Trading Utility of InjectiveProtocol

A decentralized trade (DEX) is a digital money trade that works without a focal position. Some DEXes don't have KYC forms, which are defined and are authorized as a procedure to track, screen and forestall illegal tax avoidance and financing of psychological oppression. Without a brought together authority it is extremely unlikely for a DEX to turn around an exchange and clients are confounded in the awful occasion that they are hacked for their passwords or private keys.

With the advancement of blockchain technology and the emergence of more public blockchains, there are now a variety of decentralized exchanges. DEXes are different because of the diverse public blockchains they are based on and their respective concepts and technologies. Here we only discuss the decentralized exchanges pertaining the general traits.

One of the key parts of decentralized trades is that the trade accounts liken to savvy contract accounts. In a word, putting away resources on DEX is to store them in savvy contracts which is to store them in codes, and in codes you trust. Generally most DEXes will only ask for registration (some even require KYC, and it has been criticized for a platform to call itself a DEX whilst asking for KYC), and to deposit, withdraw, and trade:

Deposit:

you deposit by transferring your assets into the smart contract address assigned to you by the platform.Withdraw:

directly withdraw to anywhere directly from the smart contract address.Tradin:

your asset is transferred from the smart contract address directly to that of your counterparty. This transfer can be checked on the blockchain through blockchain browser, and the entire transfer process relies on smart contract's automatic execution by codes.

Differences Between Centralized and Decentralized Exchanges

Brought together trades can be utilized to lead exchanges from fiat-to-digital money). They can likewise be utilized to direct exchanges between two diverse digital forms of money. While this may appear to cover the entirety of the potential exchange types, there is as yet a business opportunity for another sort of digital currency trade too.

Decentralized trades are another option; they cut out the center man, producing what is regularly thought of as a "trustless" situation. These sorts of trades work as distributed trades. Resources are never held by an escrow administration, and exchanges are done altogether dependent on keen agreements and nuclear trades.

The urgent distinction among brought together and decentralized trades is whether a center man is available. Decentralized trades are less across the board and less well known as contrasted and brought together trades. In any case, there are more decentralized trades constantly, and it's conceivable that they will give concentrated trades a run for their cash later on.

Injective Protocol

Injective chain is based on the Cosmos zone and is a decentralized protocol built on Layer-2, providing a high-speed Ethereum decentralized trading experience. It will use the Cosmos IBC protocol to achieve cross-chain transactions, VDF (Verifiable Delay Function) to simulate real time through Proof of Elapsed Time, and standardize order sequencing to eliminate early tradings. In addition, the Injective chain supports token staking and provides technical support for creating more services such as staking in the future.

Injective Protocol is a start to finish decentralized convention permitting decentralized never-ending trades, fates, edge and spot exchanging. We have fabricated each segment of our convention to be completely trustless, oversight safe, openly evident, and front-running safe.

Trade stages like BitMEX, FXT and different frameworks, care next to no about its clients with regards to income sharing, however the Injective trade doesn't simply fill in as an advanced resource trade stage, yet utilizes the framework to be all the more remunerating as it shares the benefit acknowledged from the exercises on the framework, to its clients.

This specific trait is an unmistakable sign that Injective convention is about the clients and how well they make the most of their encounters when utilizing its best in class multipurpose and instinctive stage.

Tradeble Digital Assets

Most frameworks have only a couple of computerized resources with which clients can exchange, constraining their exchanging capacities and denying them from expanding profits.Injective convention stage then again, on its decentralized framework, presents a great deal of tradable resources on its trade, in order to permit merchants, take their pick.

By putting resources into various advanced resources, dealers will shield themselves just as advantage from various streams just as bullish patterns basic to an assortment of computerized resources at different time stretches, since it is an unpredictable market.

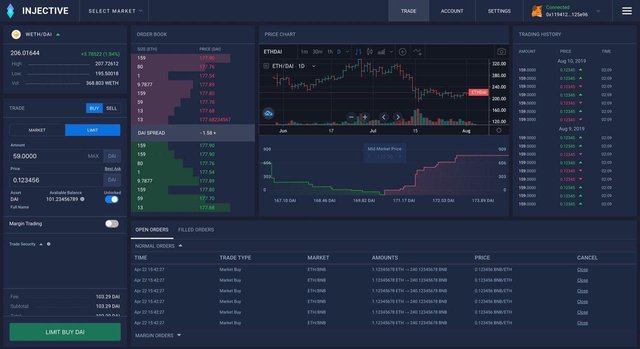

Injective Exchange

The Injective Chain is a layer-2 sidechain and Cosmos Zone connected to Ethereum. We leverage verifiable delay functions (VDFs) to enforce a fair transaction ordering consensus that reflects real-world time via proof-of-elapsed-time, solving critical race conditions and miner extractable value issues present in Ethereum.

Right now, Injective Chain controls our layer-2 subsidiaries stage, fills in as a decentralized Trade Execution Coordinator (TEC), and hosts a decentralized open orderbook. The chain itself is based on head of Tendermint and takes into account moving and exchanging Ethereum-put together resources with respect to the Injective Chain. Later on, Injective will be coordinated with Cosmos IBC, bringing progressed between chain decentralized money capacities.

Not at all like customary trades which fill in as the guardians of the crypto business, Injective makes trade a decentralized open utility. What genuinely separates Injective is that we decentralize and open source each part of decentralized trade. Everything — from the front-end trade interface, back-end framework, keen agreements, to orderbook liquidity — is given straightforwardly and to free. This turns the conventional plan of action of trade on its head, as we dispose of the specialized boundary of passage for one to permissionlessly run a profoundly performant trade.

Injective's model rather compensates relayers in the Injective system for sourcing liquidity. Thusly, trade suppliers are boosted to all the more likely serve clients, contending among one another to give better client experience, subsequently expanding access to DeFi for clients all around the globe.

A derivatives protocol is an important "weapon" of Injective. It is an open protocol that supports the development of open derivatives markets. It is also the world's first fully decentralized P2P futures and perpetual swap contracts exchange, which supports simple access to various markets. According to the team, compared with other products of the same type, Injective is the fastest, fully decentralized derivatives trading platform without gas fees in the DeFi market.

Based on the Injective chain, Injective's trading platform has also achieved a fully open source design, which allows it to be a completely decentralized network. It also provides a market-maker friendly API interface, which is close to the current mainstream exchange interface, allowing the user experience to be similar to that of a centralized exchange. Additionally, in the management system, the Injective trading platform has borrowed the design from the auditing systems of centralized exchanges, modularized design, and the audited listing system, but it is based on community management, not just one people. In addition, Injective has introduced liquidity support for DEX from a considerable number of top global market makers, including QCP, CMS, Bitlink, Altonomy, etc. Together with a powerful incentive mechanism, Injective can ensure the liquidity of the trading platform.

Visit us

Official Website: https://injectiveprotocol.com

Bounty Link : https://bitcointalk.org/index.php?topic=5256993

Telegram: https://t.me/joininjective

Whitepaper Link: https://docsend.com/view/zdj4n2d

Github: github.com/InjectiveLabs

Twitter: https://www.twitter.com/@InjectiveLabs

Reddit: https://www.reddit.com/r/injective