MoneyToken

Current mainstream cryptocurrencies have not behaved as they were expected to do. Instead of becoming a borderless, frictionless currency which could be used to pay for anything, anywhere; these cryptocurrencies have become volatile, valuable assets. Miners and owners of Bitcoin are hodling like crazy.

For cryptocurrency holders the problem is obvious — currencies like Bitcoin are not an attractive or preferable means of payment, since using them to make purchases removes the opportunity to benefit from future growth in value.

Those holders who spent their Bitcoins in the past few years can only look back with some regret at the position they would now be in had they kept their crypto-assets.

But there are always going to be times when asset holders need liquid funds to pay for current needs — whether that is for further business investment (such as miners who need to upgrade equipment or enlarge their operations), extend their asset positions (both in classical assets and crypto-assets), or to pay for immediate day-to-day needs (bills, expenses etc.

This is where Money Token comes in. The MoneyToken platform allows you to borrow liquid funds right now, based on the current and future value of your cryptocurrency asset holdings. You take out a short or medium term loan, collateralized with more volatile assets such as BitCoin and Ethereum — and in return you receive an agreed loan amount in a stable currency.

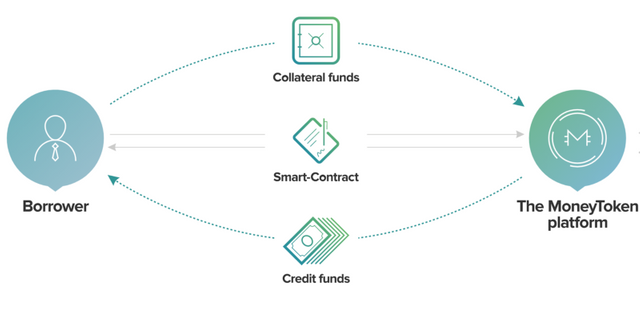

The whole process is designed to be as transparent and simple as possible:

● Using the MoneyToken platform you setup and confirm the loan terms — amount, duration, type and amount of collateral

● You deposit your crypto-asset collateral in a secure storage address

● You receive your credit funds in the agreed available currency

● At the end of the loan term you pay back the amount of the loan plus the interest

● On successful repayment, you receive back your crypto-assets in full

Introducing Amanda

Behind MoneyToken is Amanda. Amanda is an Artificial Intelligence Assistant who will provide automated loan operations within the platform.

Amanda is powered by a deep learning AI algorithm, and her goal is to provide human-like services for the platform users. Besides functioning as a loan assistant, Amanda acts as a true AI, analyzing clients activity on the platform from their first steps, through to loan completion in order to generate predicative actions; for example being able to offer additional financial services, tracking collateral performance, monitoring loan repayments and due dates – all the functions required within an ecosystem that is not managed by any central authority.

Amanda helps remove the need for middlemen and managers, hidden commissions and fees, and obscure terms written in the ‘small print’ of contracts; all the bad practices of traditional banking.

Benefits

MoneyToken gives you the opportunity to use your cryptocurrency holdings just like a true asset class; borrowing now based on the expected future value of the asset. You get to hold onto your growing assets whilst gaining the ability to spend and make investments right now.

Since your ownership of the blockchain-based asset is verifiable, and the value is transparent to the market, you don’t need to undergo invasive and unnecessary credit checks — there is nothing added to your credit history or any public credit file. Equally the loan decision can be made almost instantaneously — there is no need for MoneyToken to make extensive evaluations of the market value of your assets (unlike, for example, as happens if you remortgage a property)

Added to this, Money Token loans come with transparent, reasonable rates of interest and no additional commissions or fees. The rate is agreed during the setup of the loan through the platform and fixed for the duration of the loan term.

Finally — it’s the strength of cryptocurrencies as a growing asset that gives MoneyToken the edge, there is real potential for your crypto-assets to outperform your loan interest repayments — this means in effect your loan’s collateralized assets paying for themselves and you walking away at the end of the loan term having used your credited funds, paid off the loan and your interest, and gained from the growth in value of your assets.

Initial Money Token (IMT)

The solution that we have developed to minimize the risks, both for the platform itself and its users – a token with a

specific functionality.

a. Token Functions

● Privileged terms for platform users when depositing IMT to receive Borrower Membership.

● Up to 60% discount on the platform fees for Borrower Membership.

● When using the discount from the user’s balance, the equivalent of 50% of the discount in USD is charged in IMT tokens.

● The opportunity to become a lender when depositing IMT for Lender Membership.

b. IMT’s properties

● The supply of IMT is limited

● Additional mining is prohibited

Money Token Safety Fund

In order to level out any risks tied to a possible rapid drop of the collateral currencies’ value in comparison to the value

of the loans given out, or difficulties in processing of the collateral asset, a MoneyToken safety fund will be created.

The safety fund portfolio will consist of:

● a percentage reserved from the profits of every credit deal;

● a percentage reserved from contributions attracted to the Token sale;

● funds which will be received by the Platform from the Retail sale

Money Token Credit Fund

The credit fund regulates and influences the maximum possible amount of loans that the platform can give out.

After the Token Sale stage, the lending portfolio of MoneyToken will include a total of $20+ million and continue to

grow through contributions from early- and late-stage partners as the platform expands and scales.

Token Info

Name : MoneyToken

Token : IMT

Platform : Ethereum

Type : ERC20

Price in ICO : 0.01 USD

Private sale : 40%

Presale : 25-30%

Token sale : Up to 20%

Tokens for sale : 10,120,000

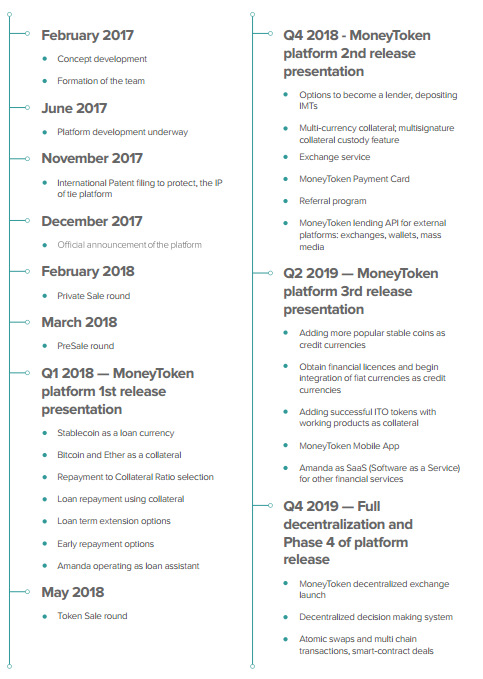

Roadmap

Well, At this stage of the market’s development, we see that cryptocurrency assets have gained the characteristics of various financial instruments. We can divide cryptocurrencies by their qualities and algorithms into investment assets and means of payment.

Investment assets are volatile and compelling for the long term, made to earn on the difference between rates of exchange or getting other types of earnings, such as from proof-of-stake algorithms, rate in interest and so on.

Payment cryptocurrencies are created to support the stability of the rate of exchange – they usually are embedded with a self-regulation mechanism, a unique algorithm to regulate the difficulty of mining or the release of new coins

Join moneytoken sale on https://tge.moneytoken.com/login

More Details About MoneyToken on

Website : https://moneytoken.com/

Whitepaper : https://moneytoken.com/doc/MoneyTokenWP_ENG.pdf

Bounty : https://bitcointalk.org/index.php?topic=3407082.0

Abstract : https://moneytoken.com/doc/Abstract.pdf

Telegram : https://t.me/moneytoken

Medium : https://medium.com/@moneytoken

Twitter : https://twitter.com/MoneyToken

Writter

Bitcointalk Username: Kenzio2016

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1999681

ETH Address: 0x152095898a7Aa50a716508f5997790beEdd276Ec