Book Review: The Age of Inflation

This book, written by Hans F. Sennholz, takes a look at the modern inflation epidemic from an economic perspective. It was published in 1979 well after the start of the inflation age which has continued to this day. Sennholz begins this book by laying out various monetary theories and explaining the importance of how money is valued. He writes about the general causes and stages of inflation. He writes about how and why the Federal Reserve System began and the consequences for the introduction of this System. Finally, Sennholz touches on the vulnerability of the American economy and provides a solution to what needs to happen to end this age of inflation.

To allow the reader some basic knowledge of economics Sennholz begins by explaining the value of money. He first explains that the idea of money occurs naturally as Carl Menger has written. It is traced back to the choices made by individuals and is not the invention of the state. Throughout human existence money has existed as the most saleable commodity whether it was furs, grains, or livestock. This was a natural way to get around barter problems. As societies began to have broader divisions of labor these types of commodities were replaced by the introduction of coins produced by public minters. This lead to the introduction of notes as a promise to pay coins on demand. In modern times, people have become accustomed to paper money as a substitute for metals. With government legislation, such as legal tender laws, paper money has become the only medium of exchange. They are no longer redeemable for the precious metals they were intended to represent. There are a great number of factors contribute to the demand for money. One such factor Sennholz addresses is population. A growing population of individuals entering the production process generates new demand which tends to raise the purchasing power of money and reduce goods prices. A declining population will have the opposite effect. I think we are now suffering the economic consequences abortion has created in killing off and dwindling the population, but that is a topic for another work.

Money is the life blood of an economic system. The corruption of the monetary system will corrupt the entire economy. Inflation is a way this corruption has been actualized in the modern world. It gradually erodes personal savings by undermining the purchasing power of the currency. It benefits debtors at the expense of creditors. Inflation is at the root of many evils which begs the question, how did this age of inflation ever come to be? The first step, according to Sennholz, was the creation of a government monopoly of the mint. Once this was firmly in place the right to debase coinage was no longer questioned and became a major source of government revenue. Next was the implementation of legal tender laws, which artificially dictated what the money was. The government then proceeded to remove the classical gold standard and establish its own fiat standard. This was followed closely by fractional reserve banking and the founding of the Federal Reserve System. The final step towards absolute government control of money was the suspension of international gold payments. All over the world, governments have adopted their own national fiat standard, which are managed and depreciated at will. Thus, this inflation age ensued to the ultimate destruction of money.

During an age, such as this, people tend to relinquish their cash holding through the purchase of goods and services. When the government resorts to inflation and prices begin to rise, people will look for lower prices. Much of the time foreign prices have not risen at the same rate as the have at home. This causes people to send their money abroad in exchange for cheaper goods. This increase in imported goods has a further negative effect on the domestic economy, at no fault of the individual I might add.

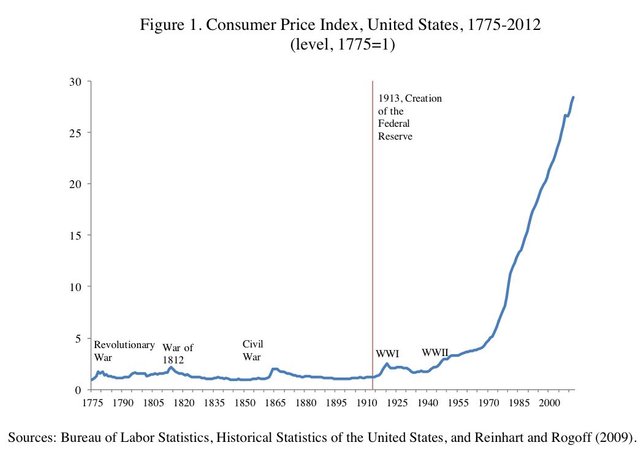

For two hundred years, inflation in America was primarily a wartime occurrence, which promptly ceased and returned to par when the war had ended. This was the case for every American war up until World War II. Before this war government financial support was only called upon in times of national emergency. However, today the public demand for government services is endless and seems to have accelerated with every waking year. This demand is constant during wartime as well as times of peace. This constant demand will continue so long as the economic and monetary ideology lingers as the result of wartime inflation. It occurred to me that perhaps the creation of the atomic bomb started the massive inflation and sparked an unending nuclear weapons race between nations costing more and more government money further inflating the money supply. The research and development for such an endeavor would not have been limited to wartime and could be a contributing factor for the level of inflation we see today. Regardless of the cause of this massive inflation there has occurred an ideology that has given birth to this age of inflation.

The first stage of inflation that Sennholz point out is what he calls “the stage of blissful ignorance”. During this stage the public is unaware of economic and monetary matters and continues to increase their cash holdings countering the effect of government deficit spending. The second stage occurs when the price of goods increase at a faster rate than the currency inflation by government. This wreaks havoc on the monetary stability of the economy. Sennholz thought this stage in America’s case would not last long due to the vulnerability of the economy to inflation. The final stage of inflation occurs when the currency is completely destroyed. It is characterized by a universal abandonment of from money into real goods. This has not happened yet, however, I suspect it will happen during the next fifty years.

Central banking is the manifestation of government control over the people’s banking and money. It was first introduced in England during the eighteenth century when a private bank got special privileges through its dealings with the British government. Unfortunately, the United States followed England’s example by creating their own central banks in 1913. During this time America was suffering from an unfavorable trade cycle. Their solution was the Federal Reserve Act which reformed the banking system allowing for a more flexible currency. Looking back, the act was rather modest in intent. However, over one hundred amendments have been made to the act shaping the Federal Reserve into a powerful tool the government uses to manage the people’s money and credit. Early amendments were made as an attempt to extend credit to help fund the war America was fighting against Germany. The Great depression ushered in new legislation. The Glass-Steagall Act of 1932 permitted the Federal Reserve to extend credit on any securities acceptable to them. Today the Federal Reserve is supposed to use these powers to create favorable conditions for high employment, rising consumption levels, and stable values. It has not achieved any such objective, but instead has delivered unbridled inflation and unparalleled economic unrest.

The Great Depression is an event that many economists claim will never happen again. Many saying it is inconceivable that America will ever have to endure such a crisis and that the government, with its great power, will intervene long before the economy reaches such lows. Sennholz was not so convinced. If the errors in policies which lead to the Great Depression are repeated it could easily happen again. Sennholz doubts the policymakers have learned their lesson and will likely make mistakes leading to new economic crisis.

The solution to the problem of inflation is a bleak and unlikely occurrence. Man’s only hope for monetary stability lies in the expulsion of government from the monetary system. True stability comes with the separation of political power from control of money. Government must be given no special privileges. Legal tender laws, the central bank system and the monopoly of the mint must all be rescinded to accomplish true stability. Any such program to stabilize the monetary system must be accompanied by preparations for an ensuing depression. This would be unavoidable if the rescindments above took place. The labor market would be hit especially hard as it has lost much of its former resilience. To vitalize the labor market all handicaps the government has placed on production must be removed. The currency that is used should not be decided by the government and should not necessarily be gold. Rather, the public should, and would naturally, decide what form of currency would be used.

In the final paragraph of his book, Sennholz says that, even in the midst of evil, we can cling to hope, for man may, through suffering, see the error of his ways. There has been no greater atrocity in America’s history than the combination of inflation and price controls. Yet, we are ever hopeful that, in the end, virtue will prevail over vice.

Work Cited:

Sennholz, Hans F. Age of Inflation. Western Islands, 1979.

Congratulations @tonehahn! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!