India Cloud Storage Market Growth, Trends & Opportunity Analysis 2024-2032

India Cloud Storage Market Overview 2024-2032

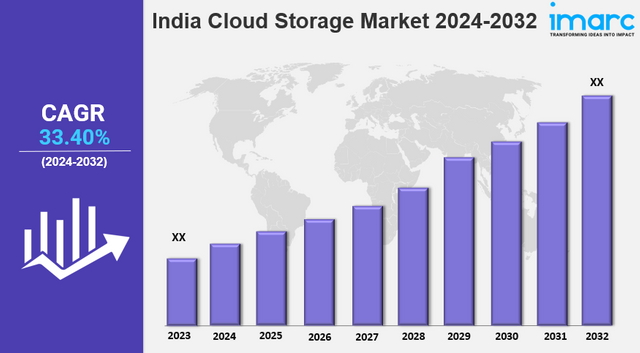

The India cloud storage market size is projected to exhibit a growth rate (CAGR) of 33.40% during 2024-2032. The integration of cloud storage with various other cloud services, such as computing resources, databases, and analytics tools, that can enhance overall business efficiency, is driving the market.

Key Market Highlights:

✔️ Strong expansion driven by digital transformation & data proliferation

✔️ Growing demand for secure and scalable cloud storage solutions

✔️ Increasing adoption of cost-effective and hybrid cloud models

Request for a sample copy of the report: https://www.imarcgroup.com/india-cloud-storage-market/requestsample

India Cloud Storage Market Trends and Driver:

The increasing reliance on digital transformation across industries is driving the demand for scalable and cost-effective cloud storage solutions in India. Businesses of all sizes, from startups to large enterprises, are shifting towards cloud-based infrastructure to manage growing data volumes efficiently. In 2024, the trend of hybrid and multi-cloud adoption is gaining traction, as organizations seek flexible storage options that balance cost and performance.

With enterprises looking to optimize IT costs, pay-as-you-go and subscription-based cloud storage models are becoming highly attractive. Additionally, the surge in remote work, digital payments, and e-commerce expansion is contributing to the need for secure and scalable cloud storage solutions. As Indian businesses prioritize data accessibility and real-time collaboration, cloud storage providers are enhancing their offerings with AI-driven analytics, automation, and seamless integration with enterprise applications.

With India’s stringent data localization policies and rising concerns about cybersecurity, businesses are prioritizing cloud storage solutions that offer robust security and compliance features. The enforcement of new data protection laws in 2024 is compelling organizations to invest in encrypted and region-specific cloud storage services to meet regulatory standards. Companies handling sensitive information, such as financial institutions, healthcare providers, and government bodies, are increasingly adopting private and hybrid cloud storage to ensure data sovereignty.

Cloud service providers are enhancing their security frameworks with advanced encryption, zero-trust architecture, and AI-powered threat detection to mitigate risks associated with cyberattacks. As enterprises emphasize compliance with global and local data privacy regulations, the demand for secure, customized cloud storage solutions is set to grow significantly.

The integration of artificial intelligence (AI) and edge computing is transforming India’s cloud storage landscape by enabling faster data processing and real-time analytics. In 2024, businesses are leveraging AI-powered storage management tools to automate data classification, optimize storage allocation, and enhance predictive analytics for better decision-making. The rise of IoT applications and 5G deployment is accelerating the adoption of edge computing, allowing businesses to store and process data closer to the source.

This trend is particularly beneficial for industries like manufacturing, healthcare, and smart cities, where real-time data insights are crucial. By reducing latency and improving data transfer speeds, AI and edge computing are enhancing the efficiency of cloud storage solutions. As companies focus on improving operational efficiency and user experience, AI-driven automation and intelligent cloud storage management are becoming key differentiators in the Indian market.

India Cloud Storage Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest india cloud storage market share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Study Period:

Base Year: 2023

Historical Year: 2018-2023

Forecast Year: 2024-2032

Component Insights:

- Solution

- Services

Deployment Type Insights:

- Private

- Public

- Hybrid

User Type Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

Industry Vertical Insights:

- BFSI

- Government and Public Sector

- Healthcare

- IT and Telecom

- Retail

- Manufacturing

- Media and Entertainment

- Others

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145