bZx- The Decentralized Margin Trading and Funding Protocol based on Ethereum

Despite the creation and existence of decentralized exchanges which seek to solve the problems associated with the older generation decentralized exchanges such as exposure to counterparty risk and centralized blockchain system exploitation, these problems still exist. bZx has been developed as a solution to these problems.

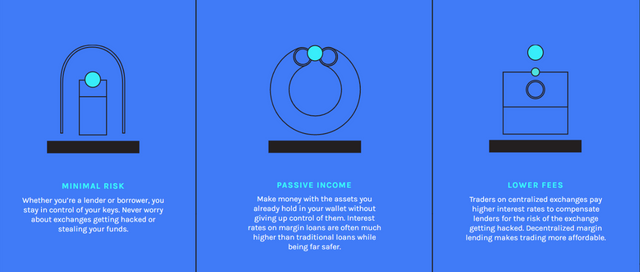

bZx is a fully decentralized peer to peer margin funding and trading protocol that is built on the Ethereum blockchain and integrated with the 0x protocol. It is a protocol that can be integrated into the current exchange infrastructure. The system offers decentralized margin lending and margin trading services. Exchanges and relays can be incentivized by fees denominated in the BZRX protocol token and assets are liquidated and valued via competing oracle provider. Competition in the oracle marketplace would cause a reduction in the oracle marginal fee and encourage flexibility and experimentation. Users are allowed to maintain private control to their wallet at all times which helps to remove custodial risk incurred by lender and borrowers using centralized exchanges.

The creation of decentralized exchanges is always embedded with significant technical challenges. Since the system has been designed to avoid security breaches, the design has to be up to standard. The bZx.js library is a promise-based asynchronous javascript library that has many functions that can be used to communicate with the on-chain bZx smart contract. Developers can use this library to easily integrate and develop for the bZx protocols and related platforms. Relays and exchanges can be done with the use of the created interface for margin trading and lending. The same way frontends created with 0x.js, bZx.js would be for funding.

The bZx portal is a decentralized website based application that serves as a face to the bZx protocol and utilizes the bZx library and serves as a full and functional shop for people hoping to interact with the protocol for margin trading and margin lending. The system provides easy access to users that are not on exchanges and relays. The portal would be split into four section and they include a section for lenders and traders to make or take loans, a section for traders to manage loans once fund are lent, a section for lenders to manage loans and a section for bounty hunters to manage open trades for margin liquidation. bZx smart contract is a combination of smart contracts that facilitates on-chain margin lending, opening, monitoring and liquidation of ERC token trades. The s0l interface can be used for storing Ether and tokens that are not tradeable and also for taking trades.

Despite the fact that the oracle is decentralized and interface with on-chain price information, network congestion can pose a big threat to its effectiveness in liquidating a position in a timely manner. The solution to this impending problem is to create an oracle marketplace where there is competition amongst the providers allowing tailored trade-offs to users. The approach or system would allow the oracle services to be given to users with high reliability, consistent, timely and low cost. The bZx oracle is fully decentralized and works partially off-chain. Support would always be given to users. The system is designed to work even under unfavorable conditions and without user intervention and engagement in the event of a market crisis.

There would be a 10% fee collected from the interest earned by lenders and be used for functions like decentralized governance, bounty hunter incentivization, gas fee refunds and systemic risk insurance. There would be competition in the oracle marketplace and since most exchanges charges as high as 15%, market forces would eventually drive down the price. Bounty hunters would be compensated for their resources expended in the calling contract and monitoring margin account health off-chain. Lenders and borrowers would receive sugar token (SUGR) as rewards and bounty hunters would also get bounty rewards in SUGR. Part of the fees collected would be set aside in a decentralized based insurance fund system denominated with the BZRX token and Ether to prevent the case of a black swan event.

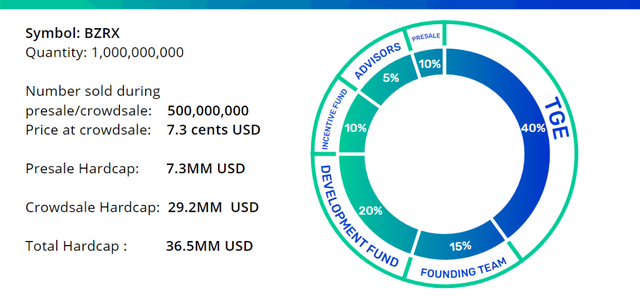

The BZRX token is a utility token and the native cryptocurrency of the bZx protocol. It will be used for the incentivization of order book aggregation by relay and for the governance of the bZx protocol. 1 billion tokens would be produced and 500 million would be offered on sale to the public . The funds generated from the sale would be used for the complete development of the system. More details on the exercise can be found below:

the bZx team is made of individuals with experience in team development and management, software engineering, and project management just to mention a few. The bZx team has top influencers within the cryptosphere as advisors some of which include the founder of Ethlend, the Chief Investment Officer (CIO) at Crossbridge Capital, and the project manager at district0x.

bZx is already in partnership with major cryptocurrency projects, a few of which are shown below:

To find out more about bZx or to become a member of the community, use any of the following links:

WEBSITE: https://b0x.network/

WHITEPAPER: https://b0x.network/pdfs/bZx_white_paper.pdf

LITEPAPER: https://b0x.network/pdfs/bZx_lite_paper.pdf

GITHUB: https://github.com/b0xNetwork

MAINNET DAPP: https://portal.bzx.network/

══════════════════════════════════

SOCIAL MEDIA

TELEGRAM: https://t.me/b0xNet

TWITTER: https://twitter.com/b0xNet

MEDIUM: https://medium.com/@b0xNet

AUTHOR: Maymae777