Review of the Must.io Project

About Must.io

Must.io is the main standard of Main transactions for the economic value of micro, small and medium enterprises. The funding system is available for decentralized economic value from micro, small and medium enterprises through tokenization kilometers and hours.

Must.io uses terms and abbreviations. This document contains a large number of special terms, applied in disciplines such as economics, psychology, informatics and programming, as well as terms and abbreviations adopted in an environment that participates in the exploitation of the automotive market, commercial vehicles, construction of machinery and equipment. It is assumed that the reader has sufficient training and awareness, so after reading to develop a holistic view of the project, the approaches and mechanisms used by the implementation.

Solution

must.io solutions are based on the Value-Based Economy form for micro, small and medium enterprises, which are built on real-world market values and mechanisms to validate information.

Strategy

As part of the strategy for the development of MUST Finance, additional products will be launched:

MUST Lending is a financing (lending) service through the tokenization of assets that when applying for financing at IHR properties.

Reverse rental model. Calculation of all payments will be accounted for in the VEC settlement unit.

MUST Escrow is a service to finance trade transactions through the tokenization of assets that will be financed under a transaction

Must.io proposes a mechanism for the transition of the world economy from speculative models, on the basis of conditional "values", to a value-based economic form built on patented values from the real market, such as hours of time, ways of kilometers, one oil barrel, one square meter of space etc.

Products MUST

• MUST Renta – leasing services for SMEs.

• MUST Lending is a financing service (loan) secured by tokenized assets for IHR.

• MUST Escrow is a service to finance trade transactions through the tokenisasi assets to be financed under the transaction.

• MUST Digital Bonds (MDB) – Digital bonds issued in the securitization process, based on token assets and cash flows on it

Available IHR funding

Financial markets and the banking industry are actively supporting large businesses and corporate investment projects, while micro, small and medium enterprises (SMEs) financing from financial institutions remain at very low levels throughout the world.

The reason for this phenomenon is the high level of regulation of financial markets and the banking industry. High cost costs are related to the IHR service segment, which is based on the need to adhere to a large number of complex regulations and regulatory requirements imposed by the Bank in handling this market segment, which led to the emergence of a level of capital shortage in the Indonesian IHR segment.

MUST.io's system provides fast and affordable funding for micro, small and medium-sized companies around the world and at the same time provides access to private and professional investors for new virtual financial instruments built on liquid assets, financed companies . MUST.io offers the most important new approach to investing in Token assets (Smart assets) based on blocking technology and algorithm algorithm for liquidity assets.

According to the Global Trade Finance Survey (Global ICC Survey on 2016 financial trade), 83% of the issue of capital availability for IHR is due to the complexity of the permits. According to the World Bank, the overall funding gap for end-2017 IHR developing countries is estimated at $ 5.2 trillion. This is double, compared to 2.6 trillion in 2013, and the dynamics have not been pushed.

First of all, Must.io focuses on the car market, freight forwarding, construction, special equipment. Scaling for other segments, such as equipment and actual estate, including in the project development plan.

The structure of the EaaS business form is a market for MSMEs that require investment on the one hand and investors are attracted by the flow of monetary projections, formed in the future from operations or liquid asset sales with others.

MUST System Elements

In this system there are many different roles, b with the main business role are:

• End Client – End customers, SME entrepreneurs interested in getting access to financing. Owner of tokenized assets (Smart Asset).

• MUST Agent / Originator – Group services company MUST, acts as an operating agent in the tokenisasi transaction / asset securitization.

• Fiat Capital Investors – Private investors, banks or investment companies interested in investing in Smart Assets or Securities with certain profitability. This type of investor includes, among other things, the consumers of the final product.

• Crypto Capital Investor – Private investor, bank or investment company interested in investing Crypto Capital in Smart Assets with certain profitability.

• Smart Asset – Assets that are token, verified by the guarantor and connected to the monitoring system.

• Proof of Asset Algorithm – The unique algorithm of tokenization and asset securitization. Includes: Smart Asset Tokenizer and Smart Asset Escrow.

• MUST SPV – A specialized company, issuer of securities issued on the basis of tokenized Smart Assets.

• MUST Wallet – Service for fiat exchange and crypto currency for tokens MUST, MST, and KYC user identification in the system.

• Crypto-Fiat Custodian – Service that includes a number of solutions aimed at managing the “cold” storage of crypto assets of its originators, performing classical storage functions. Provide an opportunity to take crypto assets for accounting.

• MUST Exchange – Crypto-active exchange, the main purpose is the organization of transactions for the sale of token assets. The familiar exchange interface will quickly and easily begin using new financial instruments.

• General Exchange – Classic exchange, which will trade securities issued on the basis of Smart Assets.

Token Issues Will Be Restricted

During the Token Sale, 200,000,000 MUST tokens will be issued without the possibility of additional emissions.

Token Must is a token utility, providing access to the system and all its services. In the early stages of system development, requests must be tokens to be given the main user group:

• Investor

• Borrower

• Final consumer product

• Asset supplier

Token Holder

The token holder must have access to all ecosystem services and offers from a value-based economy. Token MUST grant the holder the right to discount when paying commissions on MUST Exchange according to the following schedule:

• HB – 2019 Q4 – 50%

• 2020 Q1 – 2020 Q4 – 75%

• 2021 Q1 – 2021 Q4 – 80%

• 2022 Q1 – 2022 Q4 – 90%

All tokens received by the MUST system as commission payments will be burned. After listing on the exchange, tokens MUST also be exchanged for crypto-active or other fiat currencies.

Number of tokens issued 500 000 000 Additional emissions not provided. And tokens MUST be issued according to the ERC223 standard on the Ethereum network.

About Tokens

Must.io tokens will only be issued during the Sales Token in the Ethereum network according to the ERC223 standard.

• 1 MUST = 0.10 USD

• Soft Cap = 6 700 000 USD

• Hard Stamp = 35 000 000 USD

• Token Sales - 350 000 000

• Team - 50 000 000 (hold up to Q3 2019)

• Marketing & Advisory - 25 000 000

• MUST Foundation - 75 000 000 (hold up to Q3 2020)

Token Sale

• Pre-Operation Personal / 25.02 – 30.06.2018 /

• Bonus + 20%Public PreSale / 01.07 – 31.07.2018 /

• Bonus + 10%Sales of Public Token / 01.08 – 30.08.2018 /

• Bonus 0%

Token Allocation by Stages

• PreSale : 100M

• Token Sale : 250M

• PreSale - 01/Aug-30/Sep

• Token Sale - 01/Nov-30/Nov

August 1, 2018

Launch of the token sale for major investors with the entry threshold of $ 100,000

All the participants are granted with a 25% bonus.

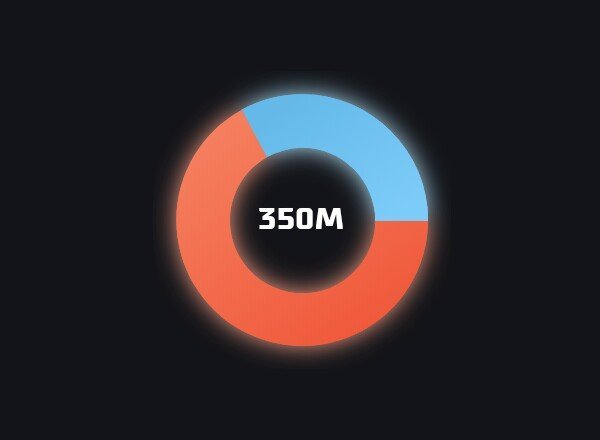

TOKEN DISTRIBUTION

• Marketing & Advisors : 15M

• MUST Foundation : 75M

• Token Sale : 350M

• Team : 50M

• Bountry : 10M

Token FREEZE

• July 1, 2019 : Team tokens are unfrozen

• July 1, 2019 : Must foundation tokens are unfrozen

• January 1, 2019 : Marketing & Advisors tokens are unfrozen

• January 1, 2019 : Bounty tokens are unfrozed

INVESTMENTS DISTRIBUTION

• 35% Research & Development

• 20% Legal

• 40% Marketing

• 5% Operational costs

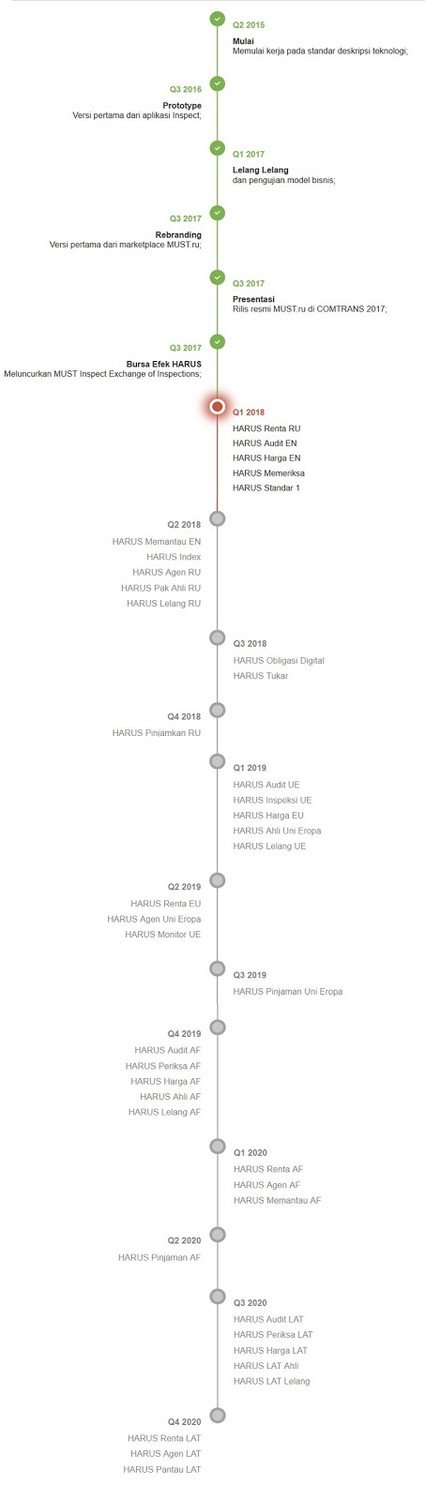

ROADMAP

TEAM

For more information about Must.io, visit the site below:

• Website: https://must.io/

• Ann Thread: https://bitcointalk.org/index.php?topic=4509154

• White paper: https://must.io/whitepaper.pdf

• Facebook: https://www.facebook.com/mustfinex

• Twitter: https://twitter.com/mustfin

• Telegram: https://t.me/must_en

• Youtube: https://www.youtube.com/channel/UCE_f7jxOCOoGL3a0l73AUxQ

• Instagram: https://instagram.com/mustfinance

Author: Sixa

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=2225617

Congratulations @instinct012! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP