Indian Crypto Exchanges Face The Brunt from Income Tax Department: What Will Happen in 2018?

With the market cap of cryptocurrencies crossing 500 Billion Dollars. The Indian Government joins the bandwagon among several other world powers, who are worried with the growing users of cryptocurrencies. Certainly it is threatening as the crypto market cap is bigger than GDP of several countries including that of New Zealand and others. A threat by free beings of humanity adopting their new age currency breaking from the shackles of the archaic reminisce of government and central banking. The tiny dot (see video) makes sense after-all?

Is it true by the Shemitah prophecy describing the plot that traces back to their (governments) law and policy enslaving humanity for its ultimate fall. Things certainly seem planned (Hint)?

Burning fiat money? Rising phoenix? 1-0 Binary? Coins? 2018? At-least raises questions in my mind!!

Certainly this globalist economy doesn’t seem convincing! Call cryptocurrency to be a Ponzi or tulip mania it seems happening and get ready for a global currency its happening. Probably crypto/binary currency shall be the change in this emerging global order and is here to stay.

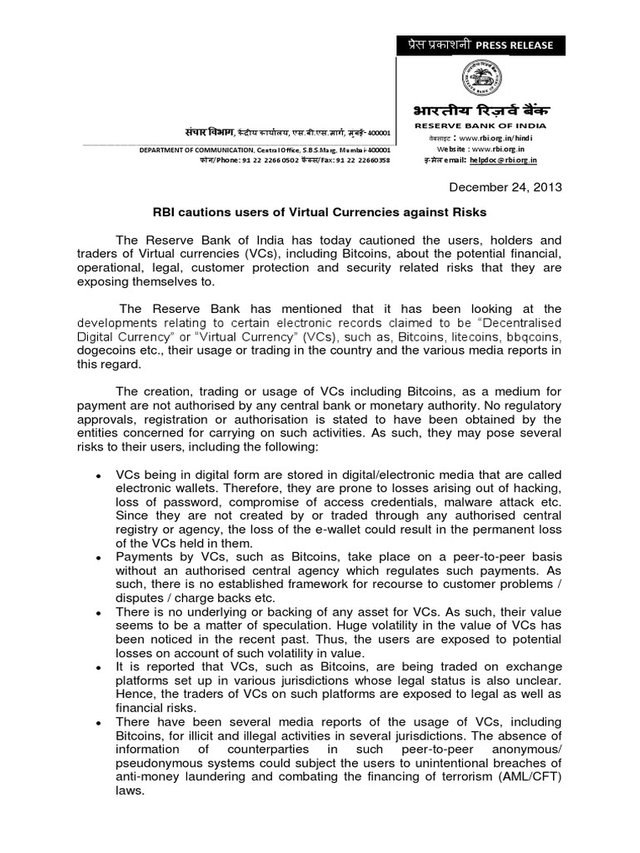

Coming to the present context, the sequence of events is followed by the Indian Reserve Bank made a caution call on virtual currencies earlier this year, while stating the potential financial risk in light of the exposed Achilles’ heel presented by the present legal framework.

Now come the Income Tax (IT) Department sleuths sniffing for clues, for tax evasion? The Crypto exchange across Delhi, Bengaluru, Hyderabad, Kochi and Gurugram were raided (survey-cum-search) by IT department.

The operation under Section 133A of Income Tax Act 1961, “the team from the Department of Income Tax are trying to identify the investors and traders who are trading or investing a significant amount of Bitcoins.” As the global digital currency ‘Bitcoin’ prices have surged 1000% this year, making many Bitcoin investors exponentially richer and reportedly people have not paid their taxes on these astronomical gains. As the cryptocurrencies are not regulated in India and despite the caution calls by the RBI the number of users has only surged.

This certainly interests the government finding their new cash cow i.e. the casual investors, traders and miners apart from (so called illegal) exchanges and they want a piece of it. With government move for securitisation in, 2002, and now bail-in provisions in India, it shall certainly shall also follow the present global order in its hind sight for all that matters including taming cryptocurrencies.

What does it mean for You and I ?

- All exchanges in India are KYC compliant and deal with money only directly from your bank account, so it is accounted and now the IT has records.

- Declaring your income through crypto shall ensure peace of mind, however, there is a confusion relating to accounting of the same in the absence of decisive guidelines.

- We might see a framework for legalisation of crypto's, definitely opening the market for traditional investors.

- Hold on tight its a long way to go and big changes come after a brief period of chaos.

All that remains as the billion-dollar question, “what shall happen in 2018?” What are your thoughts? Comment down below. I would like to hear what you guys have to say.

If you like my work do share it with your friends, upvote and resteem. You may also read my other works which might interest you:

- The End of Indian Cryptocurrency Dream? Government to Discourage Use of Crypto’s

- SCOPE OF BITCOIN AND ALTCOINS IN INDIA

- What Does It Take to Be a Cryptocurrency Investor in India?: My Story

- The dichotomy of extortion and financial freedom: “bail in” or decentralised currency?

Follow Me: @adityavijayr