Never tell me the odds

Gambling is popular in Australia, with the average Australian spending three thousand, one hundred dollars ($3,100.00) per year on gambling, the largest proportion of which goes to procuring lottery tickets. One does have to be ‘in it to win it’ as the often repeated saying goes, and we all know the odds of winning are slim… but how slim? Odds like one in eight million, one hundred and forty five thousand and sixty, or even one in seventy six million, seven hundred and sixty seven thousand and six hundred seem intangible and abstract. How do those odds effect the lottery-ticket purchaser in real terms?

If we take the average Australian spend of three thousand, one hundred dollars per year on gambling (which is equivalent to 5.12% of average Australian income), and then average out the odds of the major lotteries in Australia, we arrive at the average probability of winning of one in thirty seven million, three hundred and ninety nine thousand and seventy three. What this means in practical terms is if you took the average spend of three thousand, one hundred dollars per year and spent it all on lottery tickets it would only take eight thousand, five hundred and sixty seven years for it to be probable that you would win a jackpot. Only a probable chance of winning a jackpot, it must be stressed, not guaranteed. That’s a lot of life, fingers crossed for a cyborg body of some sort. Cross those cyborg fingers for a big wallet too, as you would regrettably have to spend around forty million dollars for the probability of winning a few million. That seems counter-intuitive.

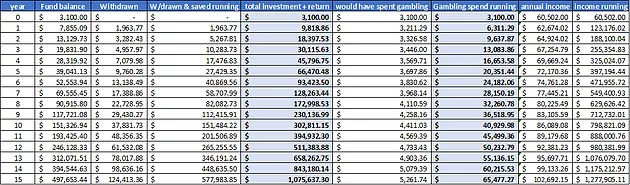

So what does one do if they want a million dollars before they reach the ripe of age of eight thousand? The images below show fifteen years of investment in a high-yield fund like what is offered at Countinghouse Fund, investment at the same rate as average Australian spend on gambling per annum. Fund growth is calculated at 83%, wage growth at 3.59%. The chart shows what may happen if an individual withdrew 25% of the high-yield fund profit and deposited into an interest-bearing account (interest factored at 2%, tax rate factored at 45%). What can be seen after a 15 year duration is that much sought-after one million dollars without spending a cent on the lottery. Without spending sixty five thousand dollars on lottery tickets more precisely.

Table One and Figure One: Showing average Australian gambling spend re-invested

It might be unsurprising to learn that investing your money in a diverse and methodical manner yields more consistent returns than a lottery ticket, but it may not have occurred to many investors that high-yield funds like Countinghouse can deliver returns that can rival that of a lotto win, provided the investor allows their investment to compound and grow throughout the years. If you do, however, have access to cyborg enhancements and the prospect of steady employment for eight thousand years… actually you should probably still invest in a high-yield fund in that instance.

Sources:

Australians gamblers, better to play on the stock market or invest in good proven designs.

Tim Dawson,Mike Pomery is our Director

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund

Tim Dawson,Mike Pomery is our Director

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund