The Legolas Protocol: Fair, Secure and Transparent/

Gathering the best of the centralized and decentralized world to create the first fair, secure and transparent cryptocurrency exchange.

Legolas Exchange brings transparency and fairness in the cryptocurrency market thanks to its protocol.

The Legolas Protocol is a semi-decentralized order matching protocol, which prevents front-running and price manipulation on Legolas Exchange.

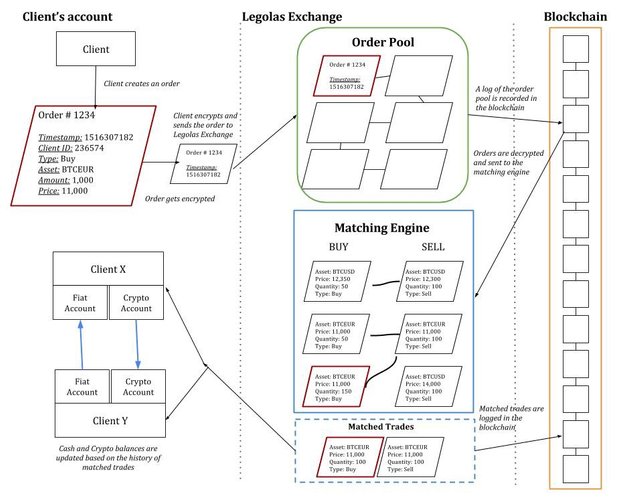

Here is how the protocol works:

Step 1: the order is created and encrypted by the client

The client will put together an order by specifying various parameters such as:

-the currency pair

-the price

-the quantity

-etc.

Once it is validated by the client, the order is encrypted and sent to Legolas Exchange. At this point, the only data available to Legolas is the cryptographic hash of the order as well as its timestamp of emission.

Step 2: the encrypted order is added to a chronologically ordered Order Pool

The order pool gathers all the new incoming orders as well as those that were not executed in the past. Orders are ranked by timestamp, and their content is encrypted. At this point, Legolas Exchange doesn’t know what is in any of the orders nor who placed them.

Step 3: a log of the order pool is recorded in a sidechain of a public blockchain at frequent intervals of time.

This recording frequency will be carefully selected and adapted to the order input, in order to provide Legolas Exchange clients with a seamless trading experience.

Step 4: The orders are decrypted and sent to the matching engine.

After being logged in the blockchain, the order pool is unencrypted and sent to the matching engine.

Step 5: The order book is created and orders are matched according to different matching algorithms.

Orders are immediately matched according to several matching algorithms (prorata, FIFO, etc). The remaining open orders are gathered and form an order book which is made available to all the Legolas Exchange users.

Step 6:Matched trades are logged in the blockchain

Two orders that match form a matched trade, which is logged in the blockchain. Thanks to this data, anyone can verify that the trades which were executed on Legolas Exchange and the orders that were placed beforehand are logically and transparently linked. The trade records are publicly available and can be audited.

Step 7:Clients’ fiat and crypto balances are updated according to the history of matched trades.

Based on the trades that were executed, the clients’ crypto and fiat balances are updated.

Conclusion

Front running and market manipulation have crippled the cryptocurrency market. Legolas Exchange is the first platform to bring back the core values of the blockchain technology, which are transparency and trust. By storing the order pool on a decentralized ledger, Legolas Exchange completely neutralizes price manipulation on its platform. In addition, the centralization of computational-heavy parts of the protocol such as the matching engine and the order pooling are made off-chain, so as to guarantee fast and secure transactions.

This way, Legolas brings the best of both the centralized and decentralized world to offer the first secure, transparent and fair cryptocurrency exchange.

About Legolas

Legolas Exchange is a demonstrably fair, bank-backed premium exchange for institutional investors. It incorporates a decentralized ledger within its proprietary centralized platform in order to guarantee the inalterability, temporality and transparency of the order book and ensure a fair trading environment.

Public Sales starts on February 1st !

If you like what you read, please don’t forget to like and share the post !