ICOs are Hot and 2018 has Already Beaten 2017. PwC & Crypto Valley Report Covers The Biggest ICOs and Countries with Most Traction

ICOs are still hot. The second half of last year was crazy and ICOs became really popular. This year they are even more popular and the total amount raised and the number of ICOs this year has already surpassed 2017.

In collaboration with Crypto Valley (Zug), PwC published a report about the ICO market and some interesting stats are included.

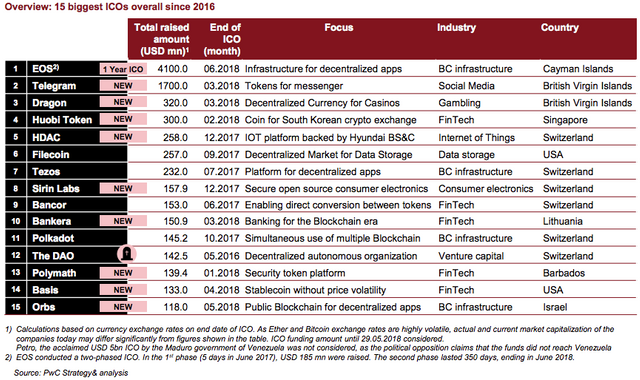

The Top 15 Biggest ICOs

Although not all public ICOs, this is the top 15 so far:

EOS and Telegram obviously stand out with their $1 billion+ ICOs. Crazy amounts! 6 of the top 15 ICOs are registered in Switzerland. I guess that says something about the regulatory environment there. 4 of the top 15 are blockchain infrastructure projects. Good, because we need those basics first! Also, FinTech is quite popular with 5 out the 15 projects focusing on it.

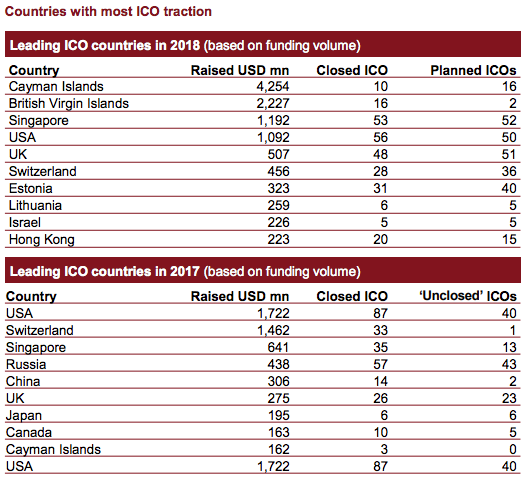

ICO Countries

ICOs are global, but some countries have a more preferable regulatory environment for ICO registration.

Tax havens the Cayman Islands and the British Virgin Islands are popular and the biggest ICOs are registered there (EOS, Telegram and Dragon). In terms of the number of ICOs registered the top 3 includes the UK, the USA and Singapore. Compared to 2017, Estonia, the Cayman Islands and Switzerland are becoming relatively more popular places for ICO registration.

Key Take-aways

The key take-aways from this according to the report are:

“USA remains a leading ICO destination, reinforced by clear and firm regulatory requirements (e.g. KYC). Within Europe, Switzerland stands out as the ICO capital, but in 2018, UK has gained terrain in terms of volume and numbers. Across Asia, Singapore is the main ICO hub, followed by Hong Kong. Cayman Islands and British Virgin Islands rank among top ICO countries volume-wise, as they hosted Unicorn ICOs EOS (USD 4.1bn) and Telegram (USD 1.7 bn). Other countries not known for being large financial markets also appear among top ICO countries (e.g. Estonia, Lithuania, Israel). Dormant ICOs: In 2017, many planned ICOs did not happen in the end or were not further publicly documented or communicated.”

The report tends to connect ‘ICO hub’ and ‘country of registration’. This implies a relatively high blockchain industry activity in certain countries. I don’t agree with this. Country of registration of the ICO is not a proxy for how active the industry is. I for instance doubt that Estonia has more active investors and developers than Russia. I also doubt that there are more blockchain meetups in the Cayman Islands than in Israel or Japan. They should have used a different word since a ‘hub’ is seen by most people as a central place of activity and people coming together.

Also, technically, the USA does not remain the leading ICO destination, but Singapore and the UK are. And they listed the USA twice in the Leading ICO countries in 2017 table. It seems like they are really pushing the USA ;-)

All in all, always interesting to see these kind of stats though. Gives us a good idea on the money involved and developments compared to 6-12 months ago.

According to you, what stands out in the report?

Sources:

---> 👍🏼 Follow me for regular updates on my cryptocurrency portfolio, crypto related articles and inspiring articles about personal time & life management.

---> 👍🏼 Resteems and upvotes are appreciated ;-)

Disclaimer: I am not a financial advisor, trader or developer. I am just a blockchain & cryptocurrencies enthusiast. Make sure you do your own research, draw your own conclusions and do not invest any money that you cannot afford to lose.

I am really surprised that South Korea is nowhere in the charts. From what I can see the population there is leading the adoption....or at least they were leading the mania last year.

I think it is because they have an ICO ban and are currently in the phase of lifting the ban. You can read more about it here: https://cointelegraph.com/news/south-korea-reviews-its-stance-on-crypto-to-become-blockchain-haven.

Did you also read the news about over 1,000 crypto projects already being dead?

It might be even more. That is why doing in-depth research before you invest is so important ;-)

Speculate*

I think that is a better word then invest. Or are there already ICO's that share their profit via a sort of dividend payment?

I agree, the type of investing we are talking about here is speculating. Investing is practically almost always speculating though ;-)

Profit sharing would make them a security so that is what's holding them back. Of course there are the exchange coins that share a bit of their profits like Kucoin Shares, Huobi Tokens and Binance Coins.

Any idea why ginabot says you upvoted me with STU?

I guess it has to do with this:

https://steemit.com/ginabot/@ginabot/major-update-ginabot-is-now-a-microservice-app

Thanks!

Although I miss how much STU is worth?

there seems to be good opportunity in ICOS, its just picking the right ones can be tough!

Definitely a challenge. Also timing is of big essence, since there are quite some good ideas and teams, but it is just not the right time for them.

No Gibraltar? That can't be right!

Gibraltar is quite crypto friendly, but I think they still need to get up to speed when it comes to attracting projects. Also big competition from malta on that front ;-)

Yeah, Malta is getting huge. But disagree regarding Gibraltar - they held tons of crypto conferences and ICO pitches sessions within the last 12 months and they have a real ICO legal framework - literally first in EU - i think the stats still missing some bits and pieces :)

True, I am not sure where they got their data from since also from other countries they miss quite some ICOs. Russia should be more like 100 I think :-P

or 200 :)))) absolutely!

Is. Ok nice in job

What stands out in the report according to you?

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Do you know what happened to the DAO?

Pretty awkward to raise $142mln and be gone/bankrupt within 1 year 😳

After a quick Google search: https://www.coindesk.com/understanding-dao-hack-journalists/

Dit was niet echt simpel en kort qua verhaal. Als ik het goed begrijp zijn die investeerders hun geld nog altijd kwijt. Maar kan die hacker het nooit ongezien uitgeven. Zo'n $70mln is echt een flinke hack!

Ook opvallend is dat het gemiddelde bedrag $13k per investeerder was. Wie geeft er nu zo veel geld aan 1 ico uit?

upvote for me please? https://steemit.com/news/@bible.com/6h36cq

great information ,thanks sir.

You got a 4.74% upvote from @postpromoter courtesy of @cryptotem!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!