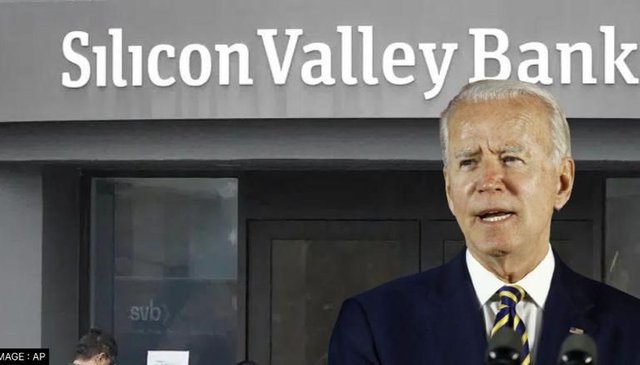

Downfall of American banks | silicon valley bank crash

Two of America's major banks have collapsed - California's Silicon Valley Bank and New York's Signature Bank. This is said to be the second biggest banking failure in American history. People are worried that this banking collapse might create another recession like in 2008. Let's try to understand what happened exactly, how it happened, and what will be the probable impacts. Silicon Valley Bank was heavily investing in startups. 65% of all startups in America were served by this bank. By the end of 2022, SVB was the 16th biggest lender in America with the value of its total assets at $209 billion - that's 17 trillion! In 2021, the startups raised a lot of money. In America, $330 billion was raised in total, almost double the record of the previous year. SVB was the #1 preference of technology-based startups. "The bank invested heavily in unprofitable startups that were on the bubble anyway," said John Doe, a finance expert. "So, when the pandemic hit, these startups went bankrupt, and that caused the bank's demise." The value of the total deposits with the bank was around $124 billion, up from $62 billion the year before - a 100% increase.

The U.S. government has recently increased interest rates, causing the value of bonds held by SVB to decrease. This decrease in value made it challenging for tech startups, including those associated with Y Combinator's startup accelerator platform, to withdraw their deposits in 2022 to meet financial needs. Additionally, venture capitalists were no longer funding startups, and many companies had their deposits with SVB." This situation put SVB in a challenging position, as their funds were incurring losses while customers were demanding withdrawals. It's essential to note that SVB was the default bank of Y Combinator's accelerator platform, and 89% of the deposits with the bank were uninsured, causing several companies to lose value due to this situation. It's important to note that the US banks' recent actions have wiped out over $100 billion from the stock market, while European banks have wiped out approximately $50 billions.

Grab a $750 PayPal Gift Card Now!

Android user ( https://tinyurl.com/Win4QZTX )

iOS user ( https://tinyurl.com/WIN4QZOS )

Many Indian startups and founders had placed their funds with SVB which has become a huge problem for them. Unlike larger corporations, startups usually only have one bank account and consequently have to rely heavily on SVB. Paytm's founder, Vijay Shekhar Sharma, expresses how SVB was one of the first investors for Paytm.