INS (Consumers Ecosystem)

The global grocery industry is dominated by mass-market retail chains. At the national level in

many countries, a large share of the grocery market is frequently in the hands of few retailers.

While some amounts of buyer power are understandable and simply desirable for competitive

advantage, the high level of concentration causes a growing imbalance of buyer power within

the supply chain.

Exerting buyer power is natural when not abused. It is understandable that any industry

participant would seek bigger volumes as a tool for negotiating better prices. But retailers push

the limits of what is fair. Grocery retailers are perpetually and aggressively extracting better

terms from already squeezed manufacturers, going far beyond the benefits a player should

receive for attaining economies of scale.

Large or small, no manufacturer has enough power. Global constituents, such as Procter &

Gamble, Nestle, and Unilever, do play a role in the industry and have more negotiating power

than small manufacturers. Still, these companies simply are no match for the extensive control

retailers have on end-customers throughout the supply chain. For example, Wal-Mart’s sales are

approximately 5 times greater than those of its largest supplier, Procter & Gamble. Wal-Mart

6

accounted for 16% of Procter & Gamble sales in 2016.

7

Retailer buyer abuse extends beyond normal pressure. The explanation of this pressure is

abuse of buyer power. Such power allows retailers to determine what will and will not be

stocked, and on what terms, such as sources, quantity, quality, delivery schedules, packaging,

returns policy, and above all, price and payment conditions. Indeed, a supermarket company

wields an important bargaining chip, namely the threat to stop selling one or more products.

Evidence of retail power abuse - The Competition Commission in the UK, for example, did find

that major retailers enjoy a price advantage that exceeds the cost difference. Additional

departures from proper retail conduct included: delaying payments to manufacturers beyond

6 . ) Source: MIT Sloan Review, Rebuilding the Relationship Between Manufacturers and Retailers (2013).

7 . ) Source: Procter & Gamble Annual Report (2017).

the terms in the contracts; and changing quantities or product-quality specifications at less than

three days’ notice, and without paying compensation to manufacturer. The figure below offers

- )

specific evidence of retail buyer power abuse and lack of adherence to codes of conduct, which

was covered in various news outlets.

SUPPLY CHAIN INEFFICIENCIES

High distances between manufacture and consumption. The average meal in the US travels

about 1,500 miles to get from farm to plate. This problem is relevant for many countries and

9

leads to acute financial and ecological consequences with significant adverse impact in the

long-term. Food miles, the distance food travels from the place it has been grown to where it is

ultimately consumed or purchased, increase significantly when buyers import food from other

parts of the country, region or world.

10

Waste in various areas of the supply chain. In distribution centers and on grocery store shelves,

food is being wasted. Every night, some perishable items must be thrown out. According to a

recent survey, 400 million pounds of food is served by supermarkets, yet nearly a third of it is

wasted annually. Unfortunately, current retail systems are designed to reduce stock-outs

11

rather than measure and manage food waste. Therefore, managers optimize to ensure food is

left over on the shelf.

12

INS will decrease food miles, enabling consumers to unimpededly access local

manufacturers, including farmers. INS will implement the effective "pull" system

to reduce inventories and out-of-stocks that would decrease the food waste.

TRADE PROMOTIONS ARE INEFFECTIVE, COSTLY AND OUTDATED

Grocery manufacturers spend up to 17% of their sales on trade promotions. Trade promotions

comprise a growing category of manufacturer expenses directed to wholesale and retail

distributors rather than to consumers. Manufacturers spend more than $500 billion on trade

promotions annually , and according to some reports 66% of that spend generates negative

13

returns and leads to higher grocery prices.

INS is targeting to replace trade promotions with a more personalized, direct

and efficient marketing, thus driving grocery prices down and facilitating the

effective direct interaction between manufacturers and consumers.

INS founders gained a first-hand and practical experience in the grocery industry while

developing and growing Instamart, the largest venture-backed grocery delivery operator in

Russia. Instamart employs over 200 people, has signed contracts with the largest retailers in the

country, and works with the leading grocery manufacturers.

Four years of operating experience in the grocery retail sector helped to identify major

inefficiencies and abuses in the industry’s current construct. INS pursue a large opportunity to

disrupt the global grocery retail market via establishing a decentralized and fair ecosystem that

directly connects manufacturers and consumers.

GLOBAL GROCERY MARKET

❖ The grocery market is one of the largest consumer markets in the world: it is expected

to reach $8.5 trillion by 2020 with up to 50% share of a customer’s wallet

❖ Grocery retailers have acquired a dominant market share and high concentration: up to

90% of the market in many countries is controlled by a handful of retailers

❖ The grocery industry is reaching a digital tipping point, with much of its growth

expected to come from online

A VERY LARGE MARKET WITH EXTENSIVE IMPACT

The global grocery industry is forecasted to grow at a 6.1% annually from 2016 to 2020,

reaching an estimated $8.5 trillion in 2020. The grocery market is a defensive one which

14

means that it tends to stay stable in good and bad economic times, given there will always be a

demand for food.

One of the biggest segments of retail and comprising a significant share of the consumer’s

wallet, the industry has a deep impact on grocery sector stakeholders, particularly

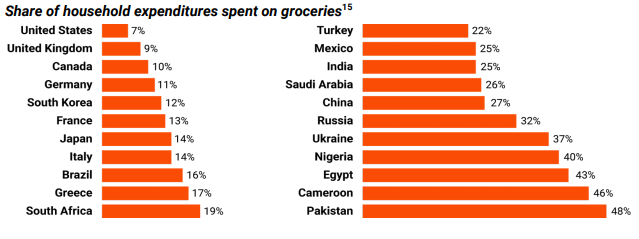

manufacturers and consumers. As an example of the consumer impact, the figure below shows

the portion of consumers’ household spending on food in a variety of countries.

ABSTRACT

This white paper explores global grocery market challenges, a technology paradigm shift

offering transformative potential, and the business and technical aspects of the solution INS is

developing for capitalizing on this potential. Highlights of the paper follow below:

The grocery market, one of the largest consumer markets in the world, is forecast to reach $8.5

trillion by 2020. It is reaching a digital tipping point, with much of its growth to come from

online. Online grocery, being the target segment for INS, is expected to grow from $98 billion in

2015 to $290 billion in 2020, according to IDG estimates.

Despite the tremendous growth, the grocery market has two large interrelated

problems - abuse by grocery retailers and ineffective trade promotions.

The grocery market dominated by retailers. Retail chains capture a very high share of grocery

revenue and have a huge influence over manufacturers, causing deep impact on consumers

worldwide. Retailers dictate what food is grown and how it is processed, packaged, priced and

promoted. As an example, in the UK, four retailers serve as a slim conduit for 7,000

manufactures to sell their products to 25 million households , which demonstrates how the

1

existence of retailer abuse in the grocery industry has not only been allowed to develop but also

thrived.

Ineffective, costly and outdated trade promotions practice. Trade promotion spending

represent 17% of manufacturer’s sales . Each year, over $50 billion on trade promotions never

2 3

reaches the consumer. Unfairness in today’s promotion-laden atmosphere go hand in hand with

the rising costs of promotions and the inefficiencies they produce. 95% of manufacturers admit

that trade promotions inefficiency is an extremely important issue.

4

INS is implementing a decentralized ecosystem enabling consumers to save up

to 30% on everyday shopping buying directly from grocery manufacturers.

5

Direct interaction between consumers and manufacturers. Bypassing retailers and wholesalers

means a more personalized and transparent grocery shopping experience at lower prices.

Сonsumers will be able to decide which brands they want and goods they need. We call it

“Consumption 2.0” since 21st century customers are tired from a one-way street type of

communication, whereby retailers push goods onto them that maximize retailer’s profit - not

what consumers really want. We also want consumers to have unimpeded access to

independent and local manufacturers, including farmers, that do not fit retailer supply chain or

procurement terms and can’t get their goods on retail shelves.

Enabling manufacturers to market their goods directly to the consumers. No more costly and

inefficient trade promotions grabbed by retailers and wholesalers. INS will enable

manufacturers to create bespoke marketing programs to reward their customers directly. These

programs run on smart contracts and powered by the INS token as a means of reward. It is

similar to miles-based reward programs of many airlines, but more advanced, cheaper to run

and personalized thanks to smart contracts behind them. This was hardly possible before the

blockchain and smart contract era.

INS has the prerequisites to perform an ambitious task of disrupting the grocery

industry based on our deep industry knowledge and confirmed interest from the

largest grocery manufacturers in the world.

More than 4 years of grocery industry track record. INS is founded by veterans of the online

grocery industry, using the knowledge and experience acquired since 2013. We have built strong

relationships manufacturers and gained valuable feedback from consumers.

INS received strong interest from both large and small consumer goods manufacturers in the

world. Selected logos of manufacturers that expressed interest to sign up (on a global or

regional basis) are provided below.

GROCERY MARKET CHALLENGES

ABUSES OF BUYER POWER BY RETAILERS

The global grocery industry is dominated by mass-market retail chains. At the national level in

many countries, a large share of the grocery market is frequently in the hands of few retailers.

While some amounts of buyer power are understandable and simply desirable for competitive

advantage, the high level of concentration causes a growing imbalance of buyer power within

the supply chain.

Exerting buyer power is natural when not abused. It is understandable that any industry

participant would seek bigger volumes as a tool for negotiating better prices. But retailers push

the limits of what is fair. Grocery retailers are perpetually and aggressively extracting better

terms from already squeezed manufacturers, going far beyond the benefits a player should

receive for attaining economies of scale.

Large or small, no manufacturer has enough power. Global constituents, such as Procter &

Gamble, Nestle, and Unilever, do play a role in the industry and have more negotiating power

than small manufacturers. Still, these companies simply are no match for the extensive control

retailers have on end-customers throughout the supply chain. For example, Wal-Mart’s sales are

approximately 5 times greater than those of its largest supplier, Procter & Gamble. Wal-Mart

accounted for 16% of Procter & Gamble sales in 2016.

Retailer buyer abuse extends beyond normal pressure. The explanation of this pressure is

abuse of buyer power. Such power allows retailers to determine what will and will not be

stocked, and on what terms, such as sources, quantity, quality, delivery schedules, packaging,

returns policy, and above all, price and payment conditions. Indeed, a supermarket company

wields an important bargaining chip, namely the threat to stop selling one or more products.

Evidence of retail power abuse - The Competition Commission in the UK, for example, did find

that major retailers enjoy a price advantage that exceeds the cost difference. Additional

departures from proper retail conduct included: delaying payments to manufacturers beyond

the terms in the contracts; and changing quantities or product-quality specifications at less than

three days’ notice, and without paying compensation to manufacturer. The figure below offers

specific evidence of retail buyer power abuse and lack of adherence to codes of conduct, which

was covered in various news outlets.

BLOCKCHAIN & SMART CONTRACTS

Blockchain is a shared-database technology, mostly popular for underpinning bitcoin digital

currency. It works with linked databases that update digital ledgers unceasingly.

Smart contracts are self-executing contracts with the terms of the agreement between buyer

and seller being directly written into lines of code. The code and the agreements contained

therein exist across a distributed, decentralized blockchain network. Smart contracts permit

trusted transactions and agreements to be carried out among disparate, anonymous parties

without the need for a central authority, legal system, or external enforcement mechanism. They

render transactions traceable, transparent, and irreversible.

The INS platform is designed as a very high-load system. The market potential for the INS

ecosystem consists of millions of users, each of them making dozens of orders per year. The

main focus is on performance, in which we seek smart contracts support, predictability, stability,

and ease of use. We plan to use the most proven and scalable open source technologies and

constantly monitor alternative technical implementations.

As the existing blockchain platforms such as Ethereum have inherent limitation in transaction

bandwidth (currently limiting to a dozen tx/sec), and prospective platforms and frameworks are

only in the development stage, we also consider designing and developing our own INS

blockchain platform in the future, where nodes are selected from a semi-trusted set of

supporters. Given the trust in the nodes, we will implement one of much faster consensus

algorithms from the BFT family (HoneyBadgerBFT/Zyzzyva/others), enabling up to thousands

transactions per second. A smart contract virtual machine will run on top of the consensus

algorithm. The state of the INS blockchain will be regularly anchored to the most popular smart

contract ledgers (at least ETH) so that proofs of state and proofs of transaction (within INS) can

be verified by Ethereum smart contracts (like it is currently done in BTCRelay or will be done in

the future in Plasma). Common optimization techniques such as state sharding and payment

channels will be also implemented.

BLOCKCHAIN APPLICATIONS IN INS

● Smart contracts

● Payments

● Supply chain management

Useful links :

Bitcointalk ANN Thread : https://bitcointalk.org/index.php?topic=2208591.0

Website : https://ins.world/

White paper : https://ins.world/INS-ICO-Whitepaper.pdf

Official Blog : https://blog.ins.world/

Official Telegram : https://t.me/ins_ecosystem

Reddit Link : https://www.reddit.com/r/INS_Ecosystem/

Twitter Link : https://twitter.com/ins_ecosystem

Facebook Link : https://www.facebook.com/ins.ecosystem/

Bitcointalk profile : https://bitcointalk.org/index.php?action=profile;u=1243626

Eth address : 0x70c3F234Fa177d5cE875D506EbDee43045560676

Upvote this for me please? https://steemit.com/christianity/@bible.com/verse-of-the-day-hebrews-4-16-nlt