2017 Deloitte Millennial Survey: Can Genesis Vision and Millennials’ Vision Align to Disrupt the $70 Trillion Asset Management Markets?

The article below is originally published here. I am the original author of this work and am syndicating it to Steemit as well as Medium and a couple other platforms like InvestFeed to better reach my target audience of Initial Coin Offering investors, cryptocurrency traders, and traditional finance people, thank you!

The 2017 Deloitte Millennial Survey

I recently wrote a few pieces on Genesis Vision as I continue to explore just how much their leadership team and business model can disrupt the traditional world of finance, utilizing blockchain technology through smart contract and cryptocurrecny token implementation. The GV Initial Coin Offering pre-sale closed early with an overwhelming level of demand, raising $2.3 million within days.

The 2017 Deloitte Millennial Survey

Follow along as we journey into **Genesis Vision’s innovative business model focused on transparency and how it aims to create synergies when combined with other facets of society leading up to their October 15th ICO launch. If you have not yet read about them, read this introduction of the GV ecosystem first. Below, we will investigate how Genesis Vision aligns nicely with the Millennial Vision, here we go!

The 2017 Deloitte Millennial Survey

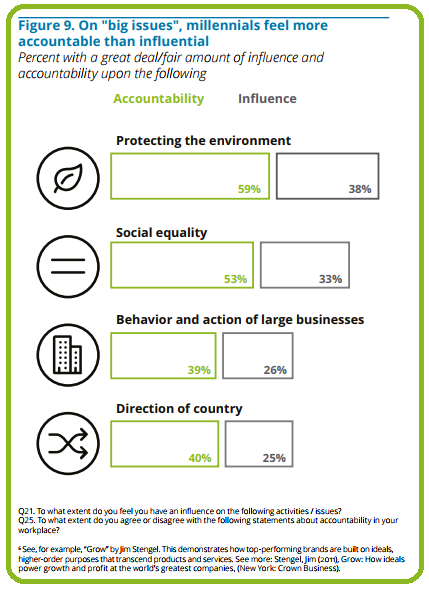

Millennials Feel They Have Little Influence in Action of Large Businesses

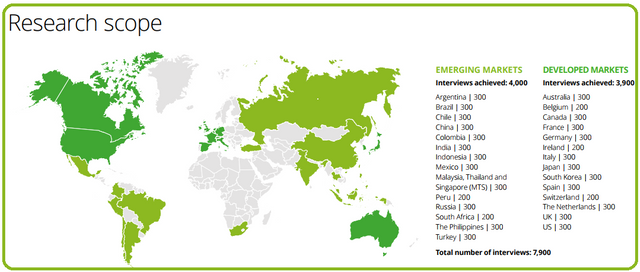

The 2017 Deloitte Millennial Survey dives more into the Human Resource/employment side of the Millennial generation, but sheds light on the overarching Millennial Vision, or outlook.

The 2017 Deloitte Millennial Survey

Looking at the visual above, Millennials feel like they have little influence on the behavior and action of large businesses while feeling like they are more likely to hold them accountable. In the case of the $70 Trillion Asset Under Management (AUM) market, Genesis Vision is creating processes that take much of the influence away from high- and low-level employees within companies in the AUM market. Meaning, they are utilizing smart contracts to create automated processes that humans cannot influence — even if they tried. GV-created automated processes will actually make it easier for employees to hold the large company accountable, leading to more empowered employees. Why? Because GV is building their ecosystem on the Ethereum Blockchain, a publicly verifiable distributed ledger that any one of us can access the transactions log for.

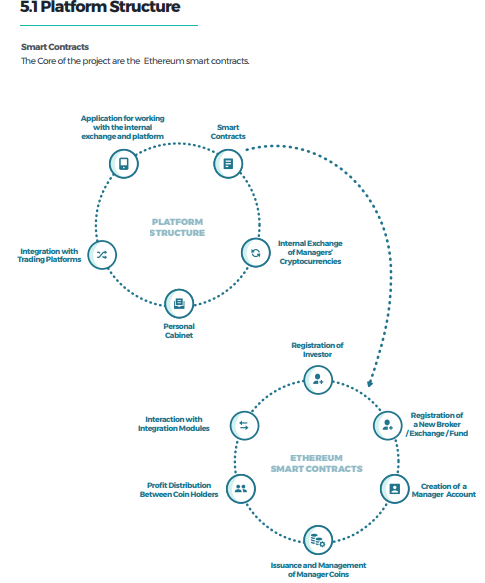

Genesis Vision White Paper

As you can see from the image above from GV’s White Paper, we can see the processes being driven by Ethereum Smart Contracts within the GV ecosystem. The best part about the automated system being created with this technology is that high-level managers do not have the ability to influence employee functionalities. For instance, Wells Fargo Personal Bankers opened more than 2 million fake accounts because of an influence on their daily functionalities. Meaning, District Managers were given larger bonuses when branches in their district reached their goals. This caused Branch Managers to put pressure on their bankers or collude in unethical decision making because their bonus was also larger when Personal Bankers within their branch reached each of their goals. The Branch Manager would essentially work in tandem with the Personal Bankers to generate fake sales.

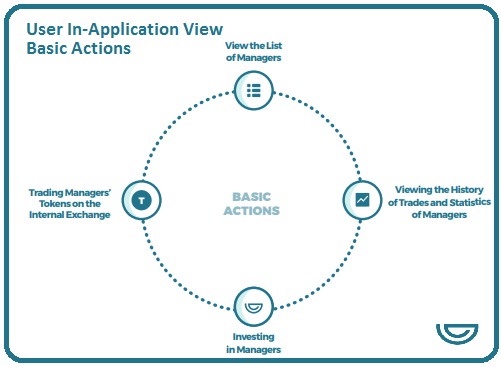

Genesis Vision White Paper

Unfortunately, the bank’s centralized system did not have the required processes or safeguards to prevent this in-branch collusion from happening. In this example, Wells Fargo could utilized a Smart Contract for the ‘Registration of Customer Accounts’ — similar to how Genesis Vision is building their Smart Contracts to trigger when customers register an account. It becomes easier to hold a large business accountable when the processes cannot be altered and are easily verifiable — just look at the above picture of basic actions in GV application. Looks like the creation of transparency to me! Nice transition into our next point about Millennial view on business’ behavior.

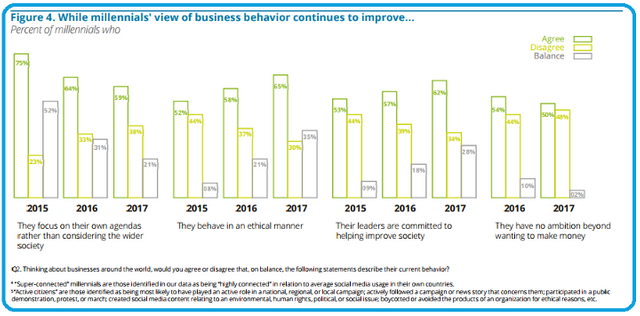

Millennial View of Business Behavior Improves

The 2017 Deloitte Millennial Survey

The Deloitte 2017 Millennial Survey suggests that over the past 3-years, Millennials have been increasingly positive toward the intentions behind business behavior. The graph above is a display of the answers received and the positive sentiment is clearly increasing, but we continue to see large corporate mishaps from corporations across the globe. Can we do better?Digging deeper…

The 2017 Deloitte Millennial Survey

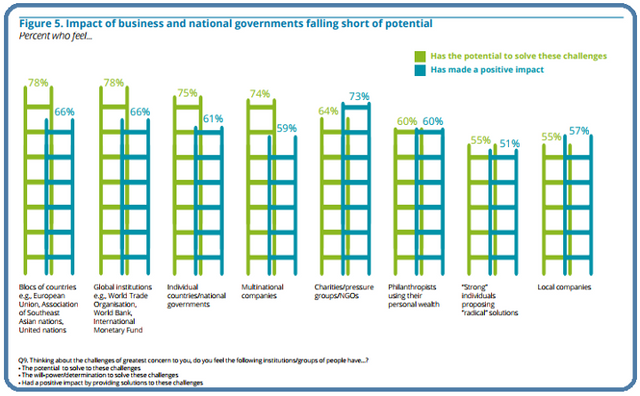

…the Millennial Vision says, YES! According to the survey, Millennials believe that Global Institutions and Multinational Companies not only have the potential to solve major challenges, BUT that they are falling short of making that positive impact.

The 2017 Deloitte Millennial Survey

Personally, I believe the aforementioned organizations not only have the ability to solve many of the problems facing society, but that they are falling very, VERY short of having a positive impact on those issues. Having worked at a very large bank, the infrastructure to have a greater impact is NO DOUBT there; however, the processes that have social impact are not built-in to our schedule in the same way the revenue impact processes are. I believe these social impact processes can be built-in to our schedules via smart contract-driven automation. More in the next point…

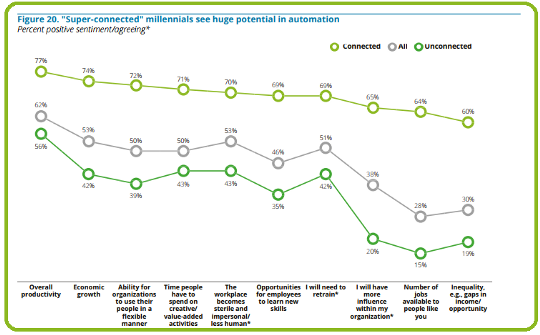

“Super Connected” Millennials See Huge Potential in Automation

The 2017 Deloitte Millennial Survey

Adding onto the last point — companies in 2017 are designed with the framework to have a “mission and vision statement.” .

The mission statement being the intentions and values of the company; the vision statement focusing more on a desired future position of the company — they are often times combined into one statement. Well, they have increasingly aimed to give off the intention that the company is working to create some type of positive social impact or change through their operations. Wells Fargo’s Mission Statement was to help all of their customers succeed financially, something we can all agree has a positive impact on society. Well, the company infrastructure was not set up in a way that ultimately helped them live and breathe their mission statement.

The 2017 Deloitte Millennial Survey

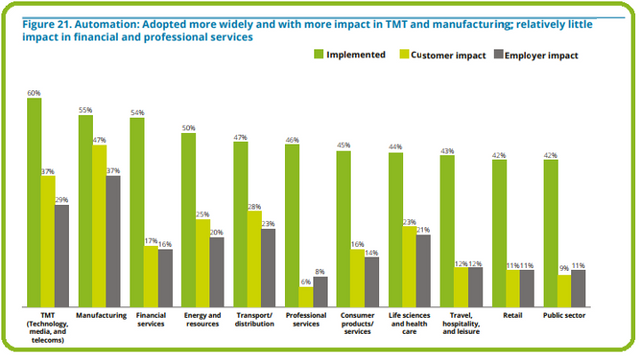

The chart above displays Millennial sentiment toward how automation will affect the various industries. I argue that automation using smart contracts can actually have an equal or greater impact in the Financial Services industry than the other industries. Why? Well, the simple example above about Wells Fargo and how they should have utilized smart contracts for customer registration. Personal Bankers won’t have as much pressure to open fake accounts because they simply cannot. This, in turn, provides the consumer with an elevated experience. Instead of a Personal Banker trying to take their lunch money, they will actually focus on helping the customer succeed financially, carrying out the company’s Mission Statement.

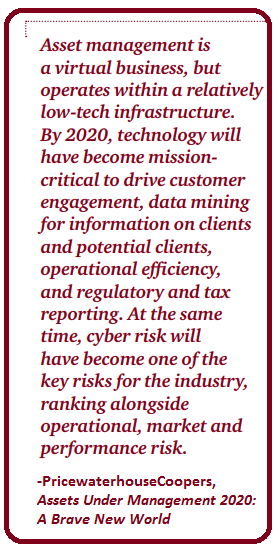

PwC’s Assets Under Management 2020: A Brave New World

Instead of having to go back and figure out ways to implement smart contracts into a existing system, Genesis Vision has the advantage of building the framework from scratch. Assets Under Management entering the 21st century, as PricewatershouseCoopers would put it. If you’re interested in learning more about the Genesis Vision project, below are past articles I’ve authored and GV’s Official website.

- An Intro to Genesis Vision Ecosystem, Token and Solutions to Industry Problems

- Can Genesis Vision Be The Catalyzing Solution to ICO Regulation Amid Jamie Dimon’s Public Deception, China Ban & SEC Charges?

- 8 Advantages to Contributing to the Genesis Vision ICO

- Investor Trust in the Asset Under Management (AUM) Market, Can Blockchain Help?

- Social Trading Dies Just in Time For Genesis Vision’s Rise

- Genesis Vision White Paper

This post was resteemed by @steemitrobot!

Good Luck!

The @steemitrobot users are a small but growing community.

Check out the other resteemed posts in steemitrobot's feed.

Some of them are truly great. Please upvote this comment for helping me grow.