bitcoin 100.000.000$ ?

Hello, today we will consider whether bitcoin can reach the price of $100,000,000. As everyone knows bitcoin is limited, there will be only 21,000,000BTC. It is estimated that 4,500,000BTC has been lost. But when we look at FIAT currencies, their number is unlimited, and now they are printed in a huge amount.

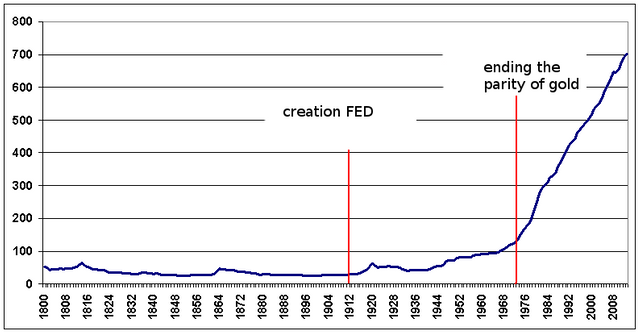

on the graph is the increase in the amount of the dollar.

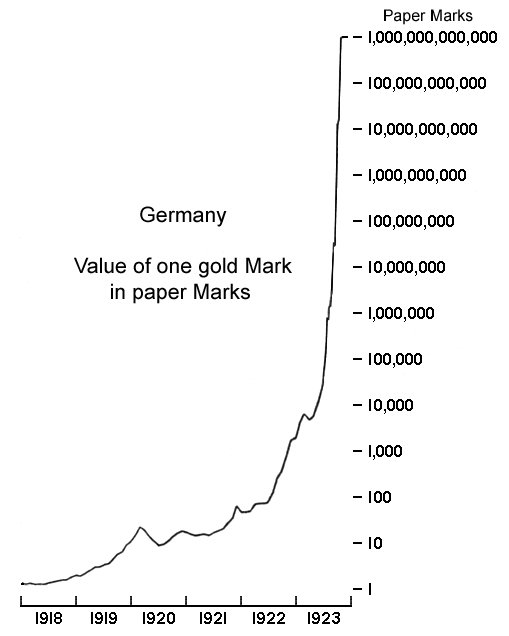

Hyperinflation in the germany(1918-1924) sorurce: wikipedia.org

To pay for the large costs of the ongoing First World War, Germany suspended the gold standard (the convertibility of its currency to gold) when the war broke out. Unlike the French Third Republic, which imposed its first income tax to pay for the war, German Emperor Wilhelm II and the German parliament decided unanimously to fund the war entirely by borrowing, a decision criticized by financial experts such as Hjalmar Schacht as a dangerous risk for currency devaluation.

The government believed that it would be able to pay off the debt by winning the war, and it would be able to annex resource-rich industrial territory in the west and east. Also, it would be able to impose massive reparations on the defeated Allies. The exchange rate of the mark against the US dollar thus steadily devalued from 4.2 to 7.9 marks per dollar. (It was only after the war that the extreme hyperinflation occurred.)

The strategy backfired when Germany lost the war. The new Weimar Republic was now saddled with a massive war debt that it could not afford. That was made even worse by the fact that it was printing money without the economic resources to back it up. The Treaty of Versailles further accelerated the decline in the value of the mark so 48 paper marks were required to buy a US dollar by late 1919.

German currency was relatively stable at about 90 marks per dollar during the first half of 1921. Because the Western Front was mostly in France and Belgium, Germany came out of the war with most of its industrial infrastructure intact. It was, in fact, in a better position to become the dominant economic force on the European continent.

The London Ultimatum in May 1921, however, demanded World War I reparations in gold or foreign currency to be paid in annual installments of 2 billion gold marks, plus 26% of the value of Germany's exports.

The first payment was made, when it came due in June 1921. It marked the beginning of an increasingly rapid devaluation of the mark, which fell in value to approximately 330 marks per dollar. The total reparations demanded were 132 billion gold marks, but Germany had to pay only 50 billion marks

Since reparations were required to be repaid in hard currency, not the rapidly depreciating paper mark, one strategy that Germany used was the mass printing of bank notes to buy foreign currency, which was then used to pay reparations. That greatly exacerbated the inflation of the paper mark.

From August 1921, Germany began to buy foreign currency with marks at any price, but that only increased the speed of breakdown in the value of the mark. As the mark sank in international markets, more and more marks were required to buy the foreign currency that was demanded by the Reparations Commission.

In the first half of 1922, the mark stabilized at about 320 marks per dollar.[5] International reparations conferences were being held. One, in June 1922, was organized by US investment banker J. P. Morgan, Jr. The meetings produced no workable solution and so inflation changed to hyperinflation, and the mark fell to 7,400 marks per US dollar by December 1922. The cost-of-living index was 41 in June 1922 and 685 in December, a 15-fold increase.

By fall 1922, Germany found itself unable to make reparations payments since the price of gold was now well beyond what it could afford. Also, the mark was by now practically worthless, making it impossible for Germany to buy foreign exchange or gold using paper marks. Instead, reparations were to be paid in goods such as coal. In January 1923, French and Belgian troops occupied the Ruhr, the industrial region of Germany in the Ruhr valley, to ensure reparations payments. Inflation was exacerbated when workers in the Ruhr went on a general strike and the German government printed more money to continue paying for their passive resistance. By November 1923, the US dollar was worth 4,210,500,000,000 German marks.

And Bitocoin can go as high as $ 100,000,000. But, not because Bitcoin will increase its value so much, just because the dollar will lose its value so much. However, it is a completely real possibility that if there is a hyperinflation, in just a few years, Bitcoin can reach the price of $ 100,000,000.

https://steemit.com/@samolot1337

If you liked it, click upvote or comment

If you are seeing this it means you have been manually selected to receive an upvote by an employee of Taskmanager Holdings. Enjoy your upvote thanks to @taskmanager and @tmholdings

Hey man I like your Profile! Can you check okt My page?

Welcome to Steemit Marcin!

Hi, Nice to meet you ! Welcome to Steemit community ! I am really glad you are here Keep up great work and enjoy the journey ! Please upvote & follow me....

Welcome to Steemit! Check out my Top 3 altcoin picks. They got good announcements this month!

POST for Thanks Bro

I'm following back and I'm sharing the content of followers organically. My account for following back is:@followback

Get Paid For Your upvote 💰 🤑 steemit.com/steemit/@homsys/how-to-make-money-on-your-steem-power-21

Welcome to #Steemit Marcin. Be active in the community, comment on blogs you find interesting, upvote those who you think are worth to be upvoted, resteem articles you really like and just write unique content or upload unique video's on #Dtube or add your music to #Dsound.

Steemit is all about all of us building this community and keeping it strong. And for that, you also get paid. Try not to copy and paste, but to add interesting and unique content.

@artakush and @minigunner welcome you to @steemit community ;)

welcome :)

vote me back :)