WHY DO PRICES DROP AFTER ICOS?

2018 has been a slaughterhouse of high hopes and expectations for many in the cryptosphere. The days of quickly flipping for a healthy profit are long in the rear-view mirror, and many early contributors and steadfast crypto-investors have noticed the changing winds in the market itself.

Whether new or old in this space, most people hope that after the ICO they have invested in has ended, their tokens will make massive gains. This has happened to some tokens in the past and made numerous people a healthy return – but this is not the case for most new cryptocurrencies entering the marketplace. In many cases, and for countless people, this is where their very scary ride into this volatile world of cryptocurrencies will start.

There is a common misunderstanding that a team can control the price of a token after their ICO. In the physical world, a supplier can tell retail stores the price they are allowed to resell their goods. That is not the case with crypto. Once a token is on the exchanges, the team who launched the token now has no control over what the prices are, and cannot recover any losses, no matter how much they would want to jump in and help. It is also illegal for them to attempt to intervene in any situation where they can fix the price of their own token on the open market.

There are many contributing factors to the decline in prices after an ICO distributes their tokens. Putting aside obvious scams and bad actors, let’s look at some of the major reasons why token prices tank post-ICO.

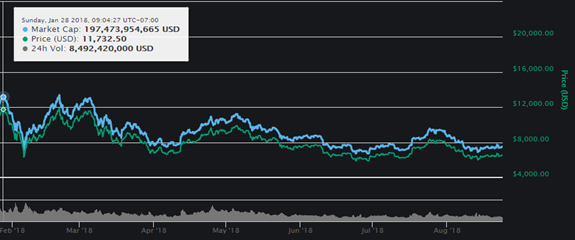

Reason 1: The overall state of the cryptocurrency market is very bearish. BTC and ETH are not just coins but also measurements, because you typically use one or the other to buy another altcoin, and that altcoin’s value is tied to the price of what it is exchanged for. We’ve seen a massive decline since late January through August, with BTC losing 67% of its value in that time.

Bitcoin in January

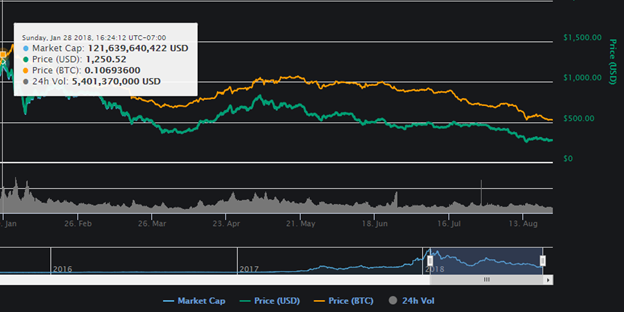

Reason 2: ETH, which is also tied to BTC, has lost 80% of its value in that same time frame. Chances are if you bought ETH to contribute to an ICO, by the time the ICO was over and the tokens were unlocked 2-3 months later, the value of ETH had gone down another $100 or more in that time.

Ethereum in January

Reason 3: Supply and demand of the market. The volume of trading right now is another huge factor - it’s almost non-existent in comparison to January’s rates. If we use the graphic above to see the volume on January 28th, Bitcoin did almost $8.5 billion dollars in 24-hour trading volume – as compared with today at just $3.4 billion. Less demand means lower prices. All the other coins, with a few exceptions, follow Bitcoin’s trend, even if there are no direct trading pairs yet (ETH, which most of the altcoins are traded for, follows Bitcoin’s trend very closely).

Reason 4: Weak hands. Many early contributors were lured into putting money into an ICO by social media ads without a proper understanding of the world they were entering. An 80% loss of anything to someone who hasn’t seen it before is justifiably terrifying. There will always be people who are quick to sell everything to recuperate some of their perceived losses, not realizing that no loss actually occurs until they cash out, and they are creating their own self-fulfilling prophecy by selling at a lower price than what they paid for it.

Reason 5: Supply and demand of the coin. The time right after ICO tokens are distributed is mathematically the highest ratio between the circulating coin supply versus the amount of people who know about that particular crypto project (compared to any time in the future). While almost everyone who is interested in the project already has their coins, there aren’t many newcomers who would like to buy these tokens straight after the ICO. High supply plus low demand equals low prices, and low prices equals panicking people, selling their coins at a lower price - causing more panic and more people to sell low, making everyone unhappy.

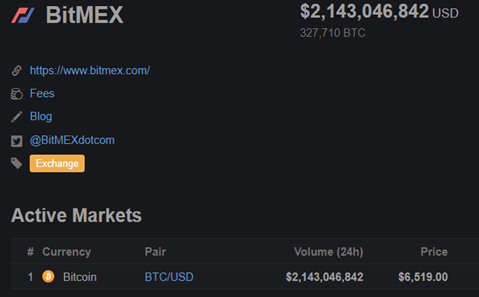

Reason 6: Futures trading. The exchange known as Bitmex allows people to place leverage and margin bets on cryptocurrencies, enabling people who know what they are doing to make a lot of money when the price of Bitcoin goes in either direction. For months now, they have controlled the price up and down, playing ping pong with it, and gaining profits in both directions. This type of market manipulation is highly unethical and, in many countries, would be illegal, but Bitmex is located in the tiny country of Seychelles, a little island off the coast of East Africa. Bitmex has a tremendous share of Bitcoin’s volume right now. Of the $3.4 billion dollars in Bitcoin volume in the last 24 hours, $2.1 billion of it is running through Bitmex, which is not good.

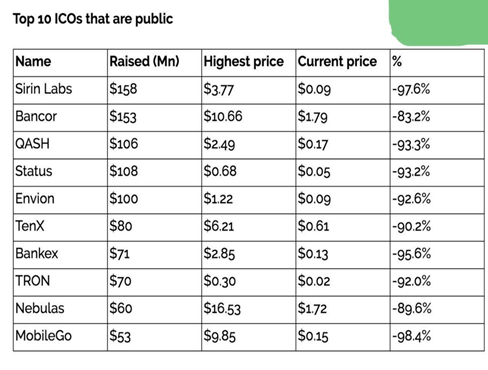

So, is the price crash only happening to the ICO you put your money in? Absolutely not.

This table is circulating around Telegram like wildfire right now. On this list are ICOs in 2018 that took in a lot of money, and had a lot of hype. Only Envion on this list was an actual scam. Tron is a Top 15 currency by market cap. TenX and Bancor are regularly in the Top 100. That’s despite their massive losses - because everything is losing right now.

Despite this horrific, depressing scene, most of the news around the world of crypto and blockchain, in terms of regulation and real-world adoption, have been very positive. Cryptocurrencies are beginning to trade on stock exchanges all over the world. Many banks are coming out with their own cryptocurrencies, or partnering up with blockchain companies to use their platforms (such as Bank of Lithuania, Scotiabank, and more).

There is light at the end of the tunnel, but the only way to get there is to believe in the project you helped to bringing to life, and hold onto your coins long-term, or HODL (hold on for dear life). That is the only feasible plan for improving the price of the tokens you adore so much.

This article was originally published at CryptoFinance24: http://cryptofinance24.com/why-do-prices-drop-after-icos-p406-171.htm

Coins mentioned in post: