Injective Protocol Trading as a public Utility

What is Injective Protocol?

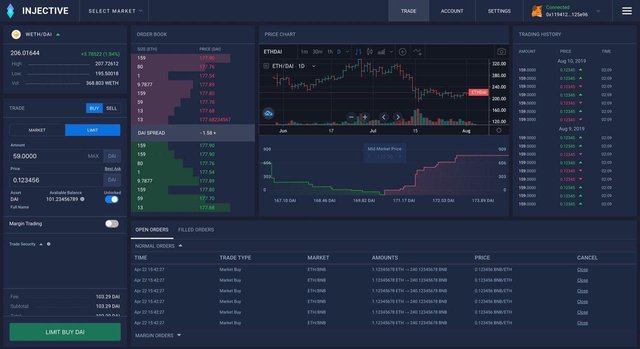

Injective Protocol is a start to finish decentralized convention permitting decentralized unending trades, fates, edge and spot exchanging. We have assembled each part of our convention to be completely trustless, restriction safe, openly obvious, and front-running safe. The convention itself is chiefly contained the Injective Chain, the Injective Exchange, and the Injective Futures stage.

Injective chain is based on the Cosmos zone and is a decentralized protocol built on Layer-2, providing a high-speed Ethereum decentralized trading experience. It will use the Cosmos IBC protocol to achieve cross-chain transactions, VDF (Verifiable Delay Function) to simulate real time through Proof of Elapsed Time, and standardize order sequencing to eliminate early tradings.

At present, Injective Chain controls our layer-2 subsidiaries stage, fills in as a decentralized Trade Execution Coordinator (TEC), and hosts a decentralized open orderbook. The chain itself is based on head of Tendermint and takes into consideration moving and exchanging Ethereum-put together resources with respect to the Injective Chain. Later on, Injective will be coordinated with Cosmos IBC, bringing progressed between chain decentralized account capacities.

Present situation of exchanges

Now either in traditional finance or internet finance, "exchange" plays a fundamentally crucial role. The quintessence of the ware economy is trade economy, and in the item economy, creations and utilizations are coordinated through market trades.When the a proper equilibrium is achieved for supply and deman, the marginal substitutional rate between any two commodities will be the same for any consumer, and the exchange of values is optimized. Obviously, the trade medium and stage have been of top significance all through the money related history.

The medium has went from shells, stones, and metals to paper and now digital numbers to our eyes.Obviously, the trade medium and stage have been of top significance all through the money related history.

Digitalization and "internetization" are the new focuses.In the previous decade, since Satoshi Nakamoto developed Bitcoin, the trade medium and stage have again moved from centralization to decentralization. After the ICO hypes in 2017, the tokenization of assets has grew popular and now towards better maturity. At the same time, various digital asset trading and exchange platforms also utilize blockchain technology to achieve decentralization, hinting a promising future for internet finance and exchange as a function itself.

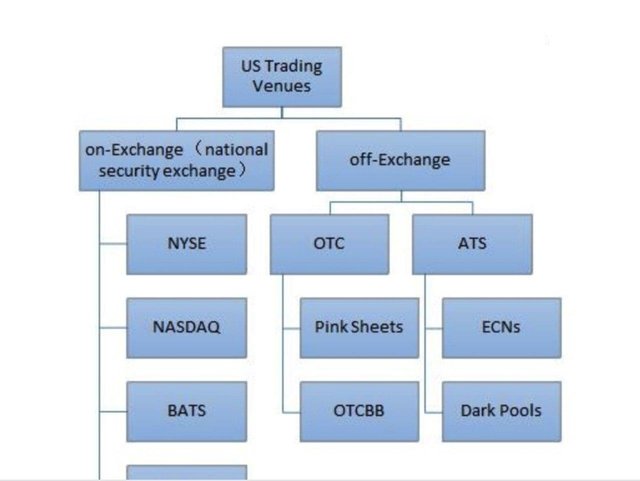

Hierarchy of Exchanges

What are the Decentralized and Centralized exchanges?

With the application of blockchain technology in asset tokenization and the trading of it, many digital asset exchanges have emerged, such as Binance, Coinbase, Bitmex etc. These well-known exchanges are also classified as centralized exchanges in the blockchain and digital asset industry.

Brought together Exchanges, as the name recommends, implies that the advantages saved by the clients are put away in the possession of the trade proprietors, and coordinating of exchanges and even costs of items are liable to unified controls worked on concentrated workers.In other words, we, as users, do everything on the platform based on our trust in the team and institution running it.

Centralized exchanges

In the expression "unified digital currency trade," the possibility of centralization alludes to the utilization of a center man or outsider to help direct exchanges. Purchasers and merchants the same trust this center man to deal with their advantages. This is regular in a bank arrangement, where a client confides in the bank to hold their cash.

The purpose behind this arrangement is that banks offer security and observing that an individual can't achieve on their own. On account of a unified digital money trade, a similar guideline applies. Transactors trust not just that the trade will securely finish their exchanges for them, and they likewise utilize the system of clients in the trade so as to discover exchanging accomplices.

On account of cryptographic forms of money, which are regularly put away in computerized wallets, an individual can lose hundreds or thousands of dollars in advanced cash property basically by overlooking the way in to a wallet. A trade won't permit this to occur, as it shields the property instead of the individual financial specialist.

Decentralized Exchanges

In comparison, the essence of decentralized exchanges (DEXes) is to allow users' assets to be under decentralized custody (assets are stored on the blockchain), with every transaction record stored on the blockchain giving transparency and traceability. Simply put, this whole decentralization is meant to prevent malicious human behaviors and to facilitate users to trust in codes and technology instead of other human beings.

With the advancement of blockchain technology and the emergence of more public blockchains, there are now a variety of decentralized exchanges. DEXes are different because of the diverse public blockchains they are based on and their respective concepts and technologies. Here we only discuss the decentralized exchanges pertaining the general traits.

DEXes can be further divided into two focuses: spot and derivative markets. Most of the DEXes in existence focuses on the spot markets, and are not many derivatives DEXes given the complexity of financial designs development workloads. However it has become palpably clear that derivatives markets have grown exponentially in digital asset domain, and we are already seeing the next boom coming from derivatives trading. Few strong contenders that have emerged in 2020 include Injective Protocol, DerivaDEX and Serum. Here let's explore Injective Protocol, which will be launched in August.

To resolve common issues faced by DEXes such as user friendliness, speed, and more, Injective Protocol proposes a global solution: Injective chain, Injective derivatives protocol, and Injective DEX.

Injective protocol with Layer -2 providing a high speed Ethereum Decentralizaed trading experience

Injective chain is based on the Cosmos zone and is a decentralized protocol built on Layer-2, providing a high-speed Ethereum decentralized trading experience. It will use the Cosmos IBC protocol to achieve cross-chain transactions, VDF (Verifiable Delay Function) to simulate real time through Proof of Elapsed Time, and standardize order sequencing to eliminate early tradings. In addition, the Injective chain supports token staking and provides technical support for creating more services such as staking in the future.

A subsidiaries convention is a significant "weapon" of Injective. It is an open convention that bolsters the advancement of open subsidiaries markets. It is additionally the world's first completely decentralized P2P prospects and interminable trade contracts trade, which underpins straightforward access to different markets. As per the group, contrasted and different results of a similar kind, Injective is the quickest, completely decentralized subsidiaries exchanging stage without gas charges the DeFi advertise.

Based on the Injective chain, Injective's trading platform has also achieved a fully open source design, which allows it to be a completely decentralized network. It also provides a market-maker friendly API interface, which is close to the current mainstream exchange interface, allowing the user experience to be similar to that of a centralized exchange. Additionally, in the management system, the Injective trading platform has borrowed the design from the auditing systems of centralized exchanges, modularized design, and the audited listing system, but it is based on community management, not just one people. In addition, Injective has introduced liquidity support for DEX from a considerable number of top global market makers, including QCP, CMS, Bitlink, Altonomy, etc. Together with a powerful incentive mechanism, Injective can ensure the liquidity of the trading platform.

What's to come is coming, and the trade, as the foundation of the computerized age, is experiencing fast and phenomenal turn of events. In 2020, we will observer this change.

You can set with Injective Protocol project from below sources

Official Website: https://injectiveprotocol.com

Bounty Link : https://bitcointalk.org/index.php?topic=5256993

Telegram: https://t.me/joininjective

Whitepaper Link: https://docsend.com/view/zdj4n2d

Github: github.com/InjectiveLabs

Twitter: https://www.twitter.com/@InjectiveLabs

Reddit: https://www.reddit.com/r/injective