Insurance is the BEST SECTOR

I believe insurance – particularly property and casualty ("P&C") insurance – is the world's best business.

It can be noted that while many insurance stocks including the best-of-breed P&C stocks had sold off following the recent hurricanes, yet there is absolutely no reason to turn bearish.

It's actually time to be even more bullish on the P&C sector today.

Markets overreact... It's a not-so-fun fact about investing... Stocks often soar further than is reasonable on good news, and they fall further than imaginable when news is bad.

The good news is that these overreactions often lead to major opportunities. And that's exactly what's happening right now in a specific area of the U.S. market...

Last month, Hurricane Harvey flooded Houston. And [last] week, Hurricane Irma devastated many parts of Florida (including where we call home). The real impacts to the citizens of Texas and Florida are the obvious tragedies of these storms.

But the hurricanes will have huge economic impacts as well. These days, a major storm can easily cost tens of billions of dollars. Who pays the bill?

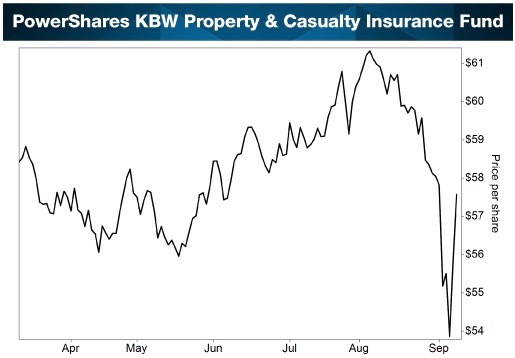

Much of the losses fall onto property and casualty (P&C) insurers. And the sector has absolutely tanked in the wake of these storms, which we can see in the PowerShares KBW Property & Casualty Insurance Fund (KBWP). Take a look...

( )

)

As you can see, the sector has already begun to rebound from its double-digit decline...

You see, P&C insurers hit a major oversold extreme based on their relative strength index ("RSI").

The RSI measures an investment's recent gains and losses. It signals when something is either overbought or oversold... which means a reversal is likely.

Last week, the P&C insurance sector hit an RSI of 22. That's an extreme oversold level... And it means big gains are likely. It's not unusual for P&C insurers to plunge after a major storm. But history suggests it is often a terrific time to buy...

Similar extreme RSI levels have led to 9% gains in three months, 12% gains in six months, and 17% gains over the following year.

The sector is already beginning to recover. It's up around 8% in recent days. But history says that's just the beginning.

These storms are devastating for our communities. But the financial markets are overreacting, based on history. We could see a sustained rally good for double-digit gains over the next year.