COBINHOOD ICO: Understanding The Company’s 10% Yearly Vesting Technique & Why Unsold Tokens Are Not Burnt

This article is for information and discussion purpose only.

The author does not guarantee the accuracy of the conclusions reached in this article.

Investment decisions should be based on the reader’s own due diligence.

Introduction

The ongoing ICO by COBINHOOD Inc. has generated a lot of interest within crypto communities, mainly due to the company’s planned product – a zero-fee cryptocurrency trading exchange. As the ICO participants increase in number and interests keep rising, various questions are being asked about the company, their product and ICO tokens. Such questions include:

Why doesn’t COBINHOOD burn unsold tokens?

If unsold tokens go back to the company, won’t they get dumped and further cheapen the tokens?

Why does COBINHOOD vest 10% tokens each year?

What does it even mean for 10% COB tokens to vest each year?

To answer these questions and clear any confusion anyone might have, this article is written.

Before we delve into answering these questions, we shall briefly consider what COBINHOOD really is and how their tokens are distributed.

What Exactly Is COBINHOOD?

For starters, we must understand that COBINHOOD is NOT just a Cryptocurrency Exchange.

COBINHOOD is actually a cryptocurrency service platform for the blockchain era. As a service platform, COBINHOOD is rolling out various ground-breaking and interesting service-products to meet current and future financial and business requirements of the blockchain revolution, and in so doing, position itself as a pioneer and shaper of the future of this industry.

The services to be launched by COBINHOOD beginning from November 2017 through the 3rd quarter of 2018 include:

- A Centralized high-frequency cryptocurrency trading exchange that features ZERO fees for spot and margin trading and for all deposits and withdrawals

- ICO underwriting services

- A Decentralized cryptocurrency trading exchange

- Crypto assets trading with stocks, forex, commodity, market indexes, and futures

- Cryptocurrency wallet and payment services

COBINHOOD’s overarching goal is to become the NASDAQ and Goldman Sachs of the cryptocurrency market, if you know what that means. NASDAQ provides an electronic marketplace that enables investors trade securities on a computerized, transparent and speedy system and serves as a benchmark index for U.S. technology stocks including world’s foremost technology giants such as Apple, Google, Microsoft, etc. Goldman Sachs is a global investment banker that provides securities underwriting services – that is, they raise investment capital from investors on behalf of corporations that are issuing securities.

You can consult the COBINHOOD whitepaper for more details.

COBINHOOD ICO & Token Distribution

COBINHOOD is currently in its Initial Coin Offering (ICO) stage. The ICO started September 13th and will continue until October 22nd, 2017. As at the time of writing, 10% bonus is being offered for purchase of COBINHOOD ICO tokens (COB) amounting to 4400 COBs / ETH.

Participation in the ICO is to sponsor the development of COBINHOOD exchange, which is expected to go online in November 2017. Details are available on their website here.

Distribution of COB Tokens

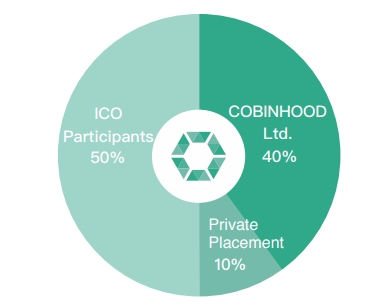

A total of 1 billion COB tokens will be issued by COBINHOOD, and distributed as follows:

• 50% for ICO Contributors (i.e. 500M COB tokens)

• 40% for COBINHOOD Inc. (i.e. 400M COB tokens)

• 10% for Private Placement – Angel Investors (i.e. 100M COB tokens)

Two very important points to note about the ICO funds and COB tokens are:

- 100% of the funds received from the ICO will be used for the development of COBINHOOD cryptocurrency exchange.

- Unsold COB tokens from the ICO will not be burnt. They will be reserved by COBINHOOD Ltd

- 10% of COB tokens held by COBINHOOD Ltd. vests every year, meaning there is a 10-year vesting period for COB tokens.

Why COBINHOOD Employs “Graded Vesting” Of COB Tokens & Why Unsold Tokens Are Not Burnt

Having introduced COBINHOOD and its ICO, we shall proceed to consider those very important issues that have generated questions about the COBINHOOD ICO pattern under the following subtopics.

We aim to answer the questions stated earlier, which are:

Why doesn’t COBINHOOD burn unsold tokens?

If unsold tokens go back to the company, won’t they get dumped and further cheapen the tokens?

Why does COBINHOOD vest 10% tokens each year?

What does it even mean for 10% COB tokens to vest each year?

COBINHOOD Will Generate Revenue From COB Tokens Held

While operating a zero-fee exchange, COBINHOOD aims to generate profits through various other means such as margin trading loan interest, ICO underwriting service fee, and subscription fees on COBINHOOD Prime service and COBINHOOD High-frequency trading server.

In addition to the above-mentioned revenue streams, COBINHOOD will also generate revenue through the company-owned COB tokens that appreciate over time. This was also confirmed by COBINHOOD’s CEO, Popo Chen, in a recent interview. That is why the company reserves 40% of tokens (400M COBs). Also, all unsold tokens will go back to the company to further increase her revenue from company-owned tokens as the token number increases. This point answers the question of why unsold tokens are not burnt. Basically, they will add up to increase company’s revenues from COB tokens held.

The next issue then is: won’t the company dump these tokens? The next point will help us understand why this is not possible.

Graded Vesting Of 10% Yearly Won’t Allow COBINHOOD To Dump COB Tokens

To protect against the company dumping her COB tokens, the company-owned tokens require a strict vesting period of 10 years at 10% per year. What exactly does this mean? And how will it protect against dumping?

To explain, let us consider what vesting period means.

In layman language, a vesting period is the length of time it takes for one to have full irrevocable right to one’s entitlements. It’s like giving you something but you cannot have access to it until after a specified period of time has passed. This period of time can be referred to as a vesting period.

To further illustrate, in employment contract, some organizations set a vesting period of 5-years of service for employees to have full access to their retirement benefits. Employees that work for less than 5 years may have access to only a portion or none of the benefits.

In setting a vesting period, different approaches are used. One approach is to allow someone access to their full entitlement after a specified period of time, e.g. after 5 years. Another approach is to give someone gradual increasing access to their entitlement from time to time, such as, allowing them take ownership of 20% of their stock every year instead of waiting 5 years to release the full 100%. This system is called “Graded Vesting” and is exactly how COBINHOOD takes “ownership” of it’s company-held COB tokens.

With this understanding, let’s analyse COBINHOOD’s vesting period and its advantages:

• The company imposes a strict 10-years vesting period on company tokens, meaning that the company will have full access to use the full tokens after 10 years.

• COBINHOOD vest 10% tokens each year – this means the company can only access and use no more than 10% of her company-held tokens each year.

Consider an example below:

• COBINHOOD holds 400M COBs as per tokens distribution chart

• Let’s say there are 100M COBs unsold tokens after ICO

• Total company-held tokens will become 400M + 100M = 500M COBs

• Each year, COBINHOOD vest 10% tokens: that means, they can only take ownership of not more than 10% of her 500M COB tokens as per our example; that is: 50M COBs per year, which they can sell if need be.

• In 10-years, COBINHOOD would have had full access to the whole company-held tokens.

Main points from this model are:

- Even though unsold tokens go back to the company, they will not be dumped, and as such won’t devalue the tokens

- COBINHOOD vest 10% tokens each year to mitigate against dumping the whole tokens in one-go and crashing their value since the tokens are released gradually over a 10-year period, while at the same time generating additional revenue for the company from the 10% vested annually.

Conclusion:

From our explanation and illustration, one can safely infer that COBINHOOD has taken steps to ensure a professional approach to running its business and ensuring maximum value to ICO contributors. They have adopted a method to spread the release of their company-held tokens over a 10-years period. That is why even though unsold tokens go back to company to further generate revenue for her, there is no fear of it getting dumped since the tokens are released over a 10-years period not exceeding 10% per year.

For Further Information

Website : https://cobinhood.com/

Whitepaper : https://cobinhood.com/assets/whitepaper/whitepaper_en.pdf

Telegram : https://t.me/cobinhood

P.S.

My twitter page:

https://twitter.com/tokenupdates

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=936680

Congratulations @tokenupdates! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @tokenupdates! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPWell explained... Now, it makes lots of sense...good

Thanks

Well written

Thanks. Glad you liked it

great

Yeah it was a great article

Do you know you can get paid for your steemit blogs in which you review Cobinhood? https://steemit.com/cobinhood/@starkerz/is-cobinhood-undervalued-get-paid-to-review-oracle-d-first-challenge