The Primacy Of Income: The Era Of Gains is over

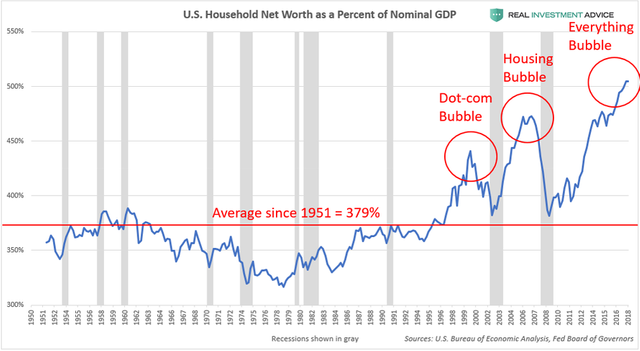

For the past 12 years, grow in household wealth is attributed to an increase in the prices of assets. This could be a problem if the "bubble of everything" implodes.

With each drawdown of the markets, the central banks of the world go back to the same playbook. The easing took the form of expanding their balance sheets.

At present, interest rates are still at historic lows which is helping to keep assets inflated although the move towards higher rates is starting to impact markets.

Click on image to read full article.

We're living through a monetary experiment. After the 2008/2009 crisis they just printed money without fixing the fundamental issue. I'm not sure how this ends...

Why I disagree with this section of the article:

During a recession there are defaults on bonds(And that's why funds with junk bonds lose so much value during a downturn). This is the same as saying: "The money disappeared".

Well, if during a crisis the money simply disappeared and the central banks started to "flood the world with liquidity" or print money like crazy, that "new money" would offset the money that disappeared.

Although, I still agree with the rest of the article.

Btw, great post!

Thanks.

Btw, the peakprosperity.com website is yours?