Nearly Half Of 2017 ICO's Already Failing - How To Protect Yourself

We all know investing in ICO's is a risky prospect that has huge potential upsides, but are the big players really taking as much risk as the smaller investors out there? Here's how to employ their tactics...

Bitcoin.com recently released results of a study showing that 46% of 2017 ICOs have 'completely failed' according to data from Token Data. Most know that when investing in ICOs, that they should assume that a lot of ICOs will fail. However, the rate at which this is happening may come as a surprise to some.

Further to these results, there are over 113 ICO's from 2017 which are classified as 'semi failed,' deemed so because their social media is no longer active, or their community size is too small that the chance of success is highly unlikely.

Its not all bad. A lot of ICOs have seen wild success. So what kind of measures are smart investors out there to protect themselves?

Do not be fooled by the way that clever marketers can polish up rubbish products with highly compensated advisors, or artificially inflated telegram channels using fake members etc. The hallmarks are almost always there. Concourseq.io is a good resource for filtering through the rubbish.

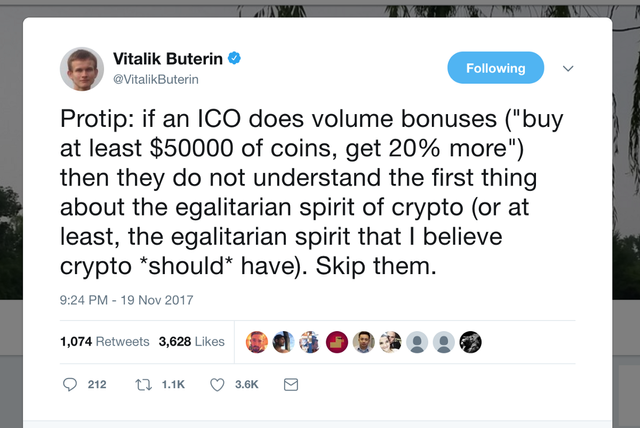

Getting bigger bonuses will also reduce your risk. Here's a popular ICO practice that only rewards the richer, until recently...

It is not such a secret that large, early investors get massive bonuses on tokens. It may suprise you that can access the same deals by pooling with other investors.

Moon Syndicate Telegram is one such pool that has a strong track record for ICOs and their Telegram Group currently has over 2200 members at the time of writing. Since I've participated in their pool they've offered 100% bonuses on top tier ICOs that only had 15% bonuses available to the public. For each ICO they do, they invite the CEO's or CTO's of the ICOs into the group to answer questions.

Of course you need to be careful when it comes to ICO pools out there, as there are a lot of scammers out there. So make sure you check the historical performance of the pool and be sure that the members of the pool are happy with the admins.

Buying pools like Moon Syndicate are bringing ICOs more in line with how Vitalik intended the ecosystem to be. Where small actors have equal opportunity as large actors.

Been around crypto for 4 years, never touched an ICO. I also have just one Token (versus multiple Coins).

Tokens generally entitle you to very little, if not nothing and in an ICO you are paying up front for that. So it's no wonder 47% failed already, there is no drive for them to succeed.

Very interesting token due diligence site (https://concourseq.io/) you posted. Doing your homework before investing in an ICO is a must!

Nicely done.

Much obliged for the links on due diligence for ICO's. I don't generally participate myself unless there's a really stand out reason for why a project appears to be worth it, and with regulations incoming it's not a surprise that many of them are dropping like flies. I imagine that there's a lot that would need to be done in order to make sure that they are within the regulatory framework so perhaps the slowdown can be attributed to that. Either way, I think it'll be positive for the general trajectory of the market.

Thanks again

Great post. Thanks!