Libra Credit ICO Review - A Next Level Decentralized Lending Ecosystem (Token Sale 1st of May)

Libra Credit wants to be the new hot lending platform in the crypto world. They propose to build an entire lending ecosystem that provides crypto-to-crypto and crypto-to-fiat lending to anyone and anytime.

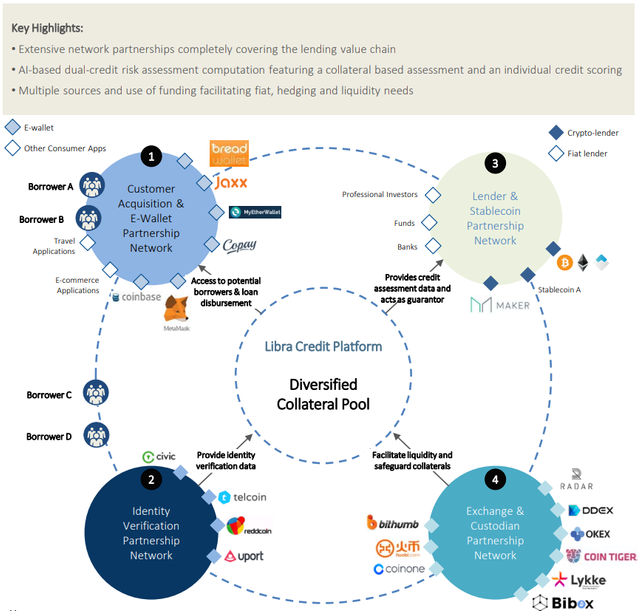

Their ecosystem is composed of a proprietary AI-based credit model for risk assessment and multiple partnerships with e-wallets, stable coins, decentralized exchanges and KYC and identity verification. All of this components can be seen in the image of the ecosystem in the bottom of the article.

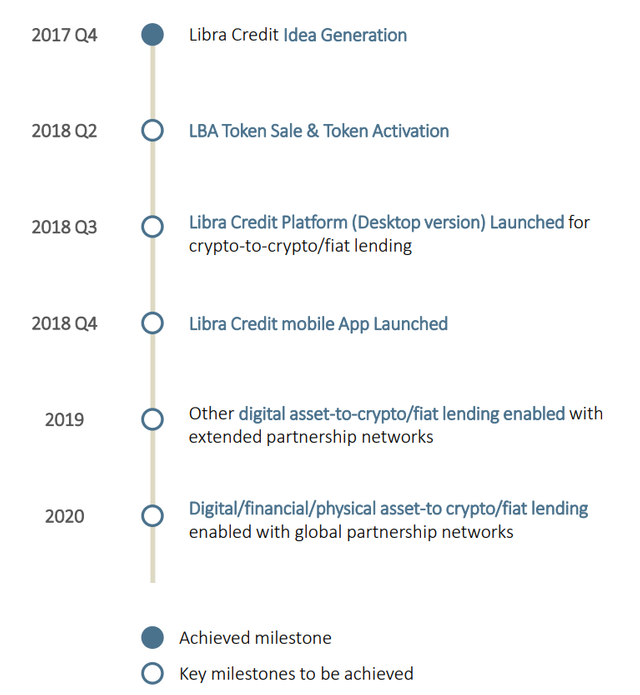

Product & Roadmap

In terms of roadmap, there is not much detail about the rollout of the products but they predict to launch both the desktop and mobile applications until the end of the year.

Although there is no prototype available before the ICO, this team seems to have previous experience with lending operations outside of the blockchain space. Which is a good indicator that the team can deliver thrive in this area.

Team & Advisors

In relation to the team and advisers, the feeling that I got was really positive.

As pros, in their Linkedin it's visible a lot of relevant experience from all the members. Their previous experiences range from previous positions in Paypal, Yahoo, Verisign and Deloitte. Which are not only top companies, they are also really relevant in the financial area. Also being a member of the 500 startups program gives them access to a wide range of advisers and a network of companies that can help in opening a lot of doors (*).

As cons, the core team is really small and there is a lack of technical people in the team. They have only a chief scientist with a previous position on Google but there is no one more listed on the website for development of the product.

(*) This is more of a note from personal experience since I am a member of a company that participated in the 500 Startups program in the past.

Community & Marketing

Social Presence:

Telegram: ~ 69900

Twitter: ~ 4000

Facebook: ~ 3600

Hype level: Medium

Blog: No

Airdrop/Bounty: Yes (That's how I came in contact with the project. Good job!)

Website and White Paper level: Good descriptions of the business and technical part. Easy to ready but require a little technical knowledge in some parts.

Token Sale

Token Price: ~ 0.1 USD (ETH)

Circulating Supply: 264M (of 1B)

Bonus: Unknown (Private Investors)

Hard Cap: ~ 26,400,000 USD

Sale Date: 1 May

Whitelist: Open

Predicted Market Cap (If sold out): ~ 26M

Similar Projects (Potential)

Market Cap of SALT: 230M (900M ATH)

Market Cap of ETHLend: 90M (355M ATH)

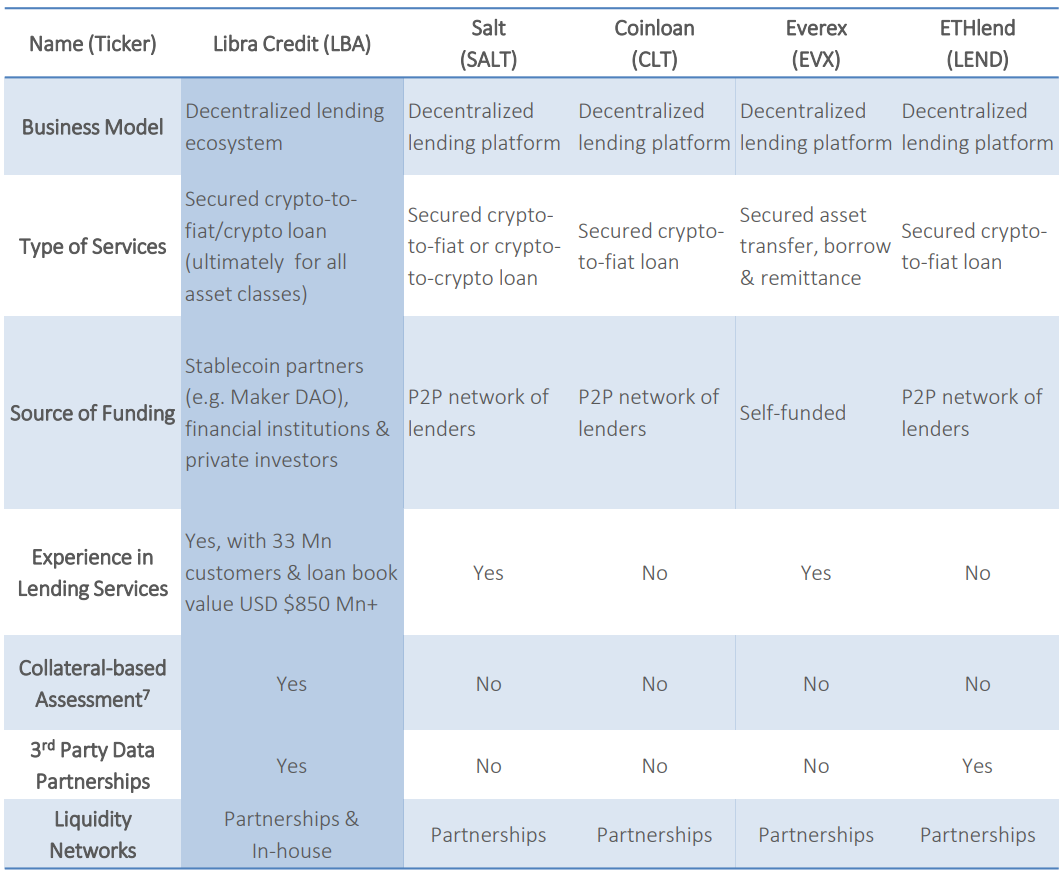

Comparison to the Other Projects

And if you're wondering if Libra Credit has what it takes to claim the same market caps of the competition, check this comparison table from the white paper listing some of the main differences.

You can also have a better understanding of how Libra Credits intends to use all the components and partnerships I listed before in this diagram of their ecosystem.

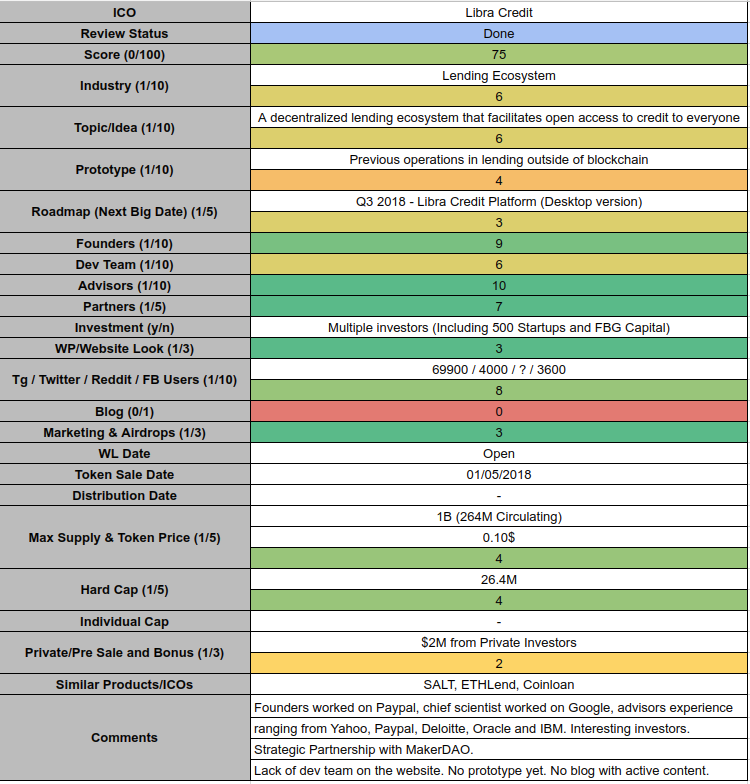

Personal Review and Score

To finalize this review here follows my personal score of this project. Below are a list of characteristics and metrics that i look at when analyzing and ICO. These points go from idea to team, marketing and token sale conditions.

Bear in mind that this is just my personal opinion and not financial advice. Always do your own research.

The score of 75/100 is an amazing score and, honestly, It didn't get better due to the lack of prototype and dev team. Also, the "low" score in terms of industry and idea is more of a personal opinion (lending is not my favorite industry nor the one where I have more expertise).

Hope this review was useful. Definitely take a look at this project and let me know your thoughts in the comments below.

Coins mentioned in post: