EQUI Capital - Game changer in Venture Capital world

Hello everyone.

Today I want to share my thoughts about the innovative approach to the Venture investment.

What is Venture Capital?

Venture Capital is long-term equity capital invested in new or rapidly expanding enterprises, which represent the financial investment in a highly risky proposition made in the hope of earning a high rate of return. No doubts It plays a vital role in supporting innovation, particularly in the technology sector. The start-ups usually based on an innovative technology or business model and they are usually from the high technology industries, such as information technology (IT), clean technology or biotechnology.

Venture capitalists are always first who discover good start-ups and help them to grow and they are essentially managers of risk. What is really missing in cryptocurrency space is the risk management. The thing is that venture firms individuals provide an important source of expertise for the emerging companies they finance.

Thank for the 90s dotcom boom, venture capitalists become one of the essential parts of acceleration and growth of the new companies.

So what has changed since that time in investment of new startups?

The first disruption of crowdfunding source has happened with the rise of the early stage investment ecosystem like AngelList syndicates, crowd-funding platforms like Kickstarter and government incentives like EIS. Kickstarter alone has backed 141,113 projects with $3.6 billion investments since their launch back in 2009. However, Venture Capitalists were still the first source of investments for tech-savvy start-ups.

Second disruption of start-ups crowdfunding occurred with the blockchain revolution just recently and it's still in infancy - Initial Coin Offerings (ICO) - the truly new & transparent way of investing in new companies, where anyone around the world able to contribute in start-ups (except China and USA, because usually citizens of these countries are not allowed to participate in ICOs). Doing an ICO has become a viable alternative to VC funding as average ICO proceeds have reached $15M which means that blockchain projects are now able to raise as many funds through crowdfunding as a mainstream startup could raise from VCs during Series A or B. According to fintech research firm Autonomous NEXT, more than $4.2 billion was raised via ICOs in only 2017 itself. Far outstripping venture capital investment in blockchain and Bitcoin firms. No doubt — ICO is the new fundraising mechanism. After that, Venture capitalists obviously have taken the competition seriously. They literally could lose the new technological boom, thus losing a lot of money. This is where the people like Doug Barrowman seeing an opportunity to disrupt the Venture Capital by means of blockchain integration and monetization of rewards.

Introducing EQUI Capital

EQUI.capital is an investment platform build on top of Ethereum blockchain which is filling the gap between community and venture capital market. EQUI is a web-based application, which works with any web-browser. By leveraging blockchain technology it will become secure, reliable and transparent investment platform with own Token and Loyalty program in place.

How it works?

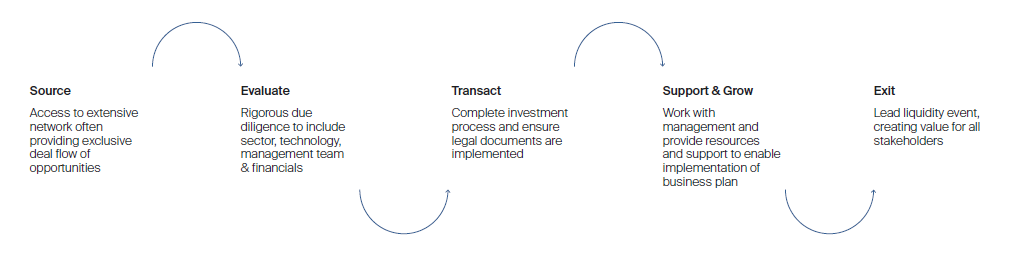

EQUI is supported by the top-notch team of successful entrepreneurs who puts their financial, operational, strategic and lifetime expertise on the line. This investment team will select the opportunities and evaluate them for investors. After thorough due diligence, legal compliance and risk assessment provided by the EQUI team, the selected start-ups will be showcased and available for investors. Any qualified member can choose the project(s) to invest. There will be not only one project available so every investor will be able to diversify his/her portfolio.

Investment process:

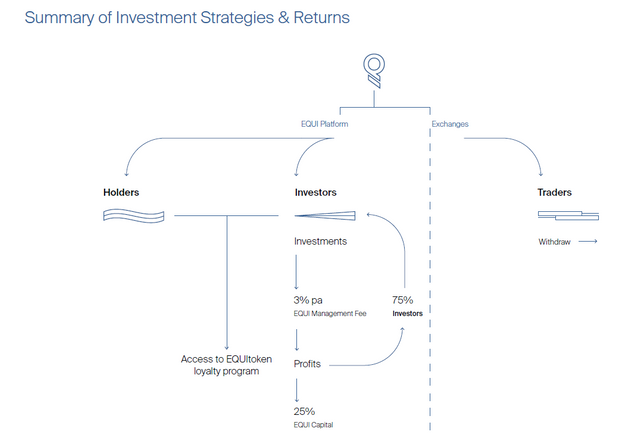

Every participant will complete the KYC first prior to be eligible to invest. Upon completion EQUI profile will be created with unique Ethereum wallet which should be used to store your EQUItokens. The investment in any showcased project on EQUI platform will be available with EQUItoken only. Participants use their EQUItokens to acquire a stake in a project(s). When the platform will be launched if any participant wants to invest in any showcased project, they will enter the smart-contract, which will dedicate EQUItokens to that particular project. The EQUItokens will be sold to raise fiat at the prevailing market rate, which will be invested in chosen project. When project you have invested become mature, returns are distributed in the relevant proportions as an Ether which can be stored in EQUI wallet, withdrawn or used for investments in future projects on platforms. The Platform itself is taking 3% based on investment funds by means of Fund Management fee.

By acquiring the EQUI token you can choose to become Investor, Holder or Trader. Investors are eligible to receive 75% of net profits generated from the projects. The remaining 25% goes to the EQUI Investment Team as a performance reward. Investors and Holders are eligible to participate in EQUI Loyalty program that allows them to be a part of 5% (of total supply) pool distributed on yearly basis. All ICO participants eligible for Loyalty program. Holders are the ones who transfer their EQUI tokens to the platform but not yet decided to invest. Holders and traders benefit from the EQUI token value growth. Those people who wants to benefit from Loyalty program but didn’t participate in ICO have to hold the tokens for 3 month to be eligible.

Team

The team is playing the vital role in the investment platforms especially when it comes to venture capital. EQUI is the brainchild of Doug Barrowman the successful entrepreneur and venture capitalist with over 30 years experience in venture capital investment and multi-millionaire exits. He is the founder and hear of EQUI platform. Another Co-founder of EQU is Baroness Mone Of Mayfair - one of the most influential businesswomen in the UK and an award-winning entrepreneur. They both passionate about cryptocurrencies and they are the first who build a large scale property The Aston Plaza & Residences at Dubai Science Park that can be acquired by Bitcoin. Awesome!

Investment team represents Aston Ventures the first private investment vehicle of EQUI founder Doug. Each investment team member brings wide and unique expertise in sourcing, completing and managing investment opportunities as well as acquisitions, disposals, fundraises and working alongside innovative, growing companies.

The project team consists of individuals with an extensive background in marketing, project management, customer services and development. The advisory board consists of successful entrepreneurs such as Duncan MacInnes (early stage backer of Facebook and Deliveroo), Morten Tonneson (CEO of Ve Global), Mark Pearson and crypto experts such as Jonas Karlberg (AmaZix), Duncan Cameron (Founder of CasinoCoin), and John Caldwell (PokerStars.com).

The team itself worth millions!

Legitimacy:

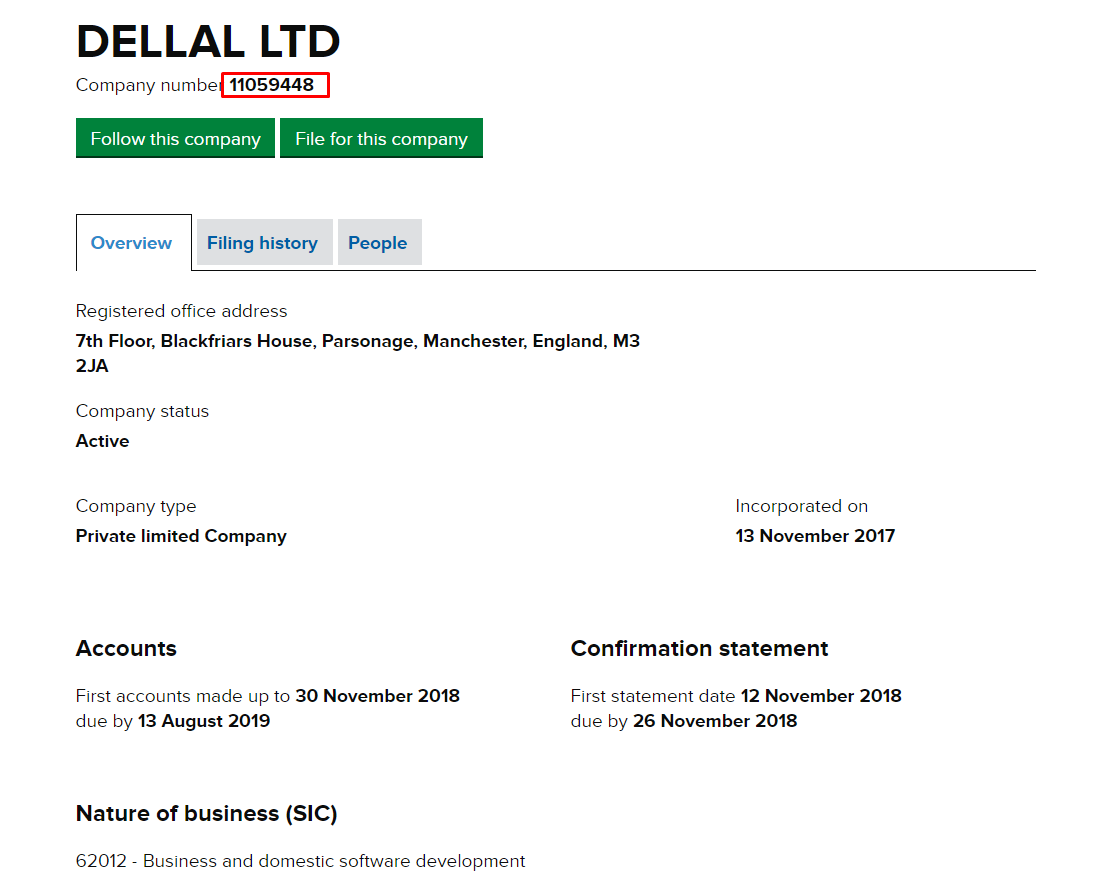

EQUI incorporated and registered in UK as Private Limited company DELLAL LTD - company registered number 11059448. It is stated in Terms & Conditions and also Privacy Policy on official website. You would ask why not EQUI? I have checked companieshouse.gov.uk for the names and two companies called EQUI LTD. already took EQUI name. Still fine for me, as long as the company registered according to the UK regulations, considered UK as one of the most stable economics.

In their whitepaper's regulation section they anticipate that the EQUI platform itself will be considered an Unregulated Collective Investment Scheme (UCIS) as per UK statutory regulation and FCA guidance based on opinion shared by legal counsel. EQUItoken is not considered a security, which is again based on legal counsel’s opinion.

Tokenomics:

Total Supply: 250 million + 5% increase every year for loyalty program

Price per token: $0.5 Soft cap: $2.5 million (surpassed)

Hard cap: $81 million

Unsold tokens: 50% to the ICO participants on a pro-rata basis & 50% back to EQUI, which will be used to support future investment projects.

Currency accepted during crowdsale: Base crypto is ETH. BTC, LTC, XRP can be exchanged via Shapeshift API.

Allocation:

65% Public/Token Sale - no lockups

12% Founders - with 6 month lock-in period

15% EQUI Team - distributed quarterly, over 2 year with 6 month lock-in period

6% Advisors - distributed quarterly, over 2 year with 6 month lock-in period

2% ICO Bounty Rewards

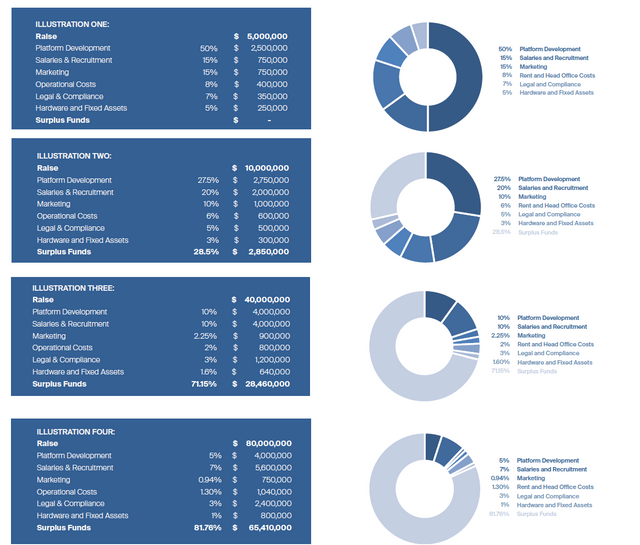

Use of proceeds:

The more funds EQUI will raise more faster it will grow within the business. Funding distribution can be found on the drawing below.

Public sale will last till 12 of April and there is no bonus at the current stage.

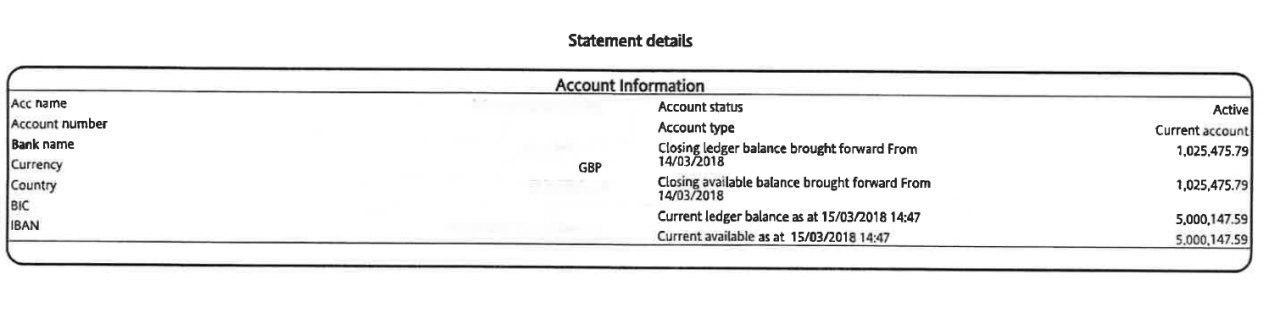

EQUI has successfully managed to raise more than $ 7 in total during presale period. Don’t worry there was only 25% bonus, what I also love in this project. No huge discounts to early backers. What is interesting for me is that majority of the total investments done during presale was through FIAT. They have provided the screenshot of their bank account which clearly showing little over £5m = $6.95m. In addition to this 720 ETH has raised also during presale round.

Why is it interesting? Because it means that around $7m USD of new money injected in the crypto space. Therefore, this means adoption of crypto and blockchain. Which is good for entire ecosystem. During the public sale, there is no contribution through FIAT payment available. Only ETH or via Shapeshift API. Platform will be launched in Q2 of 2018 according to the roadmap, and is just behind the corner.

Conclusion:

Venture Capital is not the normal form of investment for regular folks same as you or me. Many people in the regular investing space are dreaming to be part of the Venture Capital firms. EQUI is filling this gap between community and Venture Funds. The aim of Venture Capital is to find the next GEM that will offer significant returns that will overcomes the high potential risk of investing in those start-ups. EQUI gives an opportunity for everyone to participate in Venture Capital investments. It is still a solid source of funding the start-up and now it will be available on blockchain. Absolutely innovative and unique idea, which never been implemented before. Team is massive with solid background. EQUI will provide the solution offering the early access of investment to the start-ups which focused on the tech. Basically they wouldn’t be only focused on blockchain projects, but I believe the majority will be the ICOs. They are adopting crypto, which is good thing. It is 100% legal and long-term investment. Because net profits can be generated only after company roll out their product on the market, hence you might need to wait for 2-3 years for the good returns. Overall it seems to be a good investment.

Links:

Disclaimer: This review is based on my research and opinion. It doesn't represent any financial advise. I'm not a financial advisor or accredited blockchain specialist. Please always do your own research prior to invest your hard earned money.

Интересно то как.Проект заслуживает большого внимания.хорошая информация.

Взаимная подписка!!

This is a very good project, I'll figure it out in more detail. Thanks for the review.

Thanks for feedback. They have extended their ICO till June and they are coming with new detailed roadmap, website and manye more updates soon.

I hope this project gets a lot of attention

Interesting article, good review, will have to take part in this project

Да, использование блокчейна ускорит работу в данной области!

Проект просто замечательный! Стоит поучаствовать!

Интересный проект

an excellent project, the author well done!

good project