On the application of financial diversification to a property portfolio

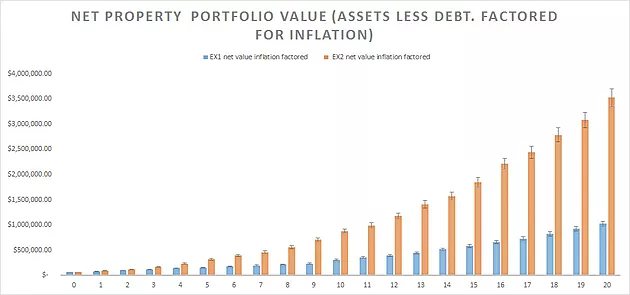

Diversification is not mutually exclusive to finance products such as stock trading and the foreign exchange. Diversification strategies implementing a high-risk, high-return product can be equally impactful on your property portfolio. Annual property portfolio profit (property value, inflation minus mortgage) can be leveraged and diversified in a similar manner as was discussed in our previous blog: “Regarding the leverage of expected growth in contribution to higher comparative returns”. Again, the diversification of risk structure can be used to significantly increase ROI when compared to low-risk, low-return products alone. See Figure 1 below for an example summary.

Figure 1: Showing net property portfolio value. Blue: Example 1. Orange: Example 2.

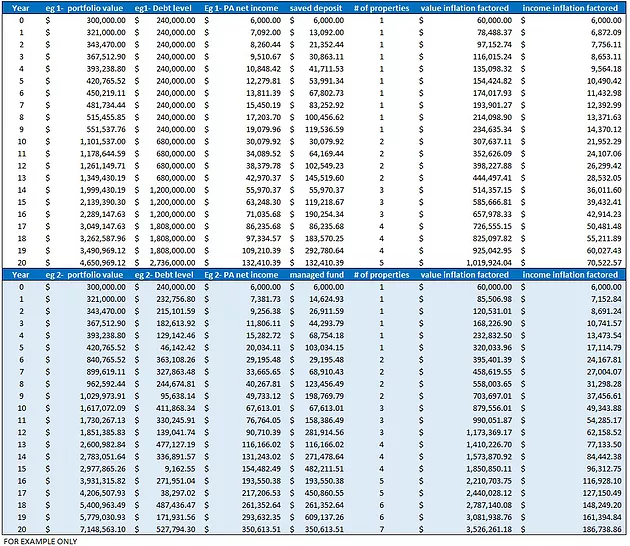

As seen above, net property portfolio value is significantly increased over the low-risk, low-return option. You have more properties over time, which increases portfolio value and ROI. The mechanics behind this are elucidated using example investment strategies which are as follows: Example 1 shows an investor starting with one house worth $300,000 with a mortgage that is 80% of the houses value, which makes this property positively geared on interest only. This investor uses this positive income to save up a 20% deposit for another mortgage worth 80% of the property and purchases another property with this new loan. This process repeats, generating a sizable per annum income only at the 20 year mark (See Table 1). This is due to the large amount of debt accrued through multiple mortgages. Example 2 shows an investor that starts in the same circumstance, but instead of saving the per annum profit for a second mortgage, the investor places this sum into a high-risk, high-return fund, drawing down 40% of the profit from this second fund and paying that amount of the initial mortgage. Once this initial mortgage is paid down, the investor buys another property with a mortgage. This process repeats, generating the same per annum income by only the 13th year, and significantly outperforming Example 1 by the 20th year (Table 1). See Figure 2 to see this significant increase in per annum income yielded through diversification techniques. Factored into these examples is the following assumptions: House value increase factored at 7% PA, inflation factored at 3% PA, mortgages calculated at 4% PA.

Table 1: Breakdown of figures for Example 1 and Example 2 over 20 years.

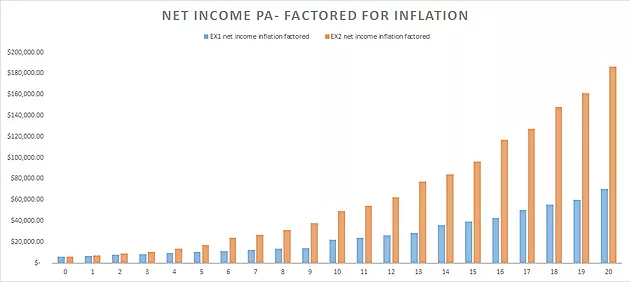

Figure 2: Showing the divergence in net income between the two examples.

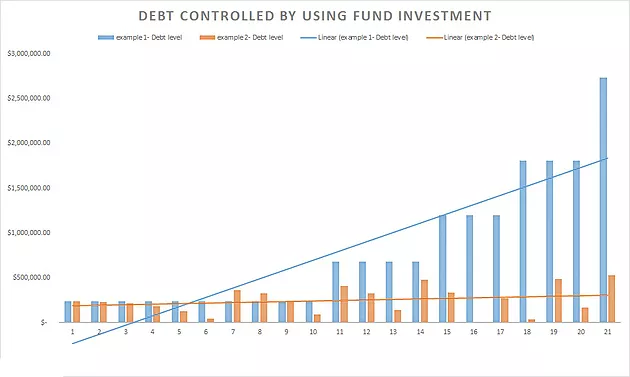

Example 2 shows increased properties owned and hence increase per annum income due to the debt reduction effects gained through diversification techniques and money management strategies (drawing down profit into mortgages annually). Property has the reputation as a slow but steady investment strategy, but by being more cognizant of effective leverage of per annum profit, an investor can diversify into a high-risk, high-return fund like Countinghouse’s algorithmic system to significantly increase ROI over the medium to long term. See Figure 3 to see a visual representation of debt control using fund investment.

Figure 3: Showing debt reduction using diversification techniques.

Thanks for very useful information.

Valuable information about strategies, a good example.Thanks.

Our company believes in providing professional investors with Forex and Crypto-currency solutions by implementing algorithmic computer learning

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund

Logical analysis and Very helpful for traders.

promising project

Our company believes in providing professional investors with Forex and Crypto-currency solutions by implementing algorithmic computer learning

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund

Countinghouse draws from over a decade of successful Foreign Exchange trading and investment experience . We are a small team with a diverse skill set.

Tim Dawson,Mike Pomery is our Director

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund

To better understand financial diversification and its impact on property portfolios, I turned to a helpful https://www.consumoteca.com/en/finance/understanding-the-ripples-in-financial-waters/ resource. This experts offers clear explanations and practical advice that have significantly improved my investment strategies. I highly recommend this site for anyone looking to diversify their financial assets. For those of you discussing financial diversification in property portfolios, this resource is incredibly valuable and informative.