Lendledger: A revolution in Lending

Introduction-

Like every other student, I had a dream to study in a reputed institution for my graduation. I had been a very hard working person since childhood and was confident that I'd get into a premier institution. As time passed, I studied harder, spent all my time solving questions, honing my skills and doing everything I could, along with two other girls who were equally driven. Time passed and soon enough we were in the battlefield. We took the entrances and attended interviews and anxiously waited for the results. On the date of result revelation, we were extremely happy to know that we three had qualified.

The dates for the counselling came about. To our horror, the fees of that institution was very high. One of my friends had sufficient finances to get into the institute,and therefore, she did. I was in a fix. I couldn't afford the fee. Hence, I hesitatingly took a student's loan to cover my education. Taking a loan was too much of a hassle but my father made it his responsibility to help me out. As for my third friend, she was not very lucky. She belonged to a poor family. She had limited choices. She could either take loans from money lenders with very high rates of interest, because banks didn't let people with poor financial background proper loans in the fear that they won't be able to repay. Or, she had to let go of her dream. She decided to go for the latter option.

About Lending-

The history of money lending and borrowing can be dated centuries back. It's in the nature of people to lend and borrow. But in the ancient times, money lending was based on trust. The idea of offering interests were originated in ancient Europe when people realised the great business opportunities money lending provides. The merchants usually had farmers or traders take loans, and when crops failed, or there were storms and droughts, those poor people would be unable to repay loans and eventually all their commodities would fall into the hands of merchants who became richer and richer.

Thankfully, after the rise of a centralized institute like banks, loans were taken in a much safer and systematic way. However, due to reasons of security and stability, the bank relied on data like credit history, financial stability of a person, and most importantly, the necessity of having a bank account to take a loan. A lot of people can't avail this facility and thus take the illegal way to help themselves.

Lendledger-

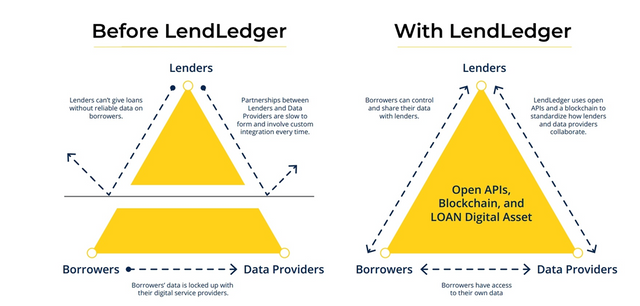

Lendledger is a decentralized platform based on blockchain technology which makes the process of lending a lot more accessible to all the people in a society. Lendledger noticed that even though a lot of people do not have bank accounts, almost everyone uses mobile wallets to pay their dues. This acts as a mark of credibility and the trust that the required person has a stable credit history in form of payment of bills, and other financial services at the right time.

Furthermore, the use of blockchain technology ensures that there is security, transparency, safety and trust with regard to the user. LEND is the digital asset of the ecosystem and transactions take place via LEND Tokens.

Conclusion-

Thus, Lendledger is a platform that tries to remove the woes of people who are unable to take loans because of a centralized platform. With a unique idea backed by professionals, it will surely succeed in its endeavor.

Website - http://lendledger.io/index.html

Whitepaper - http://lendledger.io/images/LendLedger_TechPaper.pdf

Telegram - https://t.me/LendLedger

ANN - https://bitcointalk.org/index.php?topic=4424652.0

Published by - jessicalaurenbt

Profile - https://bitcointalk.org/index.php?action=profile;u=1936052