This Week in Cryptocurrency

I Dip, You Dip, We Dip

I Dip, You Dip, We Dip

Just when we thought we were out of the pits, the cryptocurrency market throws us right back in. Prices have been on a steady downtrend since crypto’s total market cap regained positive footing in the middle of last month. On February 17th, the market’s capitalization was $519bln. Now, it’s valued at $336bln, a 35% drop on the month and a 7% drop on the week.

Could be tax season for US citizens, could be the FUD of Google banning crypto-related ads. Regardless of the catalyst, the market is grade-A bearish at the moment, and it has us wondering if this is the continued verberations of February’s crash.

Bitcoin: With its price sitting around $8,500, Bitcoin is down 5.5% since last week. Sure, not a devastating drop, but still not the kind of price action you want to see.

Ethereum: Crypto’s silver contender has little for a silver lining this week. Compared to Bitcoin, Ethereum is in double the trouble, with an 11% loss on the week at its current price of $619.

Ripple: Number three on our list is in the worst shape out of its peers, as Ripple is down 12% on the week at $0.70 per XRP.

cryptocurrency market charts march 16

Domestic News

Crypto Comes to Congress–This Time, the House of Representatives: The United States House of Representatives held a formal hearing on cryptocurrencies on Wednesday this week. Overseen by the Capital Markets, Securities, and Investments subcommittee, academics and industry leaders drove home crypto’s MO to US legislators, including Congressional Blockchain Caucus leader Tom Emmer. The meeting served as a primer for congress members unaware of crypto regulatory status, with a special focus on ICOs.

Hedging Risks? SEC Probes Cryptocurrency Hedge Funds: We know about the SEC’s beef with ICOs, but now, the US regulatory agency is going after crypto hedge funds. In order to protect consumer interests, the SEC has requested information regarding fund security features, pricing models, and compliance among others, and some funds have apparently even received subpoenas from the SEC’s Enforcement Division.

Tennessee Legislators Push for Conflicting Bills on Crypto, Blockchain: For better or for worse, things are heating up down south for crypto. Both the Tennessee State House and Senate are processing legislation that would ban retirement fund investments into crypto, but they also have bills on the table that would approve “the legal authority to use Blockchain technology and smart contracts in conducting electronic transactions” and would “[protect] ownership rights of certain information secured by Blockchain technology.” Versions of both bills have passed in the Senate while the House has yet to vote on their versions of the legislation.

Nashville skyline

Surprise, Suprise: Utility Tokens Offer Utility as a New Asset Class, According to Wyoming Legislature: In defiance with federal regulatory bodies who, in recent months, seem to be locked in a turf war over crypto’s legal classification, Wyoming is helping cryptocurrency forge its own path. Wyoming House Bill 70 was signed into law this week, the first legislation in the world to recognize crypto as its own unique asset class. Caitlin Long, co-founder of the Wyoming Blockchain Coalition, hopes that the landmark legislation will “[set]an example of how this could become a standard under federal law.”

Circle Invest Now Available to US Citizens in 46 Countries: 2018 is shaping up to be an active year for blockchain-focused company Circle. A month after the organization acquired Poloniex Exchange, the team has announced that they’ll be opening their new cryptocurrency investing platform, Circle Invest, for “early access” to US citizens in every state barring Minnesota, Hawaii, Wyoming, and New York (which they expect to add “very soon”).

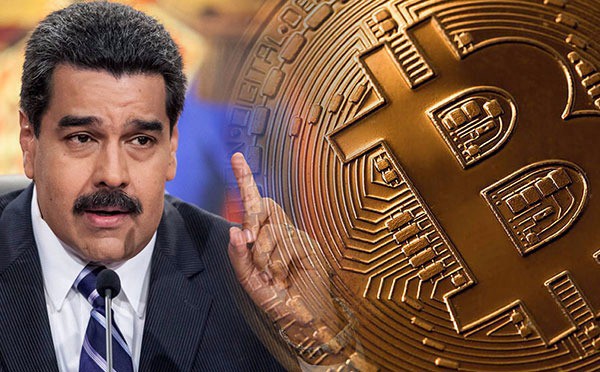

The Petro Continues to Draw Disapproval from Legislators: If a modern day dictator decides to ride the crypto hype train, don’t be surprised when the rest of the political world disapproves. Earlier this week, Florida Senator Bill Nelson sent a letter to Treasury Secretary Steven Mnuchin regarding Venezuela’s ICO for the petro, its state-sponsored cryptocurrency. Nelson, along with other international politicians, is worried that Venezuelan president Nicolas Maduro will use the ICO funding to avoid sanctions and fund his regime.

Nicolas Maduro and a Bitcoin

New Bill Could Screw Over Sex Tokens: According to a few industry professionals, both from the adult industry and the crypto-sphere, two new bills being pushed through Congress could spell trouble for cryptocurrencies that target legal sex work. The packaged-deal bills, Fight Online Sex Trafficking Act and Stop Enabling Sex Traffickers Act (FOSTA-SESTA for short) could “cause a problem for anyone involved in any kind of sex work,” Spankchain co-founder Janith Griffith believes, as “[producers] can be in trouble for, ‘promoting prostitution,’ [and] it could also potentially cause a problem for token holders.”

Winklevoss Twins Want to Weed Out Crypto Fraud with Self-Regulatory Organization: Cameron and Tyler Winklevoss have done well for themselves for some guys who, arguably, had the concept for Facebook filched out from under them. The (in)famous duo have become industry movers in the blockchain world with the Gemini Exchange. Now, they’re using their influence to propose a self-regulatory body for US-based exchanges. The Virtual Commodity Association would, they believe, help improve security, transparency, and management standards across the board for exchanges.

Nice write up show!

I'll be posting daily d.tube videos here soon on the cryptomarket. Maybe we can team up and help grow our brands! feel free to throw me a follow and i'll do the same!

Coins mentioned in post: