I have Bitcoin, the elephant in the room.

Have you ever told someone you own bitcoin or any cryptocurrency for that matter and had them look at you like you were crazy?

I tell them don’t worry about bitcoin, just worry about the technology behind it.

It’s no secret giant companies are exploring and implementing the tech, not to mention acquiring dozens of patents.

I’m a firm believer of blockchain technology although I’m a realist at the same time, I come from traditional finance and I feel I'm seeing both sides of the fence clearly.

We are skeptical of anything we don’t understand or when we can’t grasp a concept, I believe we all have had a learning curve to overcome regarding our crypto endeavors.

I’m constantly seeking and attempting to adapt traditional financial models and calculable data to value crypto projects that have no income.

In an industry driven by speculation, I have no choice but to integrate progressive industry-specific methods to calculate the viability of an investment into a digital asset.

A blockchain company can be said to be worth billions although the company has no income, they raised billions and only has expenditures for the foreseeable future and their price is ultimately coupled with the movements of bitcoin.

It’s a tough pill to swallow and a near impossible task to convince a skeptic that such an investment is viable.

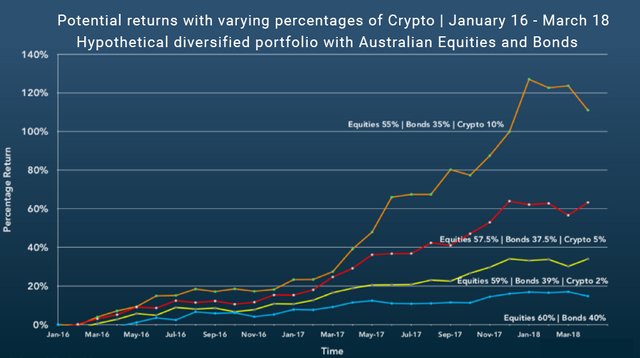

No doubt digital assets, in general, are a worthy investment, a strategically diversified crypto portfolio within a well-diversified traditional portfolio adds a layer of diversification with low correlation and significant potential to outperform a traditional index.

Many traditional finance notables have recommended 1%, 2% and even 5% of your investment funds to an allocation into crypto.

Did you invest more than 5%?

I can see how the blockchain has the potential to change the world for the better and I believe we have been given a once in a generation opportunity although we still must tread carefully.

So many ICOs raising so much money, even as a believer in a particular idea I must stay aware that an idea and adoption have many degrees of separation.

It’s a bubble they say!

Well, the December run-up was an anomaly fuelled by media and greed, it became a bubble although a thick-skinned bubble that would deflate and not burst completely.

Another 'December' is likely to never happen again nor should you want it, it’s not healthy nor sustainable, what we should want is healthy, steady growth based on a fundamental and technical analysis.

Did you hear about people mortgaging their house to invest into bitcoin at the top, near 20k?

Some valuable lessons have been learnt and are less likely to occur although if we don’t take note of past historical events we may be doomed to repeat them.

I see no doubt we will have another 'December' like run-up although possibly half the amount before a retracement and another move up. There are so many variables in this ever-evolving industry that can make predictions futile, especially long-term predictions.

Did you hear anyone predict bitcoin would hit near 20k by end of year 2017 well before the fact?

Are you hearing people predict bitcoin to hit 100k by the end of year 2018?

There are many future predictions rolling around with comparisons to past years or commodities, the infancy of the industry and lack of data and past correlations leads me to believe there may be a motive wrapped up in a high value prediction where sufficient determining data is non-existent.

Did you hear people say Consensus will start the Bull Run?

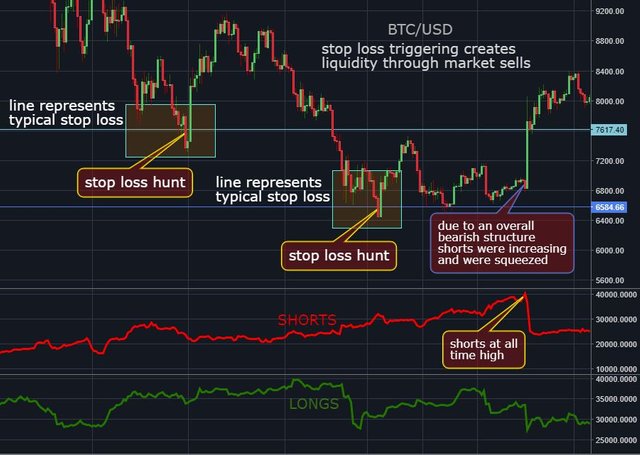

Driven by speculation only gets us so far, artificial run-ups are generally corrected to the starting point, such an example was the run-up to almost 10k starting on the 12th April 2018. Firstly shorts were at an all-time high making way for a significant short squeeze, shorts were liquidated and quickly reversed their positions to make up their losses, now they are also going ‘long’.

Money on the sidelines returned to the action and we were off to the races. The continuation was fueled by news of Consensus, many people seemed to believe Consensus would start a Bull Run and were comparing data to Consensus 2017.

By the time Consensus was upon us a few 'consensus coins' had a run up although it was soon seen that the top was already priced in.

These were artificial effects, from a strategic trading maneuver to news speculation, and are usually corrected as if they never happened of which was exactly what happened.

During that period bitcoin stabilized and we began what is known as 'alt season', the bitcoin dominance reduces as funds are moved into alts although that is a story for another time and a cycle that will repeat time and time again.

What’s an Adam and Eve structure?

Let’s briefly discuss the Adam and Eve double bottom, I was informing people of this structure before it actually completed and only a handful of people considered it or even knew about it. The unusual nature of the structure led many to believe the bottom was not in and in turn the shorts increased, this conditioned a strategic trading maneuver, a short squeeze.

Were you ever convinced of the price moving a certain way?

Have you ever been persuaded by the power of an influencer?

We have all in some way been used to provide liquidity to another.

Say hello to institutional trading strategies.

In such a small market cap crypto industry liquidity can be hard to come by especially in a time of inactivity.

One common strategy is to induce traders into an action and then make the opposite action.

Ever see a large sell-off and panic and start selling yourself only for the price to quickly turn around and start moving up?

You were just used for liquidity so the buyers could fill their orders without pushing the price unnecessarily higher.

Ever set a stop loss only for it to be hit before the price moved up?

You were just a victim of stop-loss hunting, every trader knows where the most obvious stop loss position is and by selling enough of an asset to hit that position our stop loss becomes a market sell and liquidity for the buyer.

This stop-loss example below refers to going ‘long’ although the opposite is also applicable.

Don’t forget that in a largely unregulated market your stop loss may be much more visible than you would care to imagine, at minimum a trader can accurately guess the most likely stop loss area.

Are you bullish long term?

We all need something to hold onto, without hope we have capitulation.

At this point in time, we are largely recycling existing money through the cryptocurrency market cap, without new money, there cannot be the Bull Run we hope for.

There’s conservative new money waiting for a break of 12k before entering and others waiting for CBOE ETF stating it is the only ETF we care about. Others are waiting for regulations and others for adequate custody solutions, it seems inevitable that once conservative money comes into the space followed by mainstream media coverage and in turn an influx of retail buyers we can then really see the Bull Run we are hoping for.

Without a catalyst, only capitulation can begin a trend reversal and confirm a Bull Run. Hope has been firmly placed on ETFs, often blind hope without an understanding of the process and likelihood of SEC delays.

We have a long way to go and some projects will rise from the ashes similar to the dot-com bubble and many projects will be replaced by others of greater potential and sophistication.

We are in the midst of a situation where there are too many projects without adequate business models and guidance, they may be great ideas but that simply is not enough.

These are my 2 sats for the here and now,

James Scott, Digichain Capital.

Welcome to Steem @digichaincapital.

Do read A thumb rule for steemit minnows - 50:100:200:25 for starter tips.

Spend time reading Steem Blue Paper to know how Steem blockchain works and if you still have any queries ask them on our Ask me anything about Steemit post and we will try to answer that.

All the Best!!!

Welcome to Steem, @digichaincapital!

I am a bot coded by the SteemPlus team to help you make the best of your experience on the Steem Blockchain!

SteemPlus is a Chrome, Opera and Firefox extension that adds tons of features on Steemit.

It helps you see the real value of your account, who mentionned you, the value of the votes received, a filtered and sorted feed and much more! All of this in a fast and secure way.

To see why 3432 Steemians use SteemPlus, install our extension, read the documentation or the latest release : SteemPlus 2.20: Utopian + SteemPlus Partnership = Bigger upvotes.

Nice article...always like reading a new perspective on all this Crypto stuff!

Hello, thankyou very much!

You can earn free 0.04 STEEM. Follow http://www.steemit.com/@pabisovsky and reply this comment "done". 0.04 STEEM will send in 3 hours.

Posted using Partiko Android

Hey @digichaincapital. Welcome, and I hope that you will enjoy steemit!!!

Welcome to steemit @digichaincapital.

Follow me @tuanis for random votes daily please checkout the report

Welcome the new steemians. Have a great day!

Congratulations @digichaincapital! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPWelcome to Steem Community @digichaincapital! As a gentle reminder, please keep your master password safe. The best practise is to use your private posting key to login to Steemit when posting; and the private active key for wallet related transactions.

In the New Steemians project, we help new members of steem by education and resteeeming their articles. Get your articles resteemed too for maximum exposure. You can learn more about it here: https://steemit.com/introduceyourself/@gaman/new-steemians-project-launch