Spotlight On Huobi; A Simplified And Essential Guide On Margin Trading

Hello everyone. Good to be here once again. Thank you for coming around.

Today, I'd be provided a simple and important guide that would help us enjoy the margin trading feature in the Huobi exchange. Please join me!

Brief introduction

Margin Trading is simply the process of trading with borrowed funds or adding leverage to your account. It allows users to increase their investment exposure given a limited base principal to enjoy multiple returns.

On the Huobi exchange, there are some basic things you need to know about margin trading and the steps to follow in order to enjoy this benefit.

Here are the simplified but essential guide you should follow to start trading on margin in the Huobi exchange.

¶ Open the website

The first thing you need to do is open the website and then login to your account.

After logging in, at the top menu you would find "Margin". Click on the “Margin” button. This will automatically take you to the “Margin Trading” Page.

¶ Switch Margin Account Type to Cross.

Cross Margin allows traders to apply the same margin balance to different trading positions. Then whenever the risk rating of the full position margin account reaches 110%, the system will liquidate the margin position.; While

¶ Isolated Margin is individually set aside for an outstanding margin position, with a fixed collateral amount. If there are multiple margin trading positions held, should one of the positions go into liquidation, margin set aside for other margin positions will not offset this loss and the user would have to top-up the margin for this position.

¶ The next thing would be to select the available trading pair. You will find this on the left side of the page. You can choose to trade any of them.

¶ All you need to do from here is to transfer funds as margin to your margin account. So simply click on transfer, and then on "Transfer funds" on the trading page. This will open a dialog box.

¶ Confirm the coin you wish to transfer as well as the amount and then click on "confirm".

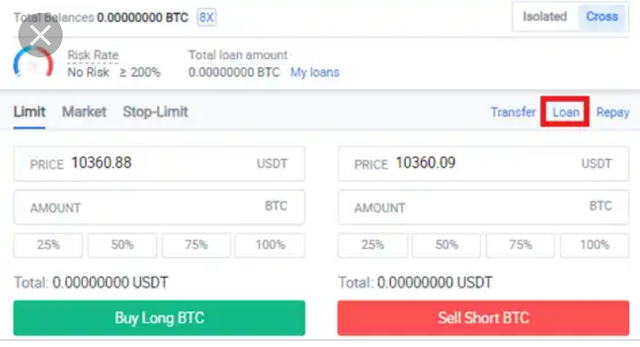

¶ After the transfer, of the principal balance to your Margin account, you can start borrowing tokens by simply clicking on the loan option on the trading panel.

¶ After clicking on "loan", the maximum amount available would be displayed based on the principal balance. Just input the required loan amount of the selected token in the box provided and it would be transferred to your Margin account.

For instance, if BTC is to be borrowed using USDT, the amount of BTC required will be transferred to your Margin account as long as it doesn't exceed the maximum available amount.

If the original input amount exceeds the maximum available loan amount, all you have to do is reduce the loan amount and it would be effective.

¶ When you have Successfully sent your loan application, the loan position will be reflected in the account, and can be verified by accessing "Balances" on the top of the website, "Margin Account" sub-menu option and then clicking on "Cross Leverage".

It is worthy of note that each token has a minimum and maximum loan amount. When the base principal is lower than the minimum loan amount, the available loan amount will reflect as 0. Under this circumstance, please top-up the principal balance from the Margin Account.

In margin trading, there are basically two forms of transactions involved. The bullish and bearish transactions.

The bull market (Buying long)

Here, the trader is buying the asset in anticipation of a rise in price. For instance, I borrow some USDT and then buy BTC with it, with the anticipation of a rise in the price of BTC. When I sell the BTC, I will then repay the loan and interest and then the difference would be my profit.

The Bear market (Selling Short)

In contrast to the bull transaction, the Bear market implies selling at a high rate in anticipation of a decline in price. Selling BTC (for instance) when the price is high and then buying it much later when it is reduced, then repay my loan and also make profits.

Repayment of Margin Loan

To payback loaned tokens and interest, simply click on"Balances" at the top of the website. Then click on "margin account" and then "Cross Leverage".

After that, click on "repay" and then input the quantity to repay, verify it and then "Confirm".

Note: Margin trading has its own risks. When margin trading, things can go south very fast because of the leveraged trades. Our anticipations sometimes fail. So please have it in mind that an investment with a high returned has a proportionate risk involved in it also.

I hope this was helpful. Thank you so much for coming around. I really appreciate.

Thank you for taking part in the Spotlight on Huobi Challenge.

Keep following @steemitblog for the latest updates.

The Steemit Team