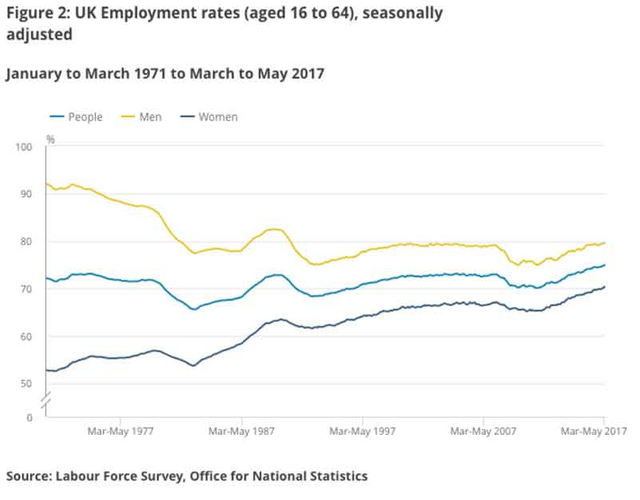

Official unemployment in the UK is 4.5%, which is the same as in the US. In fact, British labour force participation is higher than it was in during the last peak in 1990, and higher than any point since the 1970s.

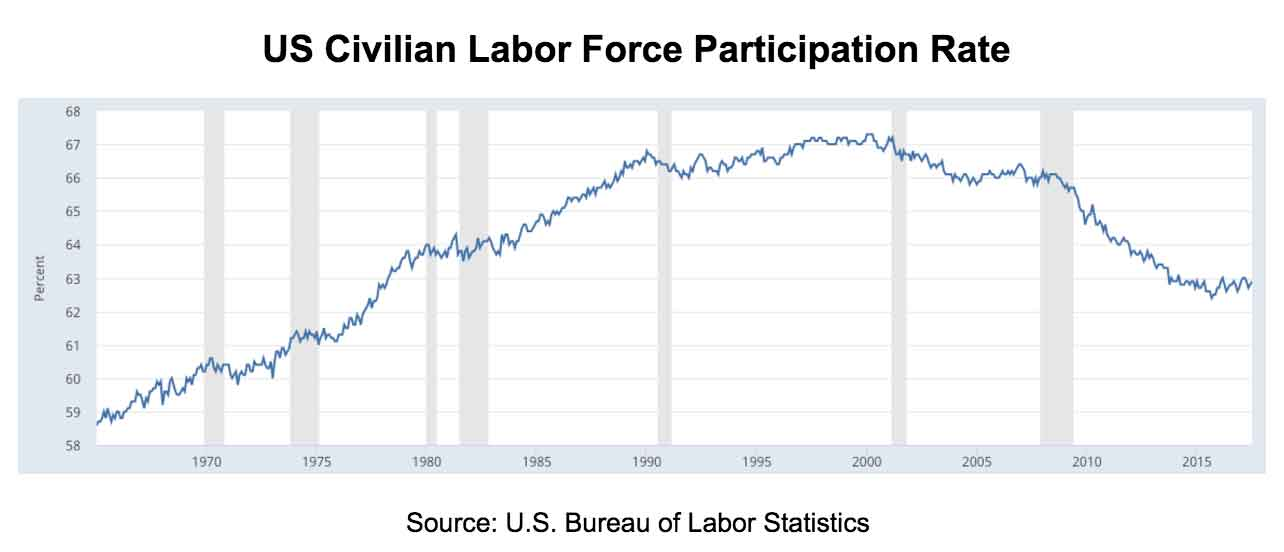

This tells a very different story to the US participation rate, which has been falling since the late ‘90s.

Of course the figures are calculated slightly differently in each country. But, notwithstanding that, there’s a huge difference in the trends. A higher percentage of adults than ever is working in the UK. The lowest percentage of adults since the late 1970s is working in the US.

On the face of it, given things like the employment figures, you’d think the UK was doing just fine. Although I note that the high levels of employment could be simply a case of more and more people having to work just to make ends meet.

Perhaps families are in an arms race to afford insanely overpriced houses and such like? Maybe one breadwinner simply isn’t enough to survive in the UK these days?

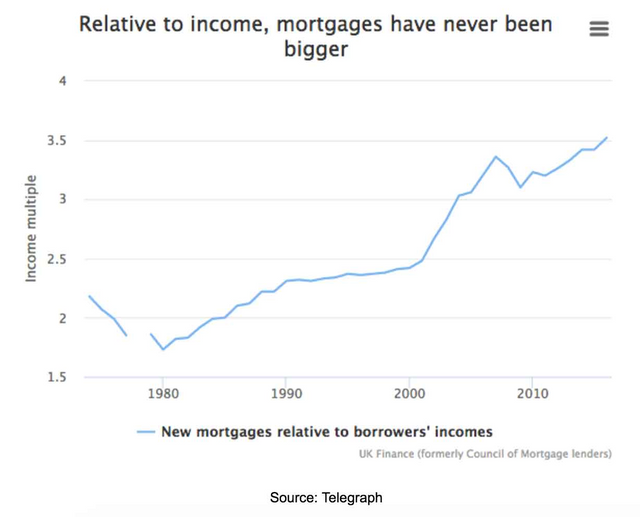

Whatever the cause, the trend in ratio of mortgage debts in the UK to borrowers’ incomes is particularly disturbing, as shown in the following chart. It runs from the mid-1970s to the present day.

The burden of UK residential mortgage debt has basically doubled in relation to incomes since 1980. Of course interest rates have plummeted in the intervening decades, making debts more immediately affordable. On the other hand mortgage terms have been extended.

I bought my first place in London in the late 1990s. In those days a 25 year mortgage term was typical. Now it’s normal to borrow for 30, 35 or even 40 years.

Today’s huge mortgage burdens may look affordable to borrowers in terms of monthly cash outlays. But many of the indebted will be enslaved to the lending banks for much longer than in the past.

Also, mortgages with long-term fixed interest rates don’t exist in the UK, unlike in the US. So if rates rise a few points (which they will, one day), borrowers will suddenly find they can’t make the payments. Many will default, others will slash general consumption as the struggle to keep their homes, the property bubble will burst, and the economy will enter a hard recession.

The UK is one of many countries that’s in the midst of a new house price bubble . Ten years ago the UK’s mortgage lenders got into serious trouble. One, called Northern Rock, was known for lending as much as 125% of the house value to borrowers. It went bust.

Since then, banks and their regulators have become more cautious. According to a recent report in the Telegraph, 5.6% of UK mortgages were for more than 95% of the property value back in 2007. Now it’s down to just 0.2%, and such large loans usually require a guarantee from the “Bank of Mum and Dad”.

So the lobbyists and squealers are out in force. Vested interests in the mortgage industry want more 100% mortgages again.

Never mind the huge risk this means for young borrowers if prices fall. That would leave them trapped in “negative equity”, possibly for many years, and unable to move home.

The lobbyists are also ignoring the real problems. They’re the ultra low interest rates and ongoing quantitative easing (printing money to suppress bond yields) that are the main causes of the house price bubble.

The Bank of England’s base rate - equivalent to Fed Funds in the US - is just 0.25%. Ten year UK government bonds, known as gilts, trade with a yield of just 1.09%. Ten year index-linked government bonds - similar to US TIPS - trade with a staggering yield of minus 1.85%!

These act to keep down mortgage rates for many. If I’d stayed living in England, then the variable rate mortgage deal I had would now cost me just 0.37% a year, being base rate plus 0.12%. Insane. Obviously that kind of deal isn’t available any more. But lots of people are still enjoying the fruits of such past arrangements.

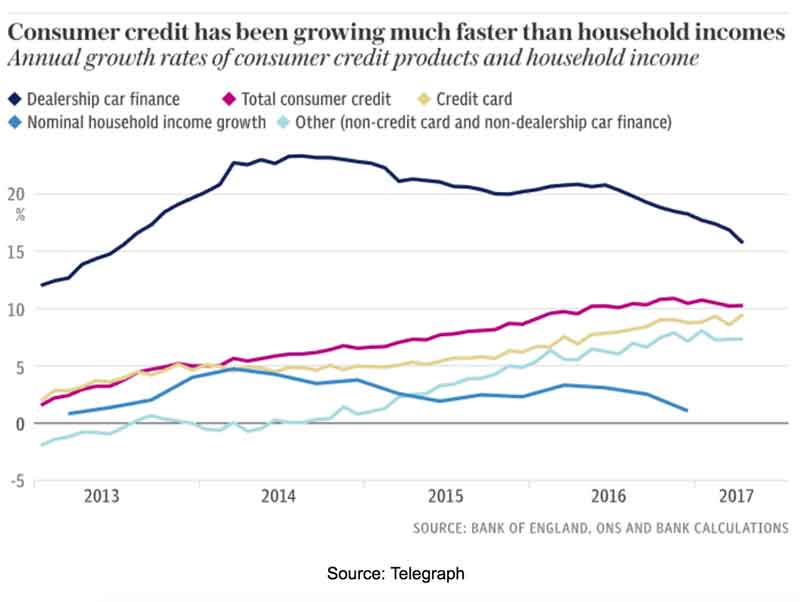

And it’s not just mortgages and the real estate market that show signs for concern. In fact, consumer credit as a whole has grown worryingly fast in the UK.

A look at the dark pink line in the chart below suggests total credit has grown at a 10% annual clip for the past couple of years, whereas earnings have grown at just low single digits.

To put that into perspective, US consumer credit grew at 7.1% in 2015, 6.5% in 2016 and less than 5% annualised in the first half of this year, using figures from the Federal Reserve.

In other words, UK credit growth is now twice as fast as in the US. This is the weak foundation upon which the UK economic edifice teeters.

Basically, the Brits are back to the bad old days. A housing bubble means buyers need ever larger mortgages. At the same time other consumer credit expands as people continue to buy things they don’t need (new cars, the latest fashions, foreign holidays) with money they don’t have.

It can’t end well, as interest rates will have to get back to normal one day. By which I mean a sensible margin above rates of price inflation, such that the lender or bond investor can make a real return after tax (and defaults).

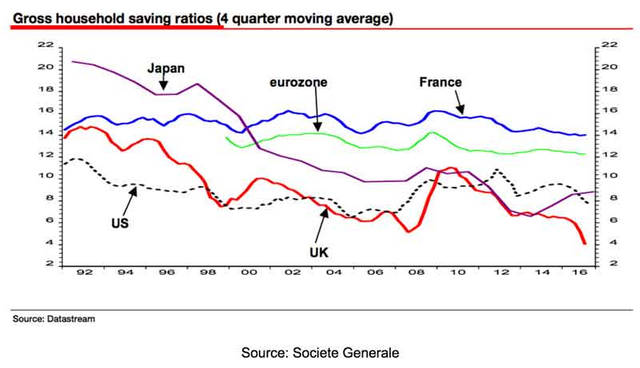

In the midst of all this, it’s no surprise that average household savings ratios have collapsed in the UK. In fact they’re dropping in the US as well, although by comparison remain relatively healthy there.

Despite the high employment levels, there’s a really ugly backdrop to the UK economy. It has a housing bubble, an excessive credit boom, a weak government, a crackpot opposition ready to step in, and the ongoing uncertainty of the Brexit negotiations.

There are bound to be exceptions. But, for the most part, I recommend that investors stay away from the UK.

source : OfWealth

Be Sociable, Share! Resteem! and Upvote!

Posts that you may like

The collapse of US economy?

This Ship is Sailing, With or Without You

3 Investing Concepts That All Beginners Should Know

Be Sociable, Share! Resteem! and Upvote!