India Over The Counter (OTC) Drugs Market Scope, Trends & Growth Forecast 2024-2032

Market Overview 2024-2032

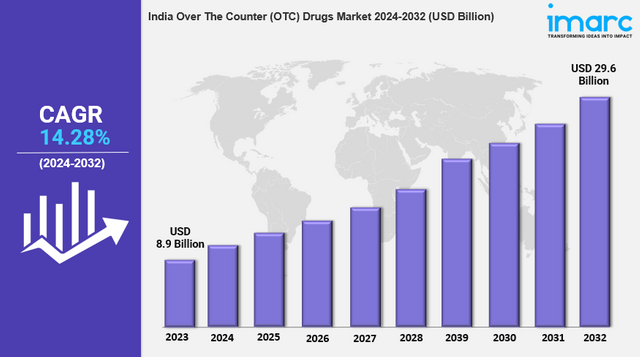

The India over the counter (OTC) drugs market size reached US$ 8.9 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 29.6 Billion by 2032, exhibiting a growth rate (CAGR) of 14.28% during 2024-2032. The growing geriatric population, the widespread popularity of e-commerce pharmacies and the rising health awareness among individuals represent key factors driving the market.

Key Market Highlights:

✔️ Strong market expansion driven by growing health awareness & self-medication trends

✔️ Increasing demand for herbal and natural OTC products

✔️ Rising focus on innovative & consumer-friendly packaging solutions

Request for a sample copy of the report: https://www.imarcgroup.com/india-textile-chemicals-market/requestsample

India Over The Counter (OTC) Drugs Market Trends and Driver:

The Indian Over-the-Counter (OTC) drugs market is witnessing a significant transformation as consumers increasingly opt for self-medication and preventive healthcare solutions. Factors such as rising healthcare costs, ease of access to OTC products, and greater awareness of common ailments are driving this trend. Consumers are proactively purchasing medications for pain relief, digestive health, immunity-boosting, and common colds without requiring prescriptions.

By 2024, this shift is expected to accelerate, driven by digital health platforms and e-commerce channels that provide easy availability and doorstep delivery of OTC medicines. Additionally, the government's push for greater healthcare accessibility and pharmacy expansions in Tier 2 and Tier 3 cities is further boosting the demand for OTC drugs, making self-care an integral part of India's healthcare landscape.

As health-conscious consumers increasingly prefer chemical-free and plant-based alternatives, the demand for herbal and natural OTC drugs is surging across India. Ayurvedic and herbal formulations for pain relief, immunity enhancement, and digestive wellness are gaining popularity, especially among those seeking holistic and side-effect-free treatments.

Major pharmaceutical and wellness brands are expanding their product lines to include natural supplements, organic cough syrups, and herbal pain balms to cater to this growing preference. By 2024, this trend is expected to strengthen, supported by government initiatives promoting Ayurveda and traditional medicine under the AYUSH mission. With increasing trust in homegrown remedies, herbal OTC products are set to capture a larger market share, appealing to both urban and rural consumers seeking effective and sustainable healthcare solutions.

The rapid growth of e-commerce and digital healthcare platforms is reshaping the OTC drugs market in India, providing consumers with easy access to a wide range of medications and wellness products. Online pharmacies offer convenience, discounts, and discreet purchasing options, making them a preferred choice for urban and tech-savvy consumers.

By 2024, the online distribution of OTC drugs is expected to grow exponentially, driven by rising smartphone penetration, improved digital payment systems, and evolving consumer preferences for doorstep delivery. Additionally, AI-powered health apps and teleconsultation services are enhancing consumer awareness and guiding them toward appropriate OTC treatments. This digital revolution is not only transforming sales channels but also enabling pharmaceutical companies to engage directly with consumers through personalized recommendations and subscription-based models.

India Over The Counter (OTC) Drugs Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2023

Historical Year: 2018-2023

Forecast Year: 2024-2032

Product Type Insights:

- Cough, Cold and Flu Products

- Analgesics

- Dermatology Products

- Gastrointestinal Products

- Vitamins, Minerals and Supplements (VMS)

- Weight-loss/Dietary Products

- Ophthalmic Products

- Sleeping Aids

- Others

Route of Administration Insights:

- Oral

- Parenteral

- Topical

- Others

Dosage Form Insights:

- Tablets and Capsules

- Liquids

- Ointments

- Others

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145