XTRD - Unifying Cryptocurrency Exchanges

PRESENTATION

A storm has hit the investment market which we are not going to recover from. Crypto investment is that storm. With strict capital controls in place by most countries to control the flow of money and charge high taxes, cryptocurrency gained usage in circumventing capital controls and taxes, leading to an increase in demand. Cryptocurrency has been able to present an easy to use digital alternative to fiat currencies. Offering frictionless transactions and inflation control, investors have been prudent enough to add these currencies in their diversified portfolios as an asset, as the size of the market does not represent a systemic risk. Cryptocurrency employs the use of cryptography that assures high-security processes and verifies transactions personal to each user. Hence, counterfeiting and anonymous transactions are impossible to achieve.

While this revolution is gaining wide acceptance, XTRD, who is bringing proven financial technologies to the cryptocurrency market has arrived.

Before I take you on this voyage, please check out this video presentation

Now that I have your attention, let’s get right to it.

What exactly is XTRD?

XTRD is comprised of a team of veteran Wall Street commerce specialists with a mission to unify the cryptocurrency exchanges. This mission has manifested in four product that ar all interconnected. These product ar a unified FIX API almost like ones already used for prime volume commerce, one purpose of Access (SPA) for cryptocurrency exchanges to extend liquidity, a downloadable commerce platform to known as XTRD professional, and a centralized Dark Pool for turning crypto into enactment. With a safer and concrete infrastructure, entities equivalent to banks, hedge funds, and enormous institutional traders will simply access cryptocurrency markets.

Brief History of XTRD

As of January 2018, there are over 120 standalone cryptocurrency exchanges, facilitating trading in more than 1000 individual markets. Daily trading volume for cryptocurrencies is now equivalent to 20 billion USD, with a total market cap of over $700 billion. The majority of the trading is concentrated among the top 20 exchanges, denominated in multiple currencies ranging from crypto ones including Bitcoin and Ethereum to sovereign ones such as USD, GBP, JPY, CNY, and KRW, among others. Predictions point to growth toward a $1-2 trillion market capitalization in 2018, and a corresponding 3% average daily trading volume of $50 billion or more. Asset managers are beginning to see increased demand for cryptocurrency exposure in their portfolios, over 500 active funds are being created to enter the market in 2018, and the regulatory climate is warming. However, the market is nascent, and large spreads are common between exchanges on the same crypto pairs, allowing for ample arbitrage opportunities that don’t exist in more efficient markets. The inefficiency is a product of cryptocurrency trading markets being highly fractured in terms of execution, account setup, automated access, liquidity, execution speed, pricing, and security. XTRD was created by finance and trading professionals to solve those problems by both improving on and consolidating current trading practices.

The Aim

XTRD aims to build trading infrastructure (Hardware and Software) in the crypto space and become one of the first full-services shop in the cryptocurrency markets for large traders and funds.

The Problem

The following problems are associated with cryptocurrency trading:

A complex web of exchanges

A combination of differing KYC policies associated with APIs, funding, and interfaces will result in a fragmented patchwork of liquidity for the cryptocurrency. Major concerns for traditional cryptocurrency market participants range from liquidity and hacking prevention to unmitigated slippage and counterparty risks.

High fees

The exchange commissions associated with trading of cryptocurrencies typically are in 0.1%-0.25% range per transaction, which are 10 to 25 basis points. The effective fees of transactions are much higher when taken into spreads and bids maintained by the exchanges.

There is generally no central regulator or authority for examining internal exchange orders that systematically separates customer activity from proprietary activity, which can ensure fair pricing.

Decrease in liquidity

If not managed correctly and executed only on the exchange, a single order to purchase USD1,000,000 worth of cryptocurrency can cost an additional USD50,000-USD100,000 per transaction to the investors due to the lack of liquidity.

The Solutions

Three separate products in sequential stages will be launched by XTRADE to solve the problem of low per market liquidity, decentralized execution in cryptocurrency space, and unfamiliar interfaces.

Stage 1. Implementation of the Multi Exchange Fix API

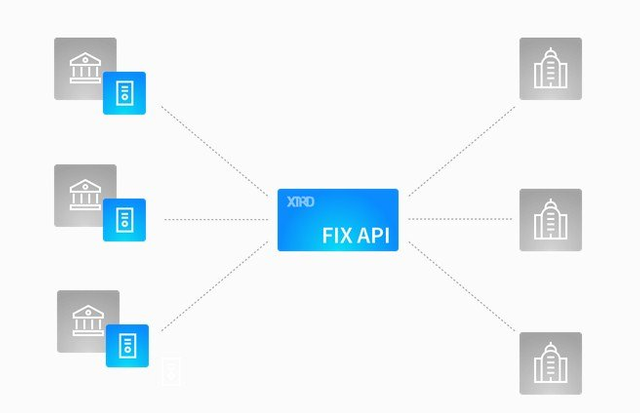

Xtrade will launch a universal low latency Financial Information eXchange (FIX) based API that will be connected to all cryptocurrency exchanges to make it easy for major algorithm traders, major institutions, and hedge funds to access all cryptocurrency markets by coding to just one FIX application.

Stage 2. Launching the XTRADE pro-trading platform

A highly robust, multi-exchange stand-alone trading platform will be launched by Xtrade in 2018 for active cryptocurrency traders around the world.

Stage 3. SPA (Single Point of Access) cross-exchange/liquidity aggregation

This platform will create a single unified point of access during stage 3 of development. It will aggregate liquidity across exchanges for cryptocurrency traders. In addition, it will allow traders to clear at the best possible price while systematically delivering the lowest possible transaction cost. It will also deliver atomic swap capability all within just one client-side account.

FIX (Financial Information Exchange) Protocol serve as the common language for international financial transactions because all other systems are different, there was a great requirement to communicate all executions between brokers, exchanges, mutual funds , investment banks and direct market access participants using a universal format.

FIX is the standard means of communication for trading in global equity markets, and is also heavily used in currencies, bonds, and derivatives. Every large institutional and professional market participant uses FIX to trade and has been doing so for over 25 years. FIX works by defining preset “tags” as value placeholders

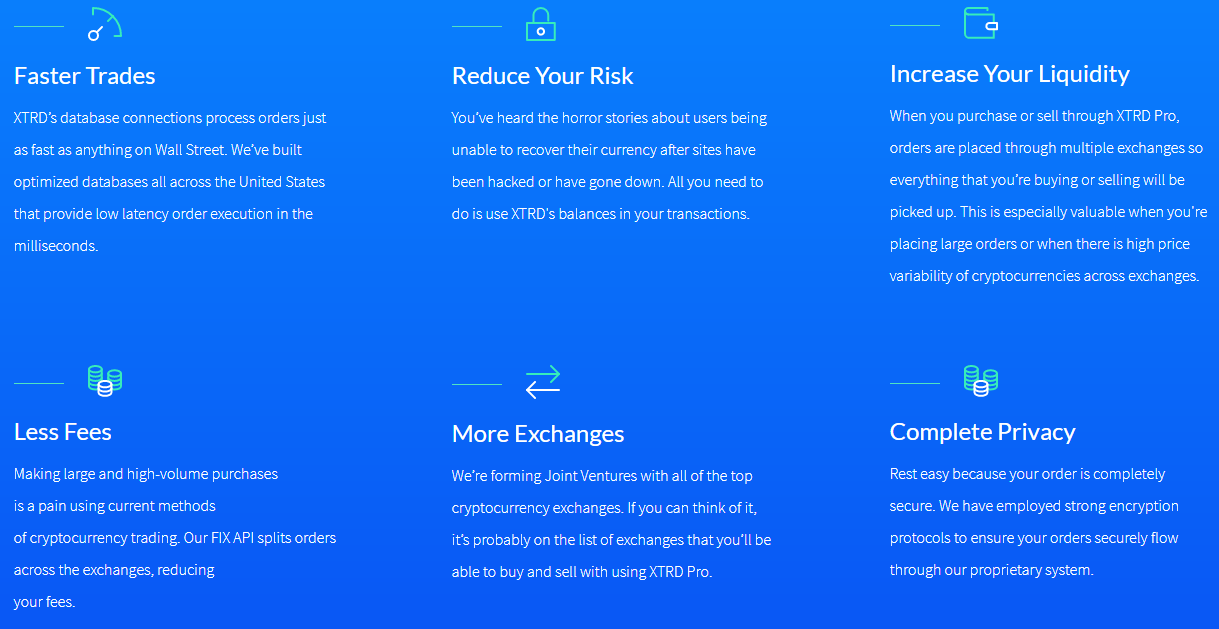

XTRD creates a single unified point of access (SPA) to aggregate liquidity across exchanges for traders. This aggregation allows traders to clear at the best possible prices while delivering the lowest possible transaction costs as well as atomic swap capability for all with just one client-side account.

XTRD Pro is a downloadable solution to the fragmented markets. You’ll have access to all cryptocurrency exchanges and all your accounts from one application. XTRD Pro is a standalone trading platform that won’t suffer outages. Make more profitable choices with hotkeys, custom buy orders, and consolidated booking.

Benefits of XTRD

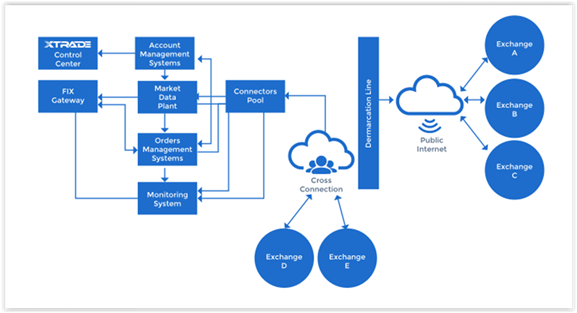

XTRD TOP LEVEL ARCHITECTURES

The XTRD has a structural architecture which displays the pattern on how the platform works. The general representation is shown below.

MARKET DATA PLANT

ORDER MANAGEMENT SYSTEM

ACCOUNTS MANAGEMENT

CONNECTOR POOL

TOKEN SALE AND ICO DETAILS

XTRD token is an ERC20 compliant utility token, which is developed on the Ethereum blockchain just like other popular ICO tokens such as BunnyToken, Cibus, Amon, Aktie Social, Alttex, THEFANDOME.

It will be used as a primary means of payment by users for obtaining services rendered by this platform. XTRD tokens will be sold by this platform to accredited investors through a SAFT (simple agreement for future tokens). The price of one token will be USD 0.10 during the ICO sale.

Token Details

Platform: Ethereum

Accepted: ETH

Start date: Feb 20, 2018

End date: Mar 31, 2018

Soft cap: 0 $

Hard cap: 45 000 000$

Minimal amount: 10 XTRD

Token: XTRD – 0.00814835$

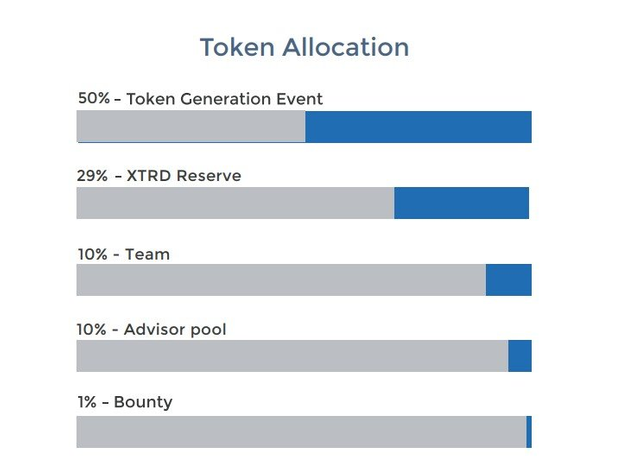

ALLOCATION OF TOKENS

50% of XTRD tokens will be issued for sale during the ICO event.

29% will be held in reserve.

10% XTRD tokens will be allocated as an advisor pool.

10% XTRD tokens will be allocated to a team.

1% tokens will be allocated for bounty rewards.

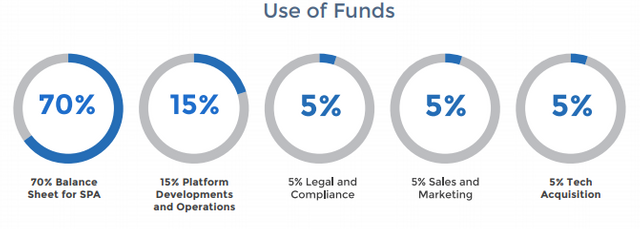

USE OF XTRD FUNDS

70% of the funds will be used for SPA development.

5% will be used for tech acquisition.

5% will be used for sales and marketing.

5% will be used for legal and compliance purposes.

15% of the funds will be used for platform developments and operations.

RoadMap

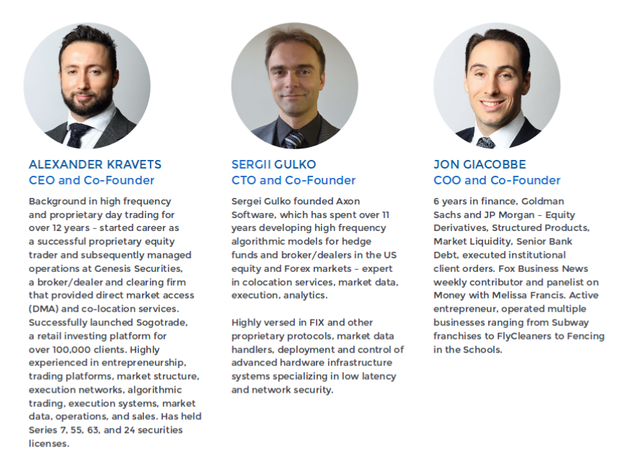

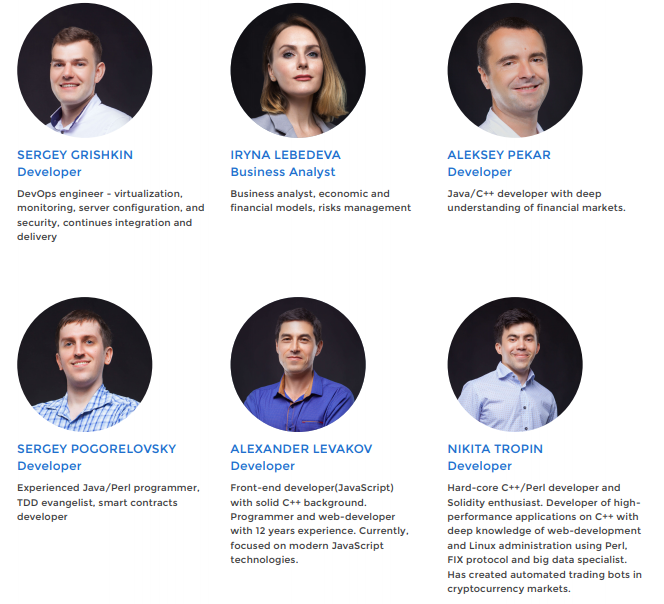

Meet The Amazing Team

Be a part of this incredible project. Download the whitepaper for the full scoop.

Till next time…

For more information, please visit:

Website : https://xtrd.io/

WhitePaper: https://xtrd.io/xtrd_whitepaper.pdf

Twitter: https://twitter.com/xtradeio

Facebook: https://www.facebook.com/xtradeio/

LinkedIn: https://www.linkedin.com/company/18273025

Telegram Community: https://t.me/xtradecommunity

Telegram Announcements: https://t.me/xtradeannoucements

Bounty chat: https://t.me/Bounty_XTRADEIO

Medium: https://medium.com/@community.xtrd

Reddit: https://www.reddit.com/r/XtradeIO

Author: TheMichaelMatch

My BitcoinTalk Profile: https://bitcointalk.org/index.php?action=profile;u=1326035

Disclaimer: This article was published in terms of the bounty campaign. I am not a project team member or its representative but a supporter of this incredible project.

Coins mentioned in post: