Uber introduces a credit card

Uber introduces a credit card

Posted yesterday by Jonathan Shieber (@jshieber)

Uber is getting into the credit card business.

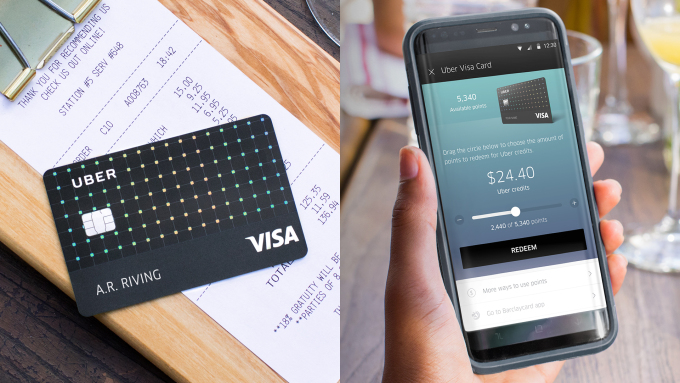

Announced today in partnership with Barclays and Visa at the Money2020 conference in Las Vegas, the new card gives Uber yet another point of access to incredibly valuable customer information and marks another front in its campaign to assume a larger role in online and offline commerce.

Not content with just having a record of some of the comings and goings of the at least 10 million people that use the company’s ride-hailing service every day, Uber will now get a record of some of those folks’ daily purchases through the new card.

Applying for the card is easy. Starting November 2, Uber will give users the option to get the card right in its app, and will populate all of the information they have on file for their customers into the application.

Folks also can apply for the card online.

After a few minutes, an applicant can get a verdict on their creditworthiness and then… Presto! The card is automatically available for use for Uber rides and UberEats purchases and a physical card will show up in the mail within a week or so.

The no-fee card offers a bonus of $100 after spending $500 on purchases within the first 90 days, and has other perks, like 4 percent back on restaurants, take-out and bar purchases; 3 percent back on airfare, hotels and Airbnb or other short-stay rentals; 2 percent back on online purchases; and 1 percent back on everything else.